IPO - Colform Group Berhad (Part 2)

MQTrader Jesse

Publish date: Tue, 21 Jan 2025, 05:38 PM

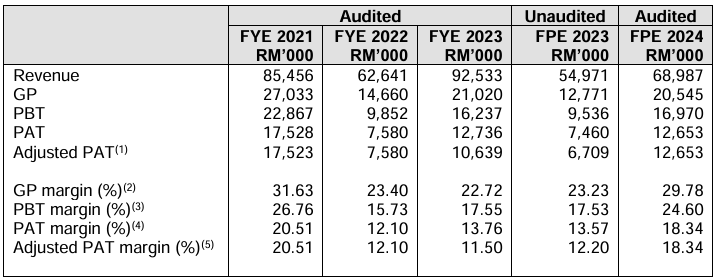

Financial Highlights

The following table sets out the financial highlights of the company’s historical audited combined statements of comprehensive income for the Financial Years Under Review:

- The revenue fell from RM85 million in FYE 2021 to RM62 million in FYE 2022 due to lower sales volume and declining global steel prices. It then rose to RM92 million in FYE 2023.

- The gross profit margin declined from 31.63% in FYE 2021 to 22.72% in FYE 2023, driven by lower margins across all segments, including manufacturing, trading, supply and installation, and project management services.

- The PAT margin dropped from 20.51% in FYE 2021 to 12.10% in FYE 2022, then rose to 13.76% in FYE 2023.

- The gearing ratio is 0.23 in FYE 2023, slightly below the benchmark range, indicating that the company still has room to increase debt and bring it within a reasonable gearing ratio range. (A good gearing ratio should be between 0.25 - 0.5).

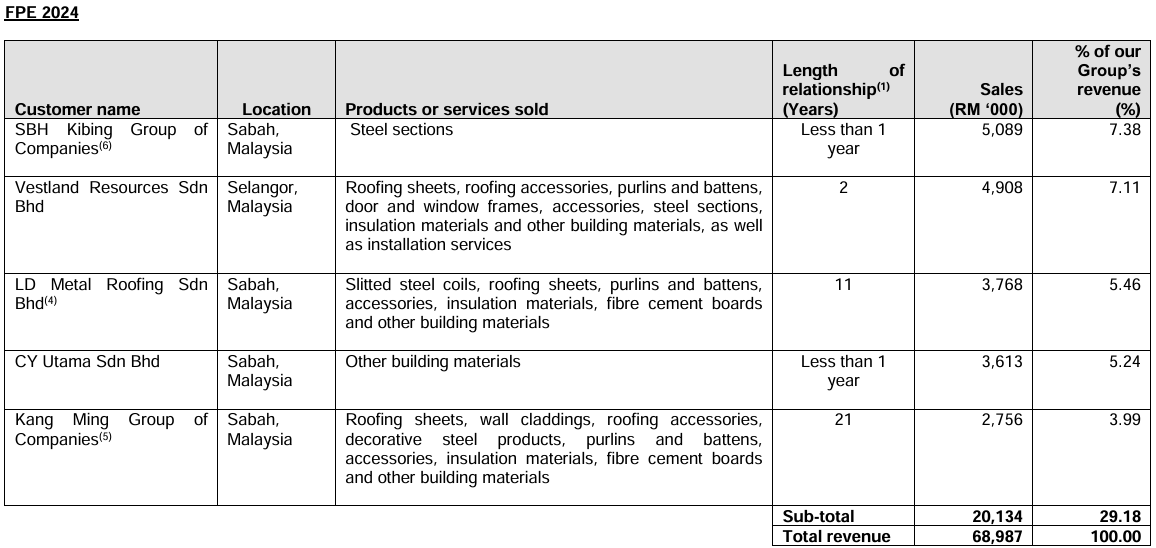

Major customers and suppliers

Major Customers

The company Group’s top 5 customers for FPE 2024 are as follows:

The company does not enter into any long-term sales agreements with its customers, as all sales are conducted on a purchase-order basis, save for the provision of supply and installation services, as well as project management services for construction projects.

