IPO - Oriental Kopi Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Thu, 09 Jan 2025, 10:20 AM

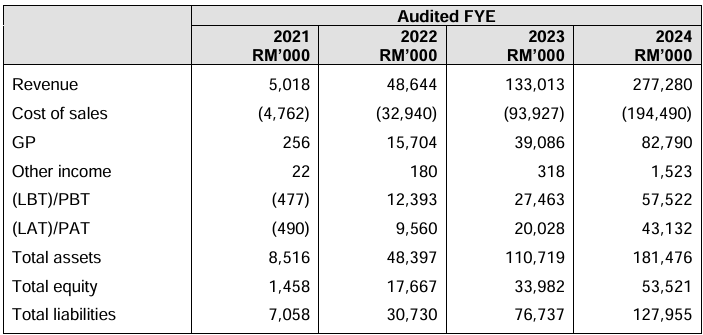

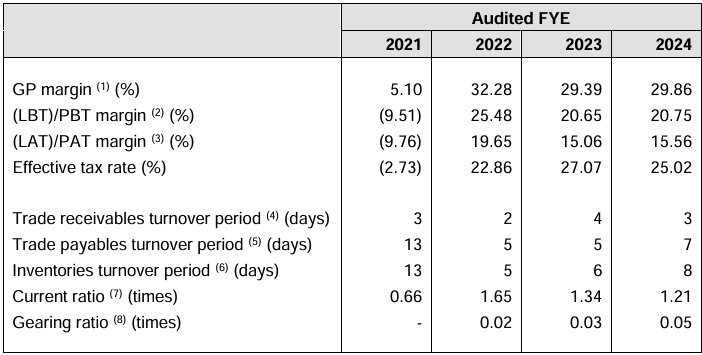

Financial Highlights

The following table sets out a summary of the company Group’s audited combined financial statements for the Financial Years Under Review:

- The revenue increased from RM 5 million in FYE 2021 to RM 277 million in FYE 2024, reflecting the company is expanding its market share.

- The gross profit margin rose from 5.10% in FYE 2021 to 32.28% in FYE 2022 but declined to 29.39% in FYE 2023 due to an increase in material and labor costs. It then increased slightly to 29.86% in FYE 2024.

- The PAT margin increased from -9.76% in FYE 2021 to 19.65% in FYE 2022, dropped to 15.06% in FYE 2023, and rose again to 15.56% in FYE 2024.

- The gearing ratio is 0.05 in FYE 2024, which is below the benchmark range. This indicates that the company still has room to increase debt and bring it within a reasonable gearing range. (A good gearing ratio should be between 0.25 - 0.5).

Major customers and suppliers

Major Customers

The company has two main business segments namely cafe chain operations and distribution and retail of its brands of packaged foods. Customers from the cafe chain operations are mainly individual end-consumers. As such, there are no major customers for the cafe chain operations. Moreover, the customers from the sales of the brands of packaged foods are mainly resellers including wholesalers and retailers such as supermarkets, hypermarkets, minimarkets, and health and beauty stores. Therefore, there are no major customers in this segment of the company’s business.

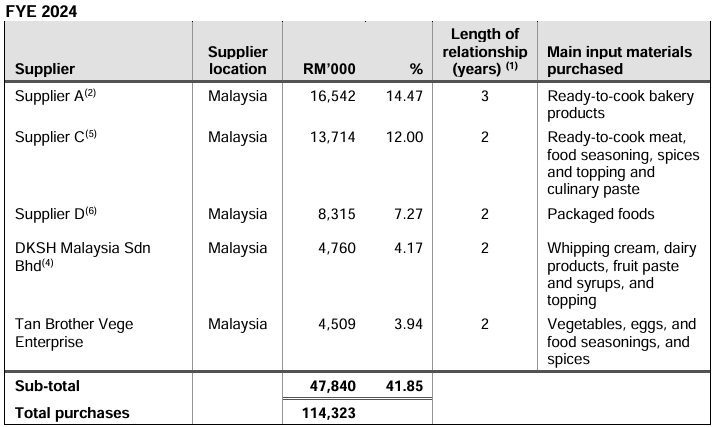

Major Suppliers

The company’s top 5 major suppliers and purchases from them for FYE 2024 is as follows:

Since the commencement of the business in FYE 2021, the company has worked with Supplier A as its main third-party supplier for ready-to-cook bakery products such as egg tart crust, and buns for the business operations. The company owns the recipes of ready-to-cook bakery products. Supplier A manufactures ready-to-cook bakery products according to the recipes. However, the company is not dependent on Supplier A as the company owns the recipes for the ready-to-cook bakery products and are able to source for other alternative third-party suppliers easily for the supply of products provided by Supplier A based on its recipes. In addition, the company has entered into a non-disclosure agreement with Supplier A to protect the recipes from being disclosed to any third party and is able to find alternative third-party suppliers easily for such purchases.

