Is Gadang’s Capital City a Golden Goose or a White Elephant?

Mr. Pink

Publish date: Wed, 07 Jun 2017, 09:38 PM

Prologue

Gadang is an investment holding company primarily involved in the construction and property business.

Since the end of last year, Gadang has attracted a lot of attention in the investment community due to the entry of a prominent investor.

Naturally, the share price has been quite volatile as a result of the unwanted attention and also lumpy earnings recorded in the recent quarters.

The fundamental merits of Gadang have been covered by many investment bank analysts as well as bloggers.

It is a well-managed construction company which has a niche in infrastructure construction. In addition, the company also has a decent properties business which contributes about 40% to its net profit.

Most of the analyst reports have focused on the solid infrastructure construction order book of RM 1.6 billion (MRT, MRT2, TRX etc.) and the dwindling unbilled properties sales of about RM 160 million.

What these analysts have not done, in my opinion, is the uncovering of Gadang’s most prized asset – The Capital City.

What is Capital City?

The Capital City project was first announced in the late 2013. The integrated mixed development is a joint venture between Gadang, Hatten group and Sunbuild development.

The whole project will comprise of a) Retail concept mall b) Two hotel blocks and c) Three SOHO towers.

As we all know, 2013 was the peak of the Malaysian property cycle and everything has gone downhill since.

Any seasoned property investors will cringe whenever the word “Iskandar” is mentioned.

Nevertheless, Capital City is not exactly located in the oversupplied Iskandar region. It is in fact located in the mature neighborhood of Tampoi, Johor.

While I have no comment on whether Tampoi is a good location or not, the confidence booster here is that Hilton Hotels have signed an agreement with the developer to set up its hotel in Capital City which will be later be known as Hilton Garden Inn.

What Gadang has to do with Capital City?

The Capital City Mixed Development is a joint venture between Gadang, Hatten and Sunbuild development.

Under this joint venture arrangement, Gadang which is the land owner of the project, will allow Hatten/Sunbuild to construct and develop on the said land.

Hatten/Sunbuild will be responsible for all the costs related to the development.

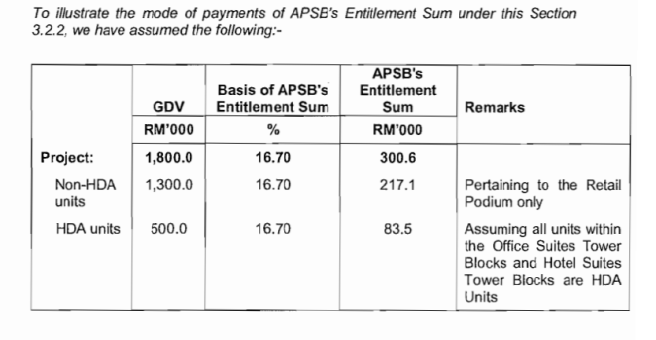

In return, Gadang will be entitled up to 16.70% of the total GDV or up to a maximum of RM 300.6 million cash from the joint-venture partner.

How much capital will Gadang contribute into Capital City?

Gadang is not liable or responsible for any costs in developing the project.

The only capital that Gadang injected into the mixed development is the cost related to the said land only.

The audited net book value of the said land was RM 31.0 million when the project was announced.

How will the monies be paid?

Gadang has provided investors with all the information related to the joint venture arrangement dated 8 April 2014.

Any investor will just have to dig deeper to understand the complex structure.

To kick start the project, Gadang had already received a RM 2 million deposit from its JV partner.

One of the condition under the JV is that the retail concept mall which comprises as much as 70% of the total GDV has to be constructed first.

[ Note: Non-HDA units = Retail Concept Mall, HDA units = SOHO + Hotel ]

From this table, it could be seen that the JV assumed a total GDV of RM 1.8 billion for the whole project.

And Gadang will be entitled of RM 217.6 million from the completion of the retail mail alone!

When will the monies be paid?

One of the immediate concerns of such arrangement is the delay of payment by the JV partner to Gadang.

Again, if we dig deeper, any investor could have written off this worry.

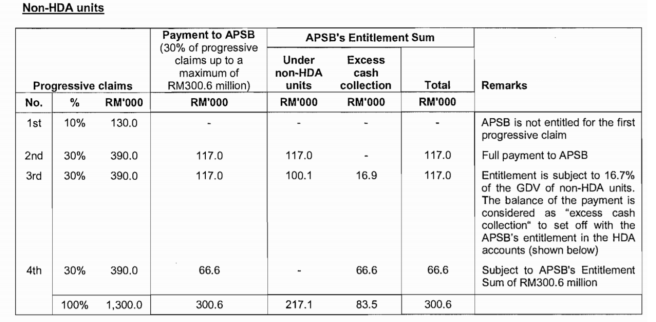

Based on my best understanding, Gadang will claim the monies from the JV partner on a progressive basis.

The JV partner will keep the first 10% of the property progressive claim.

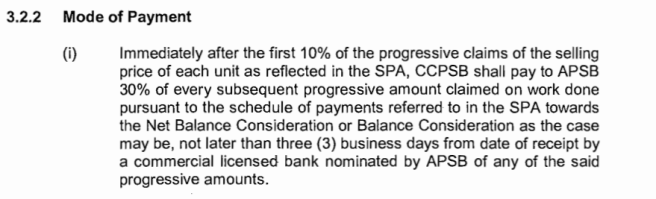

For the subsequent progressive claim, however, the JV partner must pay at least 30% of the amount to Gadang based on the work done no later than 3 business days from the bank’s notice.

The key word here is “work done”.

Hence, it does not matter how many % of Capital 21 or the retail mall was sold.

