IPO - CBH Engineering Holdings Berhad (Part 1)

MQTrader Jesse

Publish date: Mon, 30 Dec 2024, 02:33 PM

Tentative Date(s):

- Opening of application - 20 December 2024

- Closing of application - 02 January 2025

- Balloting of applications - 06 January 2025

- Allotment of IPO shares to successful applicants - 14 January 2025

- Tentative listing date - 16 January 2025

Company Background

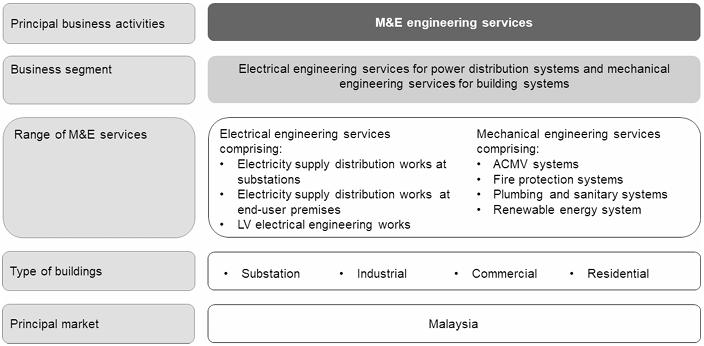

The company was incorporated in Malaysia on 18 December 2023 under the Act as a private limited company under the name of CBH Engineering Holding Sdn Bhd. Subsequently, the company was converted to a public limited company on 27 May 2024 and assumed its present name as CBH Engineering Holding Berhad. The company is an investment holding company. Through its subsidiaries, they are principally an electrical engineering service provider and is specialise in electricity supply distribution systems, where undertake the design, supply, installation, testing, commissioning and maintenance of HV, MV, LV and ELV electrical systems.

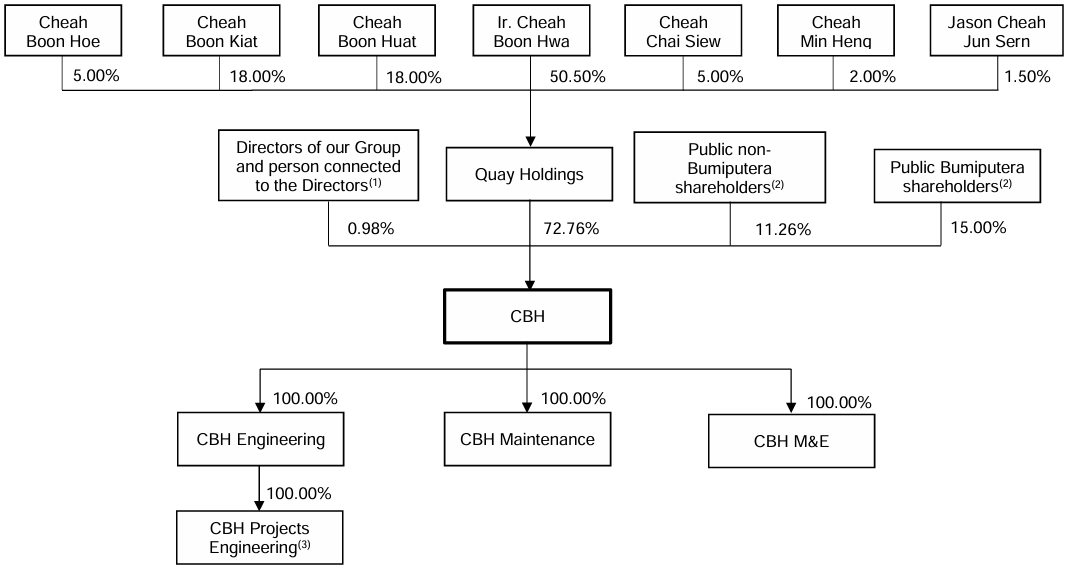

The company Group structure after the IPO is as follows:

Use of proceeds

- Business expansion

- Procurement of equipment and components for future projects - 46.15% (within 3 years)

- Payment to subcontractors for future projects - 22.15% (within 1.5 years)

- Bank guarantees for future projects - 20.73% (within 3 years)

- Recruitment of engineers and other personnel - 4.14% (within 2 years)

- Estimated listing expenses - 6.83% (within 1 month)

Business expansion

- Procurement of equipment and components for future projects - 46.15% (within 3 years)

In order to expand M&E engineering business, the company has earmarked RM38.50 million, representing 46.15% of the proceeds raised from its Public Issue for the purchase of equipment and components for future projects. The proceeds allocated for such purchases represent approximately 48.57% of the total purchases (excluding subcontractors’ costs) for FYE 2023. The typical equipment and components required for the M&E engineering projects, which the company sources from local suppliers, include amongst others, power cables, transformers, generator sets, switchgear and HV equipment. The detailed breakdown of the equipment and components cannot be determined at this juncture as it will depend on the projects that the company secures and at prevailing market prices. As at the LPD, the company has not entered into any binding agreements with any of the suppliers. In the event that the actual payment to the suppliers for the above purchases is higher than the allocated amount, the shortfall amount will be funded via the company internally generated funds and/or bank borrowings

- Payment to subcontractors for future projects - 22.15% (within 1.5 years)

The company intends to allocate RM18.48 million, representing 22.15% of the proceeds raised from its Public Issue for payment to subcontractors for future projects. The proceeds allocated for the payment to subcontractors for the future projects represent approximately 38.42% of the subcontractors’ costs for FYE 2023. These subcontractors will undertake specific aspects of the M&E engineering projects, including amongst others, civil, structural and architectural works, as well as M&E systems installation, testing and commissioning activities under the company project management and supervision. The earmarked amount will be utilised to support potential projects secured by the company group in the future. In the event of any shortfall, the deficit will be funded via the company's internally generated funds.

