Why KSL should buy back its own share - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 06 Dec 2023, 11:38 AM

Koon Yew Yin, 6th Dec 2023

My sole purpose for writing this article is to help the 3 controlling shareholders namely Ku Hua Seng, Ku Cheng Hai and Ku Tian Sek to understand the actual worth of their listed KSL shares. KSL share is so much undervalued.

The 3 brothers are very good business men, but they don’t know the actual value of KSL share.

The table below is a comparison of the top 13 leading property developers share prices, their EPS for each of the last 4 quarters and PE ratio.

Property developers share prices comparison:

| No. | Company | Price | EPS | EPS | EPS | EPS 4Q | PE |

|---|---|---|---|---|---|---|---|

| 1 | KSL | 1.06 | 8.31 | 10.8 | 8.7 | 5.8 | 33.8 |

| 2 | OSK Prop | 1.22 | 5.97 | 6.35 | 5.58 | 5.9 | 23 |

| 3 | Gamuda | 4.50 | 9.46 | 8.4 | 7.5 | 44 | 70 |

| 4 | Mahseng | 78 | 2.06 | 2.08 | 2.06 | 1.9 | 8.1 |

| 5 | IOI Prop | 1.69 | 3.17 | 4.27 | 2.1 | 7.3 | 16.8 |

| 6 | Simedaby | 61 | 2.1 | 1.0 | 0.9 | 1.5 | 5.5 |

| 7 | Guoco | 72.5 | 0.72 | 2.36 | 1.3 | 1.3 | 5.7 |

| 8 | ECOWorld | 1.01 | 2.25 | 2.13 | 1.9 | 0.06 | 6.4 |

| 9 | Sunway | 1.52 | 2.54 | 1.96 | 2.67 | 1.3 | 8.5 |

| 10 | SP Setia | 85.5 | 1.06 | 0.36 | 1.5 | 0.1 | 3.0 |

| 11 | IJM | 1.86 | 2.67 | 2.87 | 0.66 | 2.1 | 6.4 |

| 12 | UEM Sun | 71 | 0.17 | 0.49 | 0.3 | 0.4 | 1.4 |

| 13 | Tropicana | 1.23 | 0.02 | loss | loss | loss | loss |

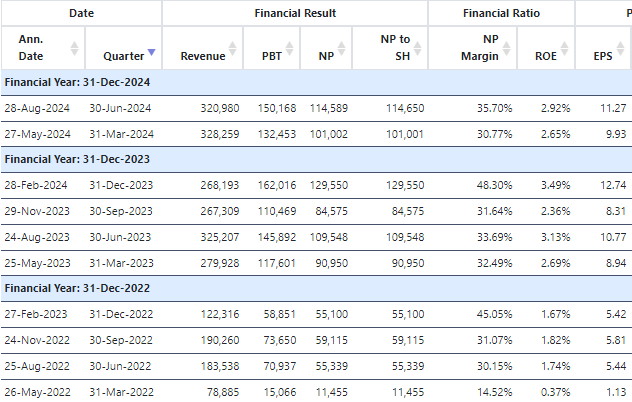

KSL EPS for the last 4 quarters is 33.8 sen and its last traded price is Rm 1.06. It is selling at PE 3.1 which is the cheapest among all the 13 top leading property developers in Malaysia. Moreover, its Net Tangible Asset (NTA) is RM3.52 per share.

