Malaysia Budget 2024: Key Policies Affecting Businesses and Individuals

LV Trading Diary

Publish date: Mon, 30 Oct 2023, 02:01 AM

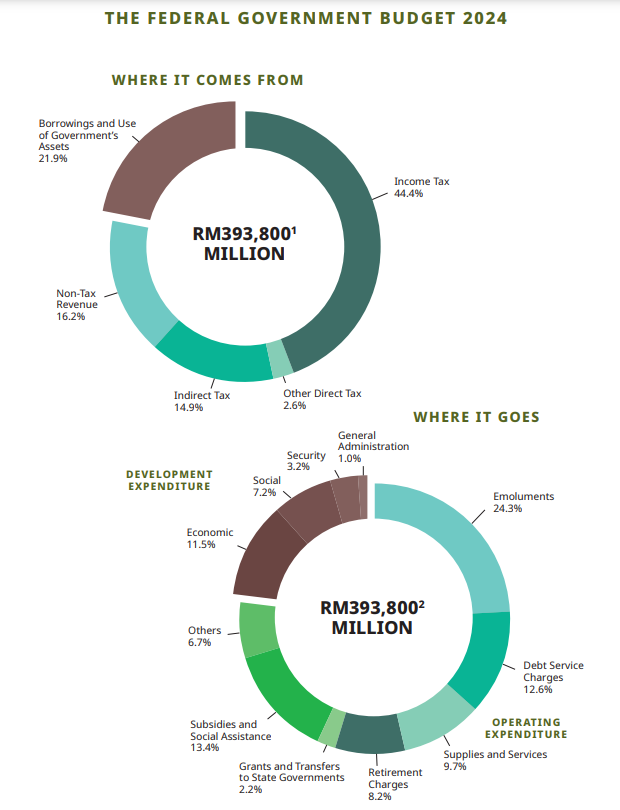

As reported, the planned total expenditure for the 2024 budget is RM393.80 billion, with RM303.80 billion allocated for operational expenses and RM90.00 billion for development expenditures.

1) Policies Relevant to Businesses:

· Starting from August 1, 2024, taxpayers with an annual income or turnover exceeding RM100.00 million will be mandated to adopt electronic invoicing.

· The Credit Guarantee Corporation Malaysia Berhad (CGC) will provide a maximum of RM20.00 billion in small and medium-sized enterprise (SME) loans, focusing on high-tech, agriculture, and manufacturing sectors, with a government guarantee of up to 90%.

· An allocation of RM8.00 billion will establish a National Bank Loan Fund to support SMEs, with RM600.00 million designated to assist micro-entrepreneurs and low-income business owners.

· An allocation of RM1.50 billion aims to encourage startups, including SMEs, to venture into high-growth, high-value (HGHV) industries.

· Bank Simpanan Nasional (BSN) will provide RM1.40 billion in small loans to small-scale traders for working capital, equipment purchase, leasing of premises, and marketing.

· An allocation of RM900.00 million will create a National Bank Loan Fund to encourage SMEs to enhance productivity through automation and digitization.

· A special allocation of RM720.00 million is intended to promote entrepreneurship among women and young people.

· RM200.00 million has been allocated to financing and risk investment institutions to provide funding for startups.

· An additional RM25.00 million has been allocated to the i-TEKAD Micro Enterprise Financing Scheme.

· RM40.00 million has been set aside for the implementation of the Malaysia Online Shop Program, enabling small businesses specializing in food products to operate online from home.

· RM10.00 million has been allocated to strengthen franchise enhancement programs, ultimately boosting exports.

· The price ceilings for broilers (meat chickens) and eggs will be removed, allowing prices to fluctuate.

2) Business Taxation Policies:

· Additional tax relief of up to RM0.30 million will be provided to companies engaged in carbon project development.

· Film production companies, foreign film actors, and film crews shooting in Malaysia will enjoy a special income tax rate ranging from 0% to 10%.

· Entertainment tax rates for theme parks, family entertainment centers, indoor game centers, and simulated game centers in federal territories will be reduced to 5.00%.

· Local artists performing in federal territories will be exempt from entertainment taxes.

· Starting from March 1, 2024, a 10.00% capital gains tax will be imposed on the sale of equities of non-Malaysian listed companies.

· Non-citizens and foreign companies transferring property ownership will be subject to a uniform 4.00% stamp duty, excluding permanent Malaysian residents.

· The service tax rate will be increased from the current 6.00% to 8.00%, except for food and beverage, telecommunications services, parking fees, and logistics.

· Luxury taxes of 5.00% to 10.00% will be imposed on specific high-value items such as jewelry and luxury watches.

· Chewing tobacco products will be subject to a 5.00% excise tax, increasing by RM27.00 per kilogram.

· The tax on sugary beverages will be raised from RM0.40 per liter to RM0.50.

· In 2025, a Global Minimum Tax (GMT) will be introduced, applicable to multinational corporations with annual revenues exceeding 750.00 million euros (approximately RM3,783.52 million).

3) Policies Relevant to Individuals:

· The government will allocate RM58.10 billion to provide various forms of subsidies, assistance, and incentives to benefit the people, with nearly 50.00% allocated for controlling prices of goods and services.

· From October 14, 2022, to March 31, 2024, repayment discounts for National Higher Education Fund Corporation (PTPTN) loans will be offered, including a 10.00% discount for lump-sum repayments of loan balances, a 10.00% discount for lump-sum repayments of at least 50% of loan balances, and a 15.00% discount for regular repayments via salary deductions or debit cards.

· Tax exemptions for operators of electric vehicle charging facilities will be extended to four years, with a maximum of RM2,500.00 in tax relief.

· Individuals with annual incomes of RM0.12 million or less who purchase electric cars will receive a RM2,400.00 cash rebate.

· Tax incentives for women returning to the workforce will be extended until December 31, 2027, aiming to increase women's labor force participation to 60.00%.

· Childcare fee tax relief will be increased from the current RM2,400.00 to RM3,000.00.

· Special tax relief for sports equipment and activities will be raised to RM1,000.00 and extended to cover sports training expenses.

In conclusion, these policies within the 2024 budget will have a significant impact on businesses and individuals, shaping the economic landscape for the upcoming year and aiding in financial and tax preparedness.

———————————————————————————————————————————————————

Disclaimer: The above is purely for educational purposes and reflects personal opinions. It does not constitute any buying or selling recommendations.

If you are interested in opening a CGS-CIMB trading account, please sign up using the following link:

https://forms.gle/kZVCyDxUurxChMcg9

———————————————————————————————————————————————————————————

More articles on LV 股票分享站

Created by LV Trading Diary | Jul 28, 2024

Created by LV Trading Diary | Jun 08, 2024