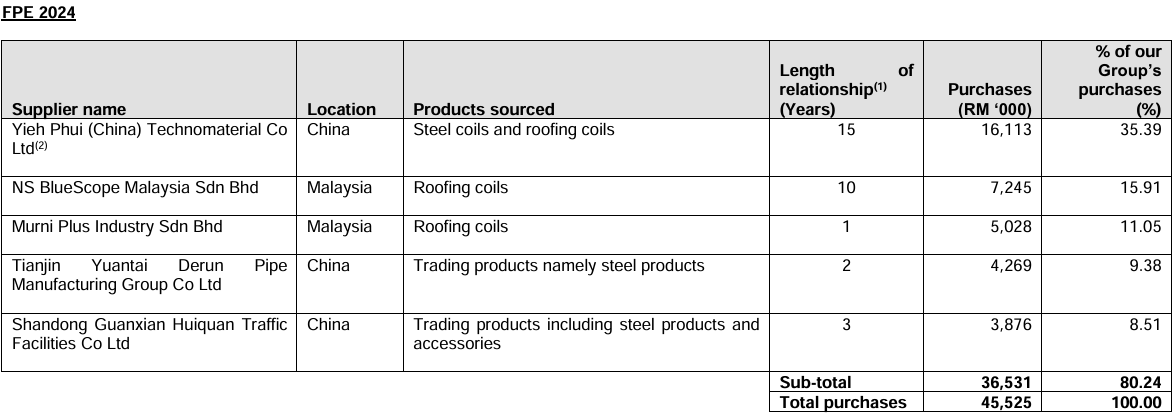

Major Suppliers

The company Group’s top 5 suppliers by total purchases for FPE 2024 are as follows:

The company is not dependent on any of the suppliers, as all relevant materials can be sourced from alternative suppliers. Additionally, the company does not enter into any long-term purchase agreements with its suppliers, as all transactions are conducted through purchase orders.

Industry Overview

Steel, an alloy of iron and carbon, often includes elements like chromium and manganese to create alloy steels with multiple grades and varying properties. As a global economic driver, it supports industries such as construction, transportation, and machinery. Steel is also used in household goods, industrial equipment, and construction structures.

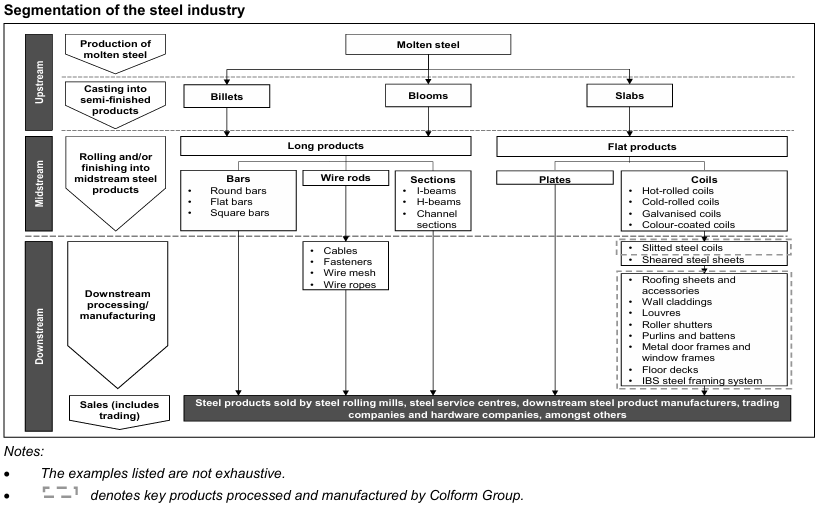

The steel industry can be segmented into 3 key processes:

Downstream steel products enhance the structural integrity and aesthetic appeal of buildings and infrastructure. They also play a key role in Industrialized Building System (IBS) construction, especially in metal framing systems, enabling faster and more cost-efficient projects.

