IPO - Azam Jaya Berhad (Part 2)

MQTrader Jesse

Publish date: Tue, 22 Oct 2024, 10:33 AM

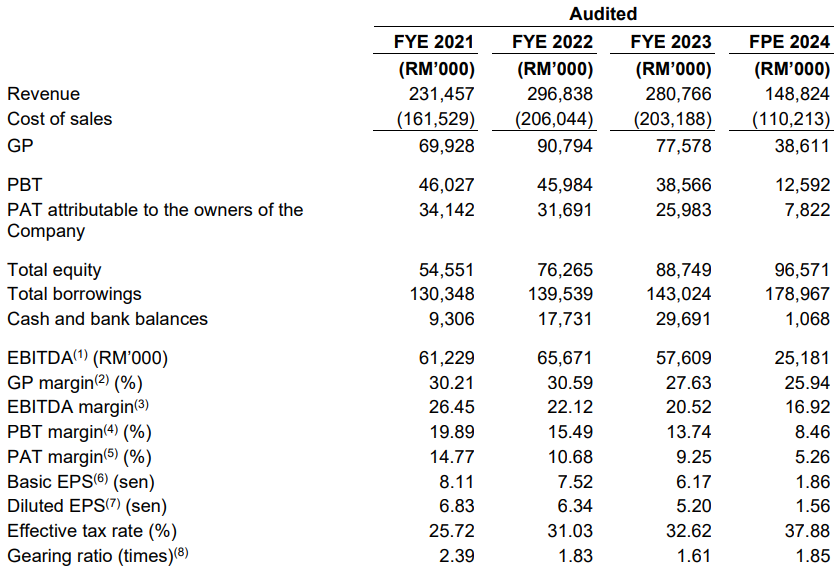

Financial Highlights

The table below sets out the audited combined statements of profit or loss and other comprehensive income of the company Group for the Period under Review:

The revenue increased from RM 231 million in FYE 2021 to RM 296 million in FYE 2022, but declined to RM 280 million in FYE 2023 due to less construction work done for Jalan Lintas Upgrading Project and Pan Borneo Highway Project.

The gross profit margin rose from 30.21% in FYE 2021 to 30.59% in FYE 2022, then dropped to 27.63% in FYE 2023 due to a decrease in revenue from the Jalan Lintas Upgrading Project and changes in design and specifications for the Pan Borneo Highway Project, which reduces the overall project costs.

The PAT margin has consistently dropped from 14.77% in FYE 2021 to 9.25% in FYE 2023.

Due to the nature of business, the gearing ratio is 1.61 in FYE 2023, which is above the benchmark range. This indicates the company is more exposed to liquidity risk.

