IPO - 3REN Berhad (Part 1)

MQTrader Jesse

Publish date: Fri, 18 Oct 2024, 10:18 AM

Tentative Date(s):

Opening of application - 09 October 2024

Closing of application - 23 October 2024

Balloting of applications - 25 October 2024

Allotment of IPO shares to successful applicants - 04 November 2024

Listing on the ACE Market - 06 November 2024

Company Background

The company was incorporated in Malaysia under the Act on 5 April 2021 as a private limited company under the name of 3REN Sdn Bhd and subsequently converted into a public limited company and assumed its present name on 19 February 2024. The company is an investment holding company whilst their wholly-owned subsidiary companies are principally involved in the provision of automation solutions and engineering services.

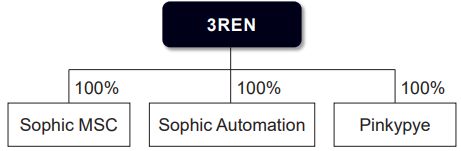

The company structure as at the LPD is as follows:

Use of proceeds

Setting up new Delivery Centres - 23.38% (within 36 months)

R&D expenditure - 16.56% (within 24 months)

Establishment of new Singapore office - 9.74% (within 36 months)

Repayment of bank borrowings - 24.67% (within 6 months)

Working capital requirements - 12.66% (within 24 months)

Estimated listing expenses - 12.99% (Immediate)

Setting up new Delivery Centres - 23.38% (within 36 months)

The company intend to set up its own dedicated Delivery Centres to specifically undertake certain product engineering services projects which are usually performed at various premises/locations of their customers.

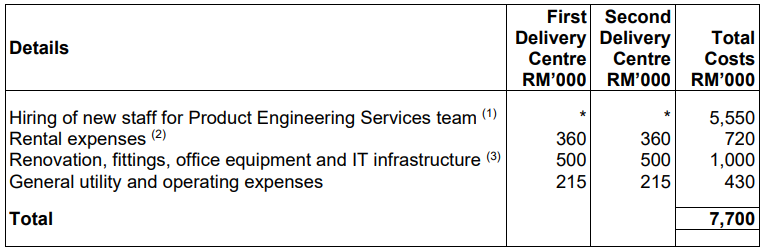

The total costs for the Delivery Centres are estimated at RM7.70 million of which RM7.20 million shall be funded from the Public Issue proceeds over a period of 36 months whilst the remaining RM0.50 million is to be financed via its internal funds, details of which are set out below:

R&D expenditure - 16.56% (within 24 months)

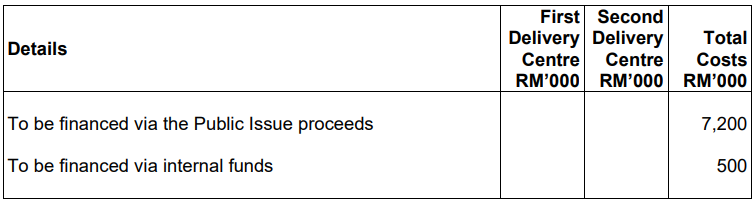

The company intend to utilise approximately RM5.1 million of the Public Issue proceeds for its continuing R&D initiatives which would include setting up of a dedicated innovation centre, hiring of additional R&D personnel as well as purchase of related IT software and hardware as well as R&D supporting tools and equipment in line with their R&D plans and strategies. The details of the future R&D expenditures are as follows:

Establishment of new Singapore office - 9.74% (within 36 months)

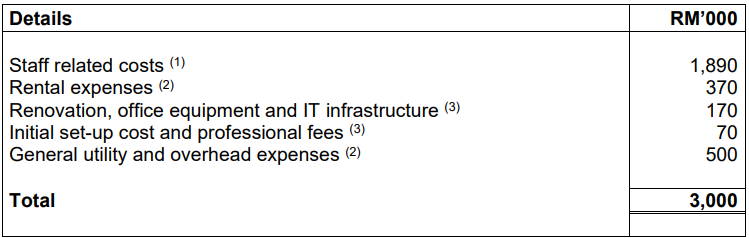

The company intend to set-up a marketing and sales office in Singapore by the first half of 2025 to increase their market presence and enhance their sales and marketing initiatives. They intend to fully finance the establishment costs and working capital of their new Singapore office, estimated at RM3.0 million, from its Public Issue proceeds. These expenses would include initial company set-up costs and professional fees, rental expenses, office renovation, office equipment and IT infrastructure (hardware and software), staff costs for 1 business development personnel and 2 software technicians, and utility expenses for a period of 36 months. The breakdown of these estimated costs is as follows:

Repayment of bank borrowings - 24.67% (within 6 months)