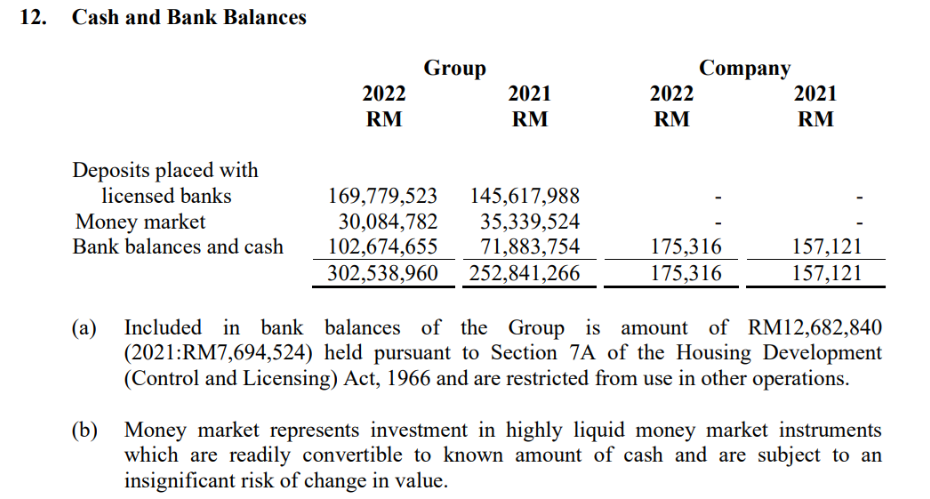

KSL 2022 annual report shows that KSL is cash rich.

That is why KSL bought land from SP Setia:

Corporate News Friday, 24 Nov 2023 PETALING JAYA: KSL Holdings Bhd is acquiring freehold land measuring 72,820 sq m in Shah Alam, Selangor, from S P Setia Bhd for RM228.8mil. In a filing with Bursa Malaysia, KSL said the acquisition will enlarge the group’s land bank and enhance its future revenue and earnings.

Share buyback:

Since KSL is cash rich and has very good cash flow, the company should buy back its own shares at the current price level. For example, the company buys at the last traded price of Rm 1.05 per share which has a net tangible asset value of Rm 3.52. That means the company can make an instant profit of more than 200%.

KSL buying back its own shares is far safer than the company buying 72,829 sq m in Shah Alam, Selangor on 24th Nov 2023 for Rm 228.8 million from SP Setia.

Total number of issued shares is 1,038 million.

The company should buy back 100 million KSL shares costing Rm 106 million to make back more than Rm 220 million immediately.

After my publication of this article, the company should buy back its own shares. When investors see that the company is buying back its own shares, they will have more confidence to buy more KSL shares. As a result, the share price should go up higher.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 30, 2024

KSL announced its total 4 quarter EPS of 42.3 sen and its net tangible asset (NTA) backing of RM3.86. It is selling for less than 50% of its net tangible asset (NTA). KSL is undervalued. Its share...

Created by Koon Yew Yin | Aug 26, 2024

In 2012, I wrote my first book “Malaysia: Road Map For Achieving Vision 2020” which was launched by former Financial Minister Tengku Razaleigh.

Created by Koon Yew Yin | Aug 26, 2024

On 21st Aug 2024, I posted my article with the title “90% of investors lose money in the stock market”. Now I will tell you how to make money from the stock market.

Created by Koon Yew Yin | Aug 26, 2024

A few years ago, one relative asked me to invest for him. I told him to let one famous professional fund manager manage his life saving. I cannot mention his name. He teaches Technical and Financial..

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Discussions

Buy back own share basically is to enable traders to lock in profit instead. 😁

2023-12-07 08:05

Kyy want to sell all his KSL holdings so that he got funds to prepare for new CYCLE.

2023-12-07 08:56

KSL managing/executive directors have been earning RM30 millions remuneration fee per year for many years without paying dividend to small shareholders. Uncle should make an appoitment with the directors to state your concern. No point at all to make comments.

2023-12-07 11:20

Uncle Koon, PBA PE is even lower because market has not noticed it yet.

Last quarter EPS is 11sen, times 4 = 44 sen.

Now trading at RM1.11, the PE is only 2.5x!

And the earnings is super solid because everyone in Penang and factories there use water everyday!

But not everyone buy property everyday...

Uncle, come read here...

https://klse.i3investor.com/web/blog/detail/bestStocks/2023-11-09-story-h-215206834-PBA_6_reasons_why_PBA_is_worth_RM2_50

2023-12-08 12:28

.png)

Seeking

Any dividend? 3 directors fees how much a year?

2023-12-07 07:57