EFRAME: A Comprehensive Door Frame Systems Supplier

LV Trading Diary

Publish date: Sat, 09 Sep 2023, 11:47 AM

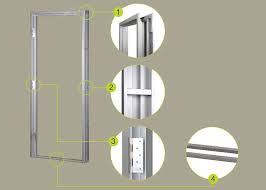

According to its official website, Econframe Berhad, also known as EFRAME (0227), was founded in 2001 and is a comprehensive door frame systems supplier headquartered in Klang, Selangor, Malaysia. EFRAME's business can be divided into two categories: manufacturing door frames and selling door frames and related products.

The company's main source of revenue comes from door frame manufacturing, primarily producing metal door frames, metal window frames, fire-rated doors, iron doors, etc., which accounted for approximately 84.25% of the total revenue in the fiscal year 2022.

The remaining revenue comes from product sales, including wooden doors, ironmongery*, and other door-related merchandise. To date, the company has sold over 100 different products. Notably, the company manufactures and sells its own products, including DUROE fire-rated doors and ironmongery, as well as ECONFRAME metal door and window frames, iron doors, and wooden doors. According to the 2022 annual report, metal door frames and fire-rated doors are the best-selling products, accounting for approximately 82.10% of the revenue in the fiscal year 2022.

*Ironmongery refers to items such as door handles, locks, closing mechanisms, and accessories for doors and hardware

EFRAME's primary customers are real estate developers. Since its inception, the company has provided customized door and window frames and a range of related products for different construction needs. Over the past two decades, the company has accumulated numerous clients, including prominent real estate developers such as ECOWORLD, GAMUDA, IJM, LBS, SPSETIA, and others. EFRAME typically secures contracts from contractors and supplies products to these real estate development companies. Due to the relatively high quality of these clients, the company faces lower bad debt risks. By the way, residential properties constitute the majority of contracts.

EFREAME garnered significant investor attention even before going public. Reports indicate that its initial public offering (IPO) was oversubscribed 40.23 times. On its debut on October 27, 2020, the company traded at RM0.345 per share, a 23.21% premium over its RM0.28 IPO price. Subsequently, EFRAME saw a strong and steady performance, reaching a high of RM1.11, marking a 296.42% increase compared to its IPO price.

In terms of financial performance, EFRAME has achieved outstanding results. Over the past two fiscal years, both revenue and net profit have shown an upward trend. The company's revenue increased from RM40.98 million in the fiscal year 2021 to RM59.39 million in the fiscal year 2022, representing a growth of approximately 44.92%. Net profit rose from RM5.11 million to RM11.24 million during the same period, an increase of approximately 111.96%.

(Note: EFRAME's fiscal year ends on August 31 each year)

EFREAME's recent performance has also been impressive. For the first three quarters of the fiscal year 2023, the company has shown significant growth in both revenue and net profit. In the latest third quarter, the company achieved record-high revenue of RM19.59 million and net profit of RM3.51 million. It's worth noting that the combined net profit for these three quarters is approximately RM9.00 million, accounting for about 80.07% of the full-year fiscal 2022. Barring any unforeseen circumstances, the company's performance for fiscal 2023 is expected to outperform the previous year.

Let's now calculate EFRAME's valuation.

In conclusion, based on the net profit of RM3.51 million in the latest quarter (Q3FY2023), the company's earnings per share (EPS) is approximately 1.02 cents, and the combined EPS for the three quarters is 2.72 cents. Assuming the company can maintain an EPS of 1.02 cents in the fourth quarter of 2023 and considering the current share price of RM0.91, EFRAME's forward price-to-earnings ratio is approximately 24.33 times.

Since there are no publicly listed companies in Malaysia directly comparable to EFRAME, it's challenging to make a direct peer comparison. However, considering the company's higher profit margins and growth rates, the valuation appears to be reasonable.

Looking ahead, with the government continuing to formulate and implement favorable measures to support the real estate market, the Malaysian property market is expected to recover and achieve long-term sustainable growth. Given the recovering real estate market and construction industry, it is expected that the metal door frame and door industry will continue to be driven by the demand for real estate properties in Malaysia.

In addition, EFRAME announced its acquisition of two companies in January, valued at RM18.20 million, expected to be completed by October 17th. For reference, the company will acquire 65.00% equity in Lee & Yong Aluminium Sdn Bhd* (LYASB) for RM17.20 million (RM8.10 million in cash plus new shares worth RM9.10 million). The remaining RM1.00 million will be used for the full cash acquisition of Trans United Sdn. Bhd. (TUSB).

*LYASB is a company engaged in the production and manufacturing of aluminum windows and glass products. For more details about LYASB, please visit https://leeyongalum.com.my/.

After completing these acquisitions, EFRAME's revenue is expected to further increase in the next 1 to 2 years, potentially bringing in at least RM4.00 million in net profit within one year. Notably, the management also mentioned in January that the company holds orders worth RM90.00 million, which are not included in LYASB's orders. Therefore, the company's future growth prospects appear promising.

Finally, let's discuss potential risks for EFRAME.

Given that the company's main source of revenue comes from real estate developers, its business operations and financial performance are highly dependent on the performance of the Malaysian real estate market. If there is a decrease in real estate demand, the planned supply of real estate will also decrease, leading to a reduced demand for metal door frames and doors. This would undoubtedly have a negative impact on EFRAME's overall financial performance.

So, readers, how do you view EFRAME, a net cash company?

More articles on LV 股票分享站

Created by LV Trading Diary | Jul 28, 2024

Created by LV Trading Diary | Jun 08, 2024