IPO - CBH Engineering Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Mon, 30 Dec 2024, 02:33 PM

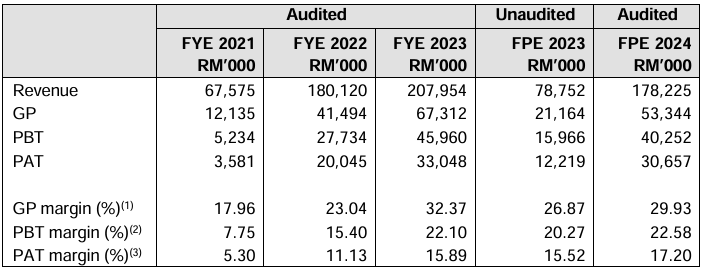

Financial Highlights

The following table sets out the financial highlights of the company's historical combined statements of profit or loss and other comprehensive income of the company Group for the Financial Years Under Review and FPE 2024:

- The revenue increased from RM 67 million in FYE 2021 to RM 207 million in FYE 2023, reflecting the company is expanding its market share.

- The gross profit margin continuously rose from 17.96% in FYE 2021 to 32.37% in FYE 2023. This was mainly due to the high contribution from substation projects and industrial building projects.

- The PAT margin increased from 5.30% in FYE 2021 to 15.89% in FYE 2023.

- The gearing ratio is 0.02 in FYE 2023, which is below the benchmark range. This indicates that the company still has room to increase debt and bring it within a reasonable gearing range. (A good gearing ratio should be between 0.25 - 0.5).

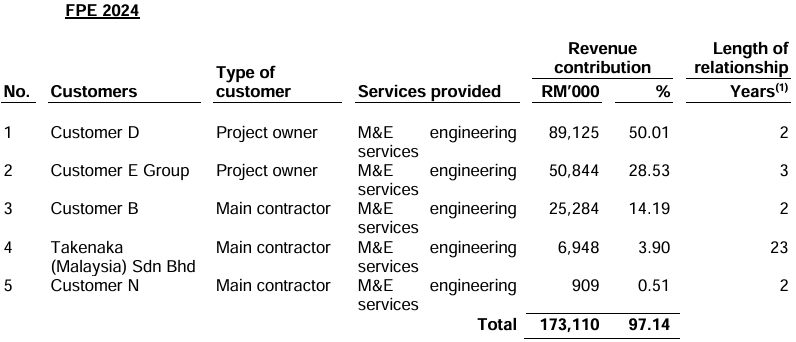

Major customers and suppliers

Major Customers

The company’s top 5 customers for M&E engineering services for FPE 2024 is as follows:

The company does not have any long-term arrangements with any of the customers. The composition of the company top 5 customers varies from year to year depending on the value of contracts secured which is determined by the type and nature of projects undertaken, complexity of the projects and the timing of the work-in-progress claims given the company’s nature of business being conducted on a contract basis. The contracts that the company enter into with the customers typically range between 12 months to 24 months, depending on the scope of services in which they have been engaged to perform. The company may not secure similar contracts in terms of size and scope or with the same customers every year. Apart from the top 5 customers, the company has also been securing contracts from different customers who have also increasingly contributed to the company Group’s revenue. The company is continuously diversify its customer base to replenish their order book. However, this does not preclude the company Group to tender for new contracts from its existing major customers should the opportunities arise.

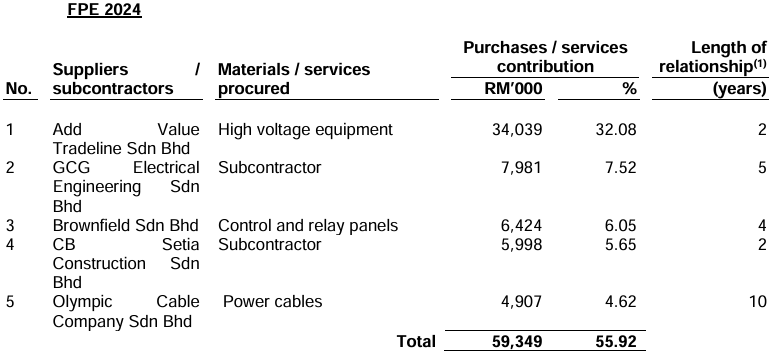

Major Suppliers

The company’s top 5 suppliers/subcontractors for FPE 2024 is as follows:

The company is not dependent on any supplier or subcontractor, as there are others in the local market with similar quality of materials and services that the company requires.

