MERSEC's IPO Oversubscribed by 45.45 Times

LV Trading Diary

Publish date: Sun, 10 Sep 2023, 09:26 PM

Mercury Securities Group Bhd (MERSEC, 0285) recently announced that its initial public offering (IPO) witnessed a remarkable oversubscription of 45.45 times for the shares offered to the public.

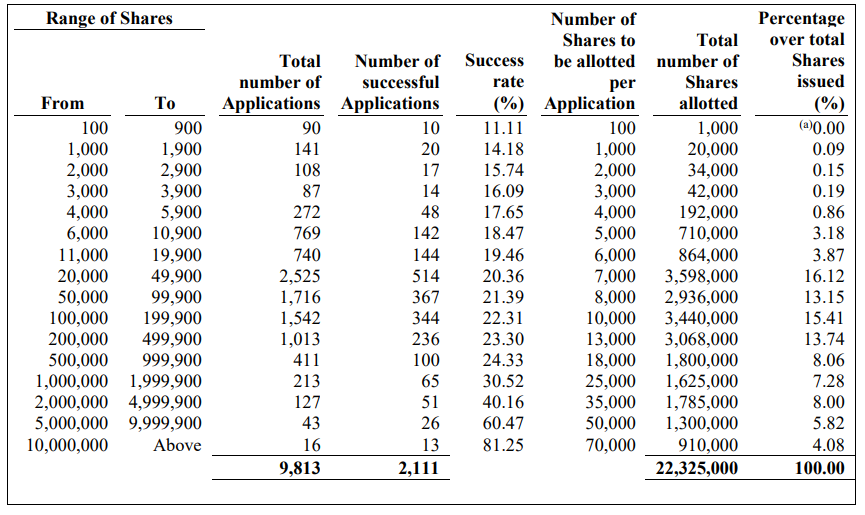

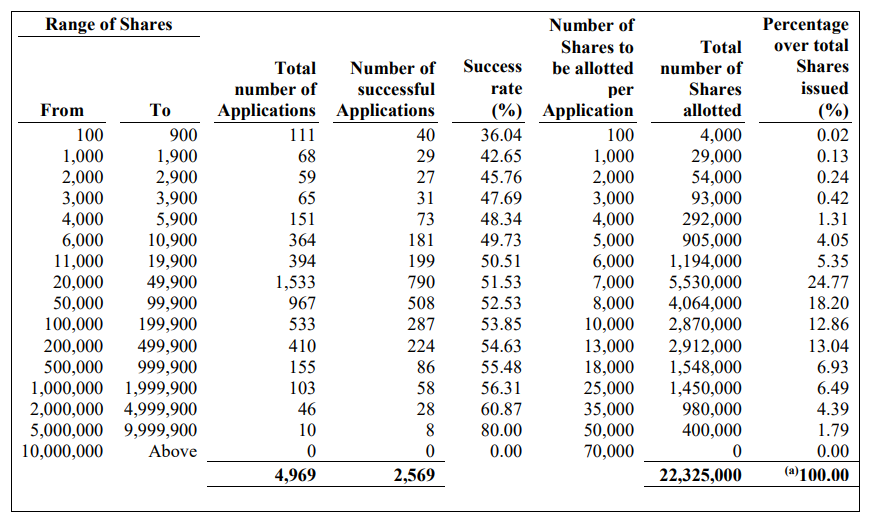

According to the report, MERSEC received a total of 12,926 applications from the Malaysian public, amounting to approximately 2.07 billion new shares, with a total value of RM518.53 million. Within this, the public portion received 7,957 applications for 1.51 billion shares, resulting in an oversubscription rate of an astounding 66.56 times. Simultaneously, for the Bumiputera public portion, there were 4,969 applications for 565.77 million shares, representing an oversubscription rate of 24.34 times.

Out of the 22.32 million issue shares, a total of 9,813 applications came from the general public, with 4,969 from Bumiputera applicants. Among them, 2,111 applications from the general public and 2,567 from Bumiputera applicants were successful in securing allocations. Consequently, the success rate for the public stood at approximately 21.51%, while Bumiputera applicants achieved a success rate of around 51.70%.

It is worth noting that allotment notices will be dispatched to all successful IPO applicants by September 15.

Additionally, the 22.33 million shares made available for application by directors, employees, and those who have contributed to the company were fully subscribed. Furthermore, the 44.65 million new shares made available for application through private placement to selected investors and Bumiputera investors approved by the Ministry of Investment, Trade, and Industry (MITI) have also been fully placed.

MERSEC's IPO comprised a public issue of 157.10 million new shares, accounting for 17.59% of the enlarged issued shares, and an offer for sale of 71.51 million existing shares, representing 8.01% of the enlarged issued shares, all at an offer price of RM0.25 per share. Therefore, the company anticipates raising RM39.27 million through this offering.

It's worth mentioning that based on the IPO price of RM0.25 per share and an enlarged issued share capital of 893.00 million shares, MERSEC's market capitalization is expected to reach RM223.25 million.

MERSEC's oversubscription rate bears a resemblance to the previously mentioned EFRAME (0227), sparking anticipation of the stock's potential to rise to RM1.00 and beyond. So, let’s look forward to it.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on LV 股票分享站

Created by LV Trading Diary | Jul 28, 2024

Created by LV Trading Diary | Jun 08, 2024