As long as the construction has reached the proper stage, the JV partner is required by law to pay Gadang the monies.

Has Gadang started to recognize profit from the Capital City Project?

The short answer to this question is, Yes.

First, the joint venture agreement is structured between a wholly owned Gadang subsidiary, known as Achwell Property Sdn Bhd and Hatten/Sunbuild.

Since Achwell is a 100% owned subsidiary by Gadang, all numbers under Achwell Property has to be consolidated under Gadang Holdings Sdn. Bhd.

The consolidation of profits & losses into the ultimate holding company might explain why Gadang is consistently recording exceptional high margin in its properties segment.

How much profit from Capital City has Gadang recognized in the last few years?

There are a few methods to determine the approximate amount of profit which Gadang has received from the project.

One of the easiest method is to look at the construction progress of the retail mail.

From my last visit, the retail mall has been built up to the car park podium (above the shopping mall).

Those who are familiar with strata properties payment schedule would have estimated that the progress of the whole project has reached about 50%.

Another method will be to look at the JV partner accounts.

The JV partner of Capital City has been listed on the SGX under the name Capital World Limited through the RTO of Terratech Limited.

Since Capital World Limited, the JV partner, has only one project under its helm, it is easy to see how much money has been billed for the retail mall from Capital World’s circular and quarterly financial reports.

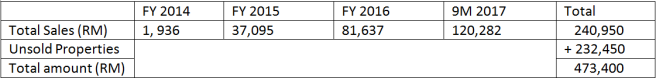

From this table, we could deduce that about RM 470 million of the project has been constructed and billed to the company.

Since the first 10% of the billings will be kept by the JV partner, Gadang has received about RM 130 million PBT which already have been recognized over the last 2 financial years.

(Math here: 473,400 X 0.9 X 0.3 = 127,818)

Gadang to record at least RM 90 million PBT from Capital City Project in the next 12 months??

In my opinion, it is very likely that Gadang will have a record breaking year in the next 12 to 16 months.

From the mode of payment set out in the JV agreement, Gadang is entitled as much as RM 217.1 million from the retail mall.

Based on Capital World Limited progressive billings, Gadang still has about RM 90 million of entitlement to be recognized in the near future from the retail mail.

Based on several retail websites, Capital 21 or the retail concept mall is scheduled for opening in June 2018.

Since the construction of the retail mall is already in an advanced stage, this suggests Gadang will fast track the profit recording when they receive the remaining RM 90 million entitlement from the JV over the next 12 to 16 months.

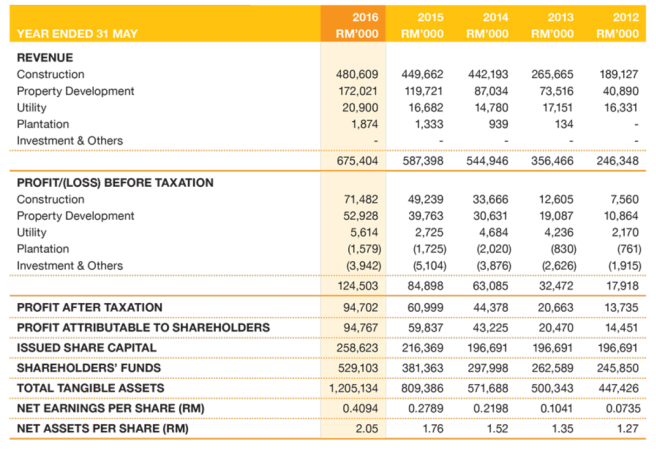

In FY 2016, the total PBT recorded by the property segment was about RM 53 million.

The remaining entitlement is sufficient to propel Gadang properties segment into the stratosphere especially when the other projects such as The Vynes@Sungai Besi is also nearing completion.

What if you are wrong?

The content in this article should serve as the opinion and educational sharing of the writer and is by no means, a buy or sell call. The decision to buy/sell is entirely on your own and the writer shall not be held accountable for any profit or losses incurred from your decision.

Kindly follow me on Facebook for more discussions!

https://www.facebook.com/MastersInRetail

www.mastersinretail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Masters Case Studies

Created by Mr. Pink | May 01, 2017

Created by Mr. Pink | Apr 21, 2017

Discussions

capital city project already factored in by market 2 years ago. the fact is investors are just not too enthusiastic with property, let alone johor property. once this project ends, gadang doesn't have many significant projects in the pipeline anymore

2017-06-08 10:20

A simpler explanation will be, in cash flow term (before tax), about RM217m cash in flow from Capital City will be recognised next couple of years (Btw, there is no GDV for Capital City, Gadang only provide land and share of GDV).

The company still have about GDV of 3-4b of property to go (Semenyih, Puchong, Kwasaland, Damansara Perdana, Cyberjaya, Pokok Sena, etc), if I remember correctly, will last them for many years.

2017-06-08 15:29

Mr Pink, very good, unbiased analysis. The future of Gadang will be very different as Tan Sri has some transformation plans underway, shareholders who support Gadang will benefit.

2017-06-09 12:08

Mr Pink, thanks for your analysis.

Appreciate it if you could clarify, last 2 FYs PBT for property is RM54m + RM40m = RM94m. You mentioned PBT recognised is about RM130m. How do we explain for the difference of RM46m? Tx.

2017-06-22 20:45

.png)

eyewitness

Mr Pink, a very detailed analysis. Would Capital City be completed this year or next?

Would it then mean that Gadang's property earnings would be much lower in 2018 or 2019?

If that were the case, valuations would have to be adjusted for FY18 or FY19.

2017-06-07 21:57