IPO - Carlo Rino Group Berhad (Part 1)

MQTrader Jesse

Publish date: Wed, 04 Dec 2024, 11:13 AM

Tentative Date(s):

- Opening of application - 28 November 2024

- Closing of application - 05 December 2024

- Balloting of applications - 09 December 2024

- Allotment of IPO shares to successful applicants - 16 December 2024

- Tentative listing date - 18 December 2024

Company Background

The company was incorporated in Malaysia under the Companies Act 1965 as a private limited company on 23 November 2009 under the name of CRG Incorporated Sdn Bhd and is deemed registered under the Act. On 13 August 2018, the company was converted into a public limited company and assumed the name of CRG Incorporated Berhad to facilitate the listing of the company on the LEAP Market on 28 November 2018. On 23 December 2022, the company changed its name to Carlo Rino Group Berhad to better reflect its corporate identity and the company Group’s core business and product offering. The company is an investment holding company. Through its subsidiaries, they are principally involved in the business of designing, promoting, marketing, distributing and retailing women’s handbags, footwear and accessories.

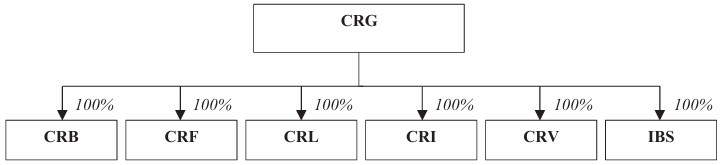

As at the LPD, the company Group structure is as follows:

Use of proceeds

- Construction and the fitting out of a new flagship boutique and other facilities (e.g., IT and security systems) - 32.32% (within 36 months)

- Refurbishment of boutiques and counters at departmental stores - 7.54% (within 36 months)

- Maintenance of IT infrastructure - 1.08% (within 24 months)

- Working capital requirements of the company Group

- Purchase of inventory - 21.99% (within 24 months)

- A&P expenses - 6.47% (within 24 months)

- Rental of boutiques - 21.55% (within 24 months)

- Defrayment of estimated expenses for the Corporate Exercise and the IPO - 9.05% (within 3 months)

Construction and the fitting out of a new flagship boutique and other facilities (e.g., IT and security systems) - 32.32% (within 36 months)

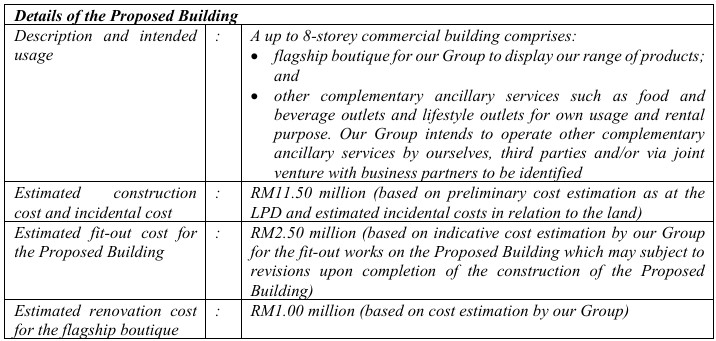

The company has earmarked RM15.00 million (or approximately 32.32% of its Public Issue proceeds), for the construction and fitting out of a commercial building to be erected thereon (“Proposed Building”) and the renovation cost for the flagship boutique in the Proposed Building.

The details of the Proposed Building are as follows:

If the above capital expenditure is due and payable prior to the Transfer of Listing, they will use a combination of internally generated funds and/or borrowings (if required) to settle such payment while pending the receipt of the proceeds from the Public Issue. Upon receiving the proceeds from the Public Issue, they will use the proceeds to replenish internal funds used and/or to repay borrowing obtained to fund the construction works (if any) and pay the remaining capital expenditure. If there is a surplus of proceeds, the amount will be reallocated for the company Group’s working capital purposes, wherein the breakdown of re-allocation amongst the category of working capital of the company Group will be determined later. If there is a deficit of proceeds, they will use a combination of internally generated funds and borrowings to fund such capital expenditure.

Refurbishment of boutiques and counters at departmental stores - 7.54% (within 36 months)

The company has earmarked RM3.50 million (or approximately 7.54% of the total proceeds from the Public Issue), to refurbish boutiques and departmental store counters. As refurbishment of boutiques and counters at departmental stores is an on-going initiative, the number of boutiques and counters at departmental stores to be refurbished, their locations and costs cannot be determined at this juncture as it will be dependent on the prevailing quotation as well as the refurbishment requirements at the time of utilisation and such costs may differ for each type and location of retail space. Based on the company Group’s historical data, the refurbishment cost is expected to be approximately RM100 to RM350 per sqft. Should there be any material variances in the future about refurbishment costs as a result of, amongst others, inflation, the shortfall will be funded via the company Group’s internally generated funds.

The estimated refurbishment cost covers, amongst others, the following:

- purchasing and installing new fixtures, fittings, lighting and flooring;

- interior design fees;

- new merchandising and display tools; and

- IT and security equipment and related hardware.

Maintenance of IT infrastructure - 1.08% (within 24 months)

The company intends to allocate RM0.50 million (or approximately 1.08% of the total proceeds from the Public Issue), for subsequent maintenance of such upgraded IT infrastructure which includes subscription fees for the cloud-based applications, as well as office productivity software and product design tools and applications. The company estimates the monthly IT maintenance cost after such upgrading to be RM20,000 to RM50,000.

Working capital requirements of the Company Group

The company intends to allocate RM23.20 million (or approximately 50.01% of the total proceeds from the Public Issue), for the following working capital requirement:

- Purchase of inventory - 21.99% (within 24 months)

The company had incurred RM25.0 million to RM37.00 million annually to purchase inventory to ensure they have sufficient inventory to meet demand from their customers. The inventories mainly consist of finished goods of women’s handbags, footwear and accessories. The company plans to use RM10.20 million of the proceeds from Public Issue to finance the purchase of inventory.

- A&P expenses - 6.47% (within 24 months)

The company plans to use RM3.00 million of the total proceeds from the Public Issue to undertake various A&P activities, such as billboard advertisement; digital marketing across various online channels; engagements of social media key opinion leaders and influencers who have positive and strong reputations in the fashion line to market the company Group’s products to their followers; and organise campaigns or events to drive new product awareness and customer engagements.

- Rental of boutiques - 21.55% (within 24 months)

The company plans to use RM10.00 million of the total proceeds from the Public Issue to fund the boutique rental expenses.

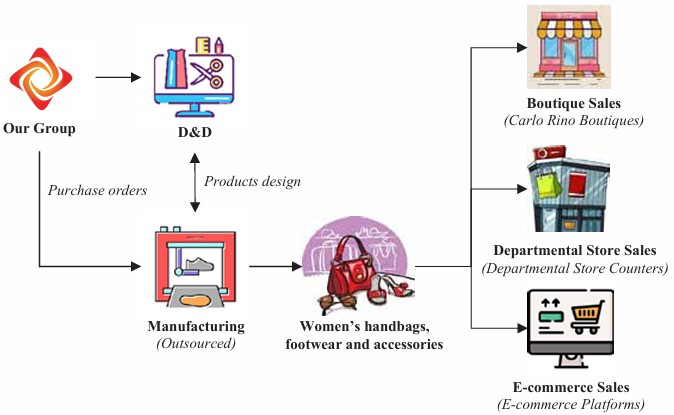

Business Model

The business model for the company's principal activities is as follows:

Click here to continue the IPO - Carlo Rino Group Berhad (Part 2)

Looking for flat 0.05% brokerage?

Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)