SFPTECH Achieves Record Revenue and Profit in Q3 FY2023

LV Trading Diary

Publish date: Tue, 21 Nov 2023, 11:45 PM

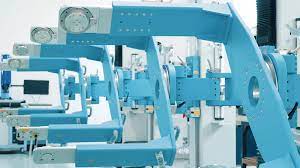

A few days ago, SFP Tech Holdings Berhad (SFPTECH, 0251), a technology company providing comprehensive engineering support services, announced exceptional quarterly financial results. Notably, the company has exhibited a growth trend in both revenue and profit for the fiscal year 2023, setting new highs in the latest third quarter.

Without further ado, let's delve into SFPTECH's recently disclosed financial performance.

Revenue Comparison (YoY +70.19%, QoQ +2.79%)

As of September 30, the company's revenue stood at approximately RM37.46 million, marking an impressive increase of around 70.19% compared to the same period last year (RM22.01 million). This substantial growth was primarily attributed to the significant expansion in the Mechanical Assembly business, contributing approximately RM28.88 million in revenue for the quarter, representing a remarkable year-on-year increase of about 1,238.94%. According to the management, this surge can be attributed to recurring orders from existing customers in Malaysia.

In addition to the Mechanical Assembly business, the company's revenue contributions for the quarter from CNC Machining, Sheet Metal Fabrication, and Automated Equipment Solutions were approximately RM4.11 million, RM3.05 million, and RM1.42 million, respectively.

In terms of geographical distribution, around RM33.13 million of revenue came from the Malaysian market, constituting approximately 88.44% of the total revenue for the quarter. The remaining market revenue was derived from the United States (5.76%), Singapore (3.79%), India (0.06%), and other countries (1.95%).

Compared to the previous quarter, the company's revenue increased by approximately RM1.02 million or 2.79%.

Net Profit Comparison (YoY +19.63%, QoQ +3.76%)

Driven by robust revenue from the Mechanical Assembly business, SFPTECH achieved a net profit of approximately RM11.03 million, reflecting a year-on-year increase of around 19.63%.

Similarly, compared to the previous quarter, the company's net profit increased by approximately RM0.40 million or 3.76%. This growth is also attributed to the appreciation of the US dollar against the Malaysian ringgit.

Outlook

Despite the global semiconductor sales slowdown in the first half of 2023, SFPTECH remains focused on its core Engineering Supporting Services and Automated Equipment Solutions to drive business growth. The company plans to expand its customer base by increasing machinery and diversifying its product range in order to enter more industries and markets. For your information, as of October 31, the company's machinery count had already increased to 240 units.

In conclusion, given SFPTECH's outstanding financial performance and strategic initiatives, the management expresses confidence in the company's future prospects. Now, readers, what are your thoughts on SFPTECH, with its current P/E ratio standing at approximately 60.70?

———————————————————————————————————————————————————

Disclaimer: The above is purely for educational purposes and reflects personal opinions. It does not constitute any buying or selling recommendations.

If you are interested in opening a CGS-CIMB trading account, please sign up using the following link:

https://forms.gle/kZVCyDxUurxChMcg9

———————————————————————————————————————————————————————————

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on LV 股票分享站

Created by LV Trading Diary | Jun 08, 2024

newbie8080

During it's IPO days, sheet metal fabrication and CNC Machining represent 78% of their total revenue.

Today, mechanical assembly takes 76% of the total revenue.

Do noticed that mechanical assembly is the low tech biz with lower profit margin than CNC machining and others.

Your words describing the company eg: Remarkable, Exceptional and Impressive is not reflecting the company's struggle in topping their orderbook with high profit margin biz.

2023-12-26 10:36