SNS Network Tech (0259) Renewed Momentum

MercurySec

Publish date: Mon, 02 Sep 2024, 09:11 AM

Technical Highlights

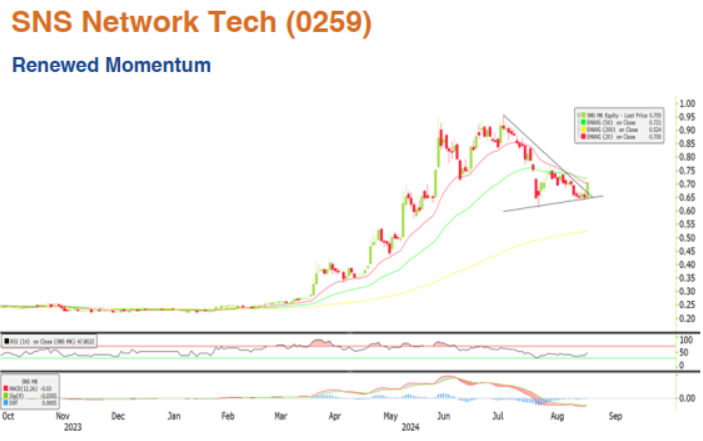

Technical Highlights The stock has been consolidating since early June after reaching its 52-week high. Last Friday, a signal indicating a reversal in the downtrend was observed when the stock surged and formed a large green candle, breaking through a pennant pattern that had been forming for approximately 2 months. This breakout was accompanied by a significant increase in the RSI reading, indicating strong trading momentum and suggesting a strong trend reversal signal. As such, we expect more upside potential in the short term going forward.

Last Friday, the MACD displayed a golden cross, indicating strong momentum expected going forward. Additionally, the upward-pointing RSI and 50 EMA lines confirm the bullish trend in the short term.

With these positive indicators, we think the stock could be pushed towards challenging its first resistance at RM0.745 and subsequently the next resistance at RM0.845. Conversely, consolidation occurs if the stock falls below its RM0.650 support, determined based on the recent low.

Entry – RM0.685 – RM0.705

Stop Loss – RM0.600

Target Price – RM0.745 – RM0.845

Source: Mercury Securities Research - 2 Sep 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-22

SNS2025-01-22

SNS2025-01-21

SNS2025-01-21

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-16

SNS2025-01-16

SNS2025-01-16

SNS2025-01-13

SNSMore articles on Mercury Securities Research

Created by MercurySec | Jan 22, 2025