Industry Overview

Engineering is the field or discipline, practice, profession and art that relates to the development, acquisition and application of technical, scientific and mathematical knowledge about the understanding, design, development, invention, innovation and use of materials, machines, structures, systems and processes for specific purposes.

Mechanical and Electrical (M&E) engineering are sub-fields defined as follows:

- Mechanical engineering focuses on the theory and application of physical or mechanical systems, encompassing the design, manufacture, and operation of various mechanical components, devices, and systems. Mechanical engineers are involved in the design and production of machines to lighten the burden of human work while others practice in the areas of air conditioning and mechanical ventilation (“ACMV”), automotive, manufacturing, and refrigeration engineering.

- Electrical engineering relates to the theory and application of electrical systems, focuses on the study and application of electricity and electromagnetism. The discipline of electrical engineering includes the subjects of power generation and distribution, electric circuits, transformers, motors, electromagnetic and associated devices. In a broad perspective, electrical engineering deals with larger-scale electricity systems, power transmission and distribution systems and energy.

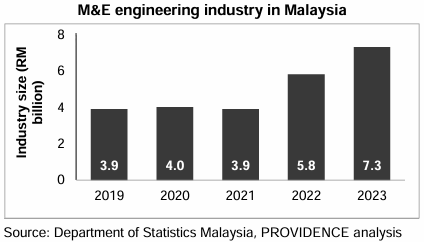

The M&E engineering industry in Malaysia, measured in terms of the value of M&E engineering works done, increased from RM3.9 billion in 2019 to RM7.3 billion in 2023 at a compound annual growth rate (“CAGR”) of 17.0%. From this, electrical engineering works increased from RM1.8 billion to RM3.7 billion at a CAGR of 19.7% while mechanical engineering works increased from RM2.1 billion to RM3.6 billion at a CAGR of 14.4%. PROVIDENCE projects the value of M&E engineering to rise from RM7.3 billion in 2023 to RM10.6 billion in 2026 at a CAGR of 13.2%.

The key drivers in this industry:

- Growth in the residential and commercial property markets supports the demand for M&E engineering services

- Growth in end-user industries drives demand for M&E engineering services

- Growth in foreign and domestic investments endorses the development of M&E engineering services

- Increased outsourcing and relocation of E&E manufacturing activities to Southeast Asia

The key risks and challenges in this industry:

- The industry players are dependent on imports of M&E materials and components

- The industry players may be impacted by changes in economic, regulatory, political, or social conditions and developments in Malaysia

- There are inherent risks in the electricity supply market

Future plans and strategies for CBH ENGINEERING HOLDING BERHAD

The company’s business strategies and future plans are set out below:

- The company intends to strengthen its internal workforce through the recruitment of qualified employees

- The company intends to strengthen its financial resources to undertake M&E engineering projects

MQ Trader View

Opportunities

- The company’s range of electrical engineering services has enabled them to establish a strong presence in the M&E engineering industry in Malaysia

- The company has existing contracts that provide sustainability in the near term

Risk

- The company’s projects are non-recurring and there is no guarantee that it will be able to secure new projects

- The company secures M&E engineering projects through main contractors

- The company is dependent on the supply and quality of services of its subcontractors and suppliers to complete the projects

Click here to continue the IPO - CBH Engineering Holdings Berhad (Part 1)

Looking for 3x cash & 2x shares trading limit? Get started now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)