- Bank guarantees for future projects - 20.73% (within 3 years)

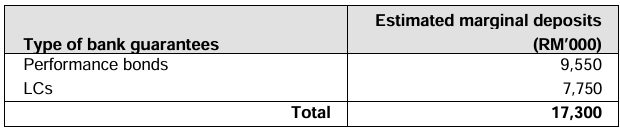

The company is required to provide performance bonds for certain M&E engineering projects. Typically, these performance bonds required by its customers or project owners, range from 5.00% to 10.00% of the total project value. These performance bonds are generally issued in the form of bank guarantees by financial institutions to the customers or project owners to serve as an assurance or security for the company to fulfill its roles and obligations set out in the contracts satisfactorily.

Apart from performance bonds, the company projects typically involve the issuance of Letter of Credits (“LCs”) as required by its suppliers. These LCs provide additional comfort to the suppliers, ensuring that payment will be made to the suppliers upon the release of goods and/or services, guaranteeing compliance with the specific requirements set out in the LCs.

To facilitate the issuance of performance bonds in favour of the customers, as well as LCs required by the suppliers, the company must maintain a marginal deposit through fixed deposits pledged with financial institutions until the project is completed for the performance bond or conditions are fulfilled for the LC. Typically, the marginal deposits for performance bonds and LCs constitute approximately 20.00% of the performance bond value and the invoice value. Consequently, this leads to tying up of a portion of the company Group’s working capital during the project durations, thereby affecting its liquidity.

As at the LPD, the company has been granted for banking facilities amounting to a total of RM109.01 million from financial institutions, including RM104.00 million in banking facilities for the purposes of, amongst others, performance bonds, LCs, trust receipts and banker’s acceptance. As at the LPD, the company has utilised RM39.07 million for performance bonds, RM2.25 million for LCs and RM0.10 million for banker’s acceptance. These performance bonds, totaling RM39.07 million, were obtained for the company's 3 ongoing projects with an aggregated contract value of RM261.83 million. In connection with this, the company has pledged RM7.48 million of marginal deposits, equivalent to 19.15% of the total value of performance bonds with financial institutions.

Hence, the company intends to allocate a total of RM17.30 million or 20.73% of the total proceeds raised from its Public Issue to be utilised for marginal deposits. The proceeds allocated for marginal deposits represent approximately 14.32% of the total banking facilities granted to the company Group for the above-mentioned purposes. These marginal deposits will be pledged with financial institutions to secure bank guarantees (i.e. performance bonds and/or LCs) for the company's future projects. This is in line with the expansion of the company’s M&E engineering business as they intend to pursue larger-scale M&E engineering projects moving forward. Such allocation is expected to free up the company's internally generated funds, which would otherwise be used to meet the contractual obligations in relation to the placement of marginal deposits with financial institutions and thereby, improve the liquidity of the company Group.

The detailed breakdown of the allocation of marginal deposits to be pledged with the financial institutions is set out in the table below:

The amount of marginal deposits to be maintained by the company with the financial institutions for the issuance of performance bonds and LCs is expected to increase in line with the growth of the M&E engineering business and the value of the contracts awarded to the company. In the event the actual proceeds utilised for marginal deposit on bank guarantees for the company future projects is lower than the earmarked amount, the excess will be used for the procurement of equipment and components for M&E engineering works. Any excess amount required for the marginal deposits on bank guarantees for the future projects will be funded from the company internally generated funds.

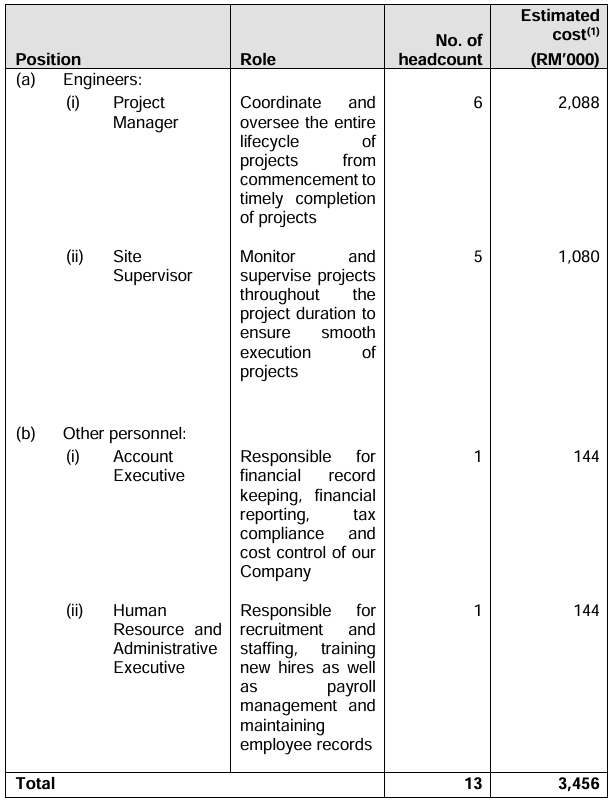

- Recruitment of engineers and other personnel - 4.14% (within 2 years)

The company intends to allocate RM3.46 million, representing 4.14% of the proceeds raised from its Public Issue to expand its workforce by hiring additional engineers and other personnel. This initiative aims to strengthen the company internal capabilities and support the growth of the company business operations.

The details of the recruitment of engineers and other personnel are summarised in the table below:

Business Model

The company’s business model is as follows:

Click here to continue the IPO - CBH Engineering Holdings Berhad (Part 2)

Looking for flat 0.05% brokerage?

Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)