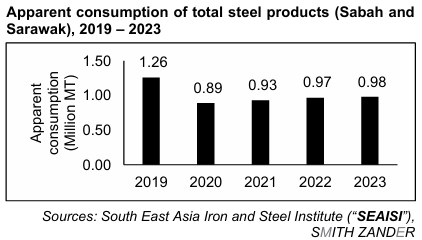

The steel industry in Sabah and Sarawak, represented by apparent steel product consumption, declined by 29.37% from 1.26 million metric tonnes (MT) in 2019 to 0.89 million MT in 2020 due to nationwide movement restrictions imposed during the COVID-19 pandemic. However, the industry recovered, growing at a CAGR of 3.26% to reach 0.98 million MT in 2023.

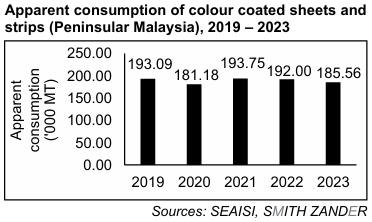

In Peninsular Malaysia, the apparent consumption of colour-coated sheets and strips fell by 6.17% from 193.09 thousand MT in 2019 to 181.18 thousand MT in 2020 due to the pandemic, then rebounded by 6.94% to 193.75 thousand MT in 2021. Subsequently, consumption declined at a negative CAGR of 2.14% to 185.56 thousand MT in 2023, potentially due to increased exports of colour-coated sheets and strips. The colour-coated coil manufacturing industry in Peninsular Malaysia is moderately competitive, with approximately five manufacturers based on publicly available data.

The growth of the downstream steel industry in Peninsular Malaysia will continue to be driven by the future growth in the construction industry in Peninsular Malaysia as downstream steel products are crucial components for the construction of residential, commercial, and industrial properties as well as public infrastructure. SMITH ZANDER forecasts the industry to grow to RM3.90 billion in 2024 and RM4.05 billion in 2025, with a CAGR of 3.78% from 2023 to 2025. The performance of the construction industry in Peninsular Malaysia, as measured by the value of construction work done in Peninsular Malaysia, decreased from RM125.52 billion in 2019 to RM91.24 billion in 2021 at a negative CAGR of 14.74%. Nevertheless, it recovered in 2022 and 2023, whereby growing at a CAGR of 9.90% from RM91.24 billion in 2021 to RM110.20 billion in 2023.

The key drivers in this industry:

- Upstream: Melting raw materials into semi-finished products (e.g., billets, slabs).

- Midstream: Rolling and coating semi-finished products into bars, coils, and plates.

- Downstream: Manufacturing final products (e.g., roofing sheets, purlins) for construction, automotive, and other industries.

- Growth in the construction industry in Sabah and Sarawak drives the demand for downstream steel products

- Demand for property drives planned supply which leads to the increasing demand for downstream steel products

- Government initiatives to promote public infrastructure and IBS adoption will drive the demand for downstream steel products

The key risks and challenges in this industry:

- Exposure to global steel coil price fluctuations

- Exposure to unfavorable changes in import duty regulations

- Reliance on foreign workers as general labor

Future plans and strategies for COLFORM GROUP BERHAD

A summary of the company’s business strategies and future plans are set out below:

- The company intends to expand its business to Peninsular Malaysia by setting up a factory in Klang, Selangor

- The company intends to produce colour coated coils in-house by installing a colour coil coating production line

- The company intends to expand its storage space in Kota Kinabalu by constructing a storage facility adjacent to the Kota Kinabalu Factory

- The company plans to invest in an ERP system to streamline the business operations

MQ Trader View

Opportunities

- The company offers a wide range of steel products to its customers in the construction industry

- The company emphasizes product quality to maintain industry standing and reputation

Risk

- The company is subject to fluctuations in steel prices which may affect the financial results

- The company is subject to foreign exchange fluctuation risks which may impact the costs of the raw materials

- The company is subject to supply chain disruptions from foreign purchases which may result in the disruption of the operations

Click here to continue the IPO - Colform Group Berhad (Part 1)

Eager to explore more trading opportunities? Apply margin account now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)