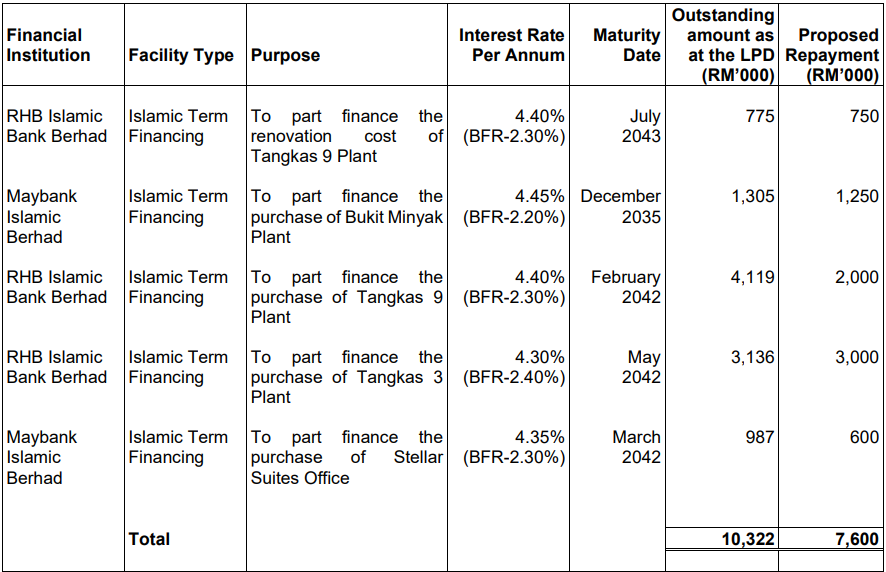

The company intend to allocate RM7.60 million from the Public Issue proceeds to partially reduce some of their outstanding bank borrowings, the details of which are as set out below:

Working capital requirements - 12.66% (within 24 months)

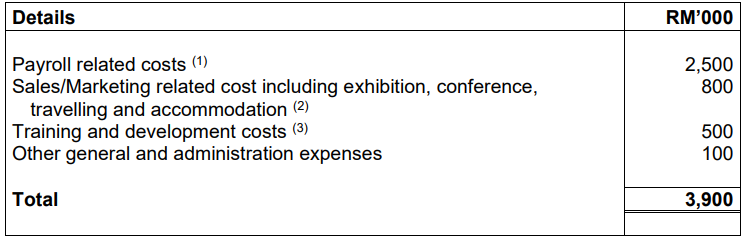

The company requirement for working capital is expected to increase in line with their expected expansion and business growth. Therefore, the company Group proposes to allocate approximately RM3.9 million for their working capital requirements for the following:

Business Model

The company business model is summarised as follows:

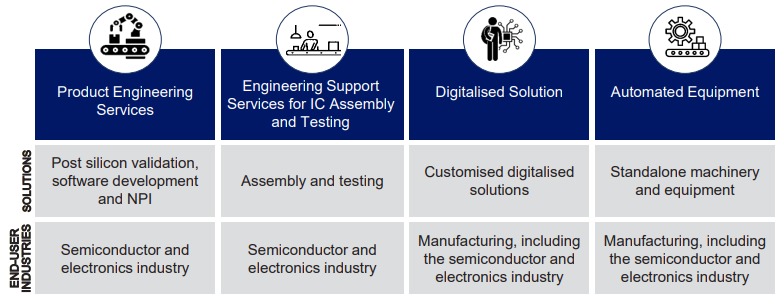

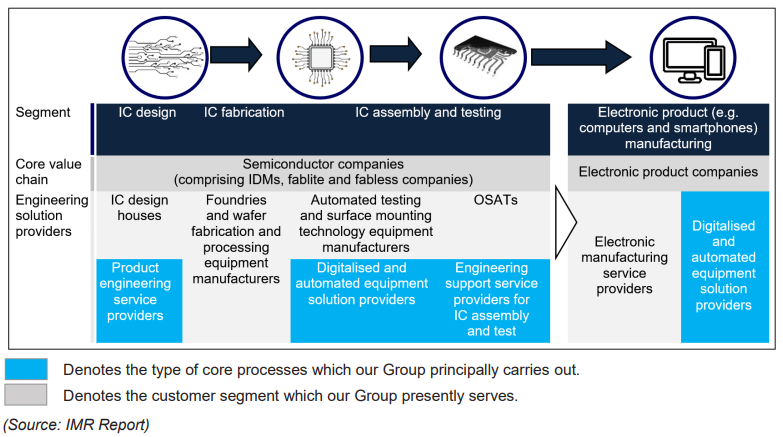

The company principal business activities serve various segments of the semiconductor and electronics industry value chain, as illustrated below:

Click here to continue the IPO - 3REN Berhad (Part 2)

Interested to start trading? Send your inquiry now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)