The company is not dependent on of the other major third-party suppliers as each of them accounted for less than 10.00% of the total purchases for the Financial Years Under Review with the exception of Supplier C which exceeded 10.00% of the total purchases for FYE 2024 only. Nevertheless, the company is also not dependent on Supplier C as they are able to source from alternative third-party suppliers for similar products.

Industry Overview

F&B services encompass the full process of preparing, presenting, and serving food and drinks to customers across a range of establishments including cafes and coffee shops, restaurants, F&B service centres, food vendors, alcoholic & non-alcoholic beverage services establishments, and off-premises F&B service establishments. The categorization of establishments may sometimes overlap, such as cafes and restaurants.

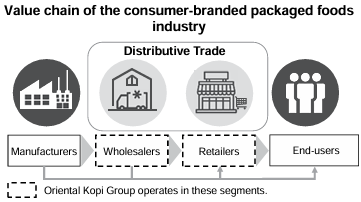

The distributive trade encompasses all activities and linkages in the intermediary stage that channel goods for resale (known as wholesale trade) or direct consumption by end-users (known as retail trade). The value chain of the consumer-branded packaged foods industry begins with manufacturers undertaking the production process. The finished goods are then sold to wholesalers for distribution, which may involve breaking bulk, packaging, branding, storage and transportation to retailers such as supermarkets, hypermarkets and minimarkets for sale to end-users. Wholesalers may also sell their products to other wholesalers for resale, while some may have their own retail network for selling to end users, including through online platforms. In some cases, manufacturers may also sell their products directly to retailers and end-users.

Consumer-branded packaged food is a segment within the broader consumer-branded packaged goods, sometimes referred to as fast-moving consumer goods. Consumer branded packaged foods refer to foods that are branded and in retail packaging in sizes targeted for end-user consumption such as individuals, homes or organisations. It is commonly processed products in a final form that is significantly different from its original raw materials or primary food products. Consumer-branded packaged foods commonly exclude fresh produce.

F&B services encompass activities relating to food services, catering services and beverage services. According to the research from Vital Factor analysis, between 2021 and 2023, the real GDP of F&B services grew at a CAGR of 11.9%. Growth in 2022 was in part due to the recovery in domestic demand following the reopening of the economy, while growth in 2023 was mainly attributed to the partial recovery in tourism spending. Despite the growth, the real GDP of F&B services remained below its pre-COVID-19 levels in 2019. In the first nine months of (9M) 2024, the real GDP of F&B services continued to grow by 3.7% compared to 9M 2023. The household consumption expenditure on restaurants and cafes is indicative of the demand for F&B services. Between 2019 and 2022, the average monthly household consumption expenditure on restaurants and cafes in Malaysia grew at a CAGR of 6.6%, indicating an increasing trend of consumers dining outside their homes.

The key drivers in this industry:

- Growth in economic performance

- An improvement in household spending

- Increased tourist arrivals and spending

The key risks and challenges in this industry:

- Exposure to economic, social, political, and regulatory risks in operational markets

- Price fluctuations of coffee beans, as they are commodity-traded items

Future plans and strategies for ORIENTAL KOPI HOLDINGS BERHAD

The summary of the company’s business strategies and future plans are set out below:

- Domestic expansion

- New head office and central kitchen

- New cafes in various states in Malaysia

- Expansion in the packaged foods segment

- Foreign expansion

- Expand cafe chain to foreign countries

- Marketing activities

MQ Trader View

Opportunities

- The company has 2 pillars of business namely the cafe F&B services and packaged foods which provide the company with two sources of revenue and diversity in product and service offerings

- The company’s business is modular and scalable thus facilitating prompt and simplified procedures to expand the number of the cafes

- The company has direct and indirect distribution channels to optimize market access

Risk

- The company is reliant on third-party suppliers to produce ingredients for the cafe operations and brands of packaged food products

- Inflationary pressure or other cost increases may necessitate price increases for the products and services which may adversely affect the company’s business performance

Click here to continue the IPO - Oriental Kopi Holdings Berhad (Part 1)

Looking for 3x cash & 2x shares trading limit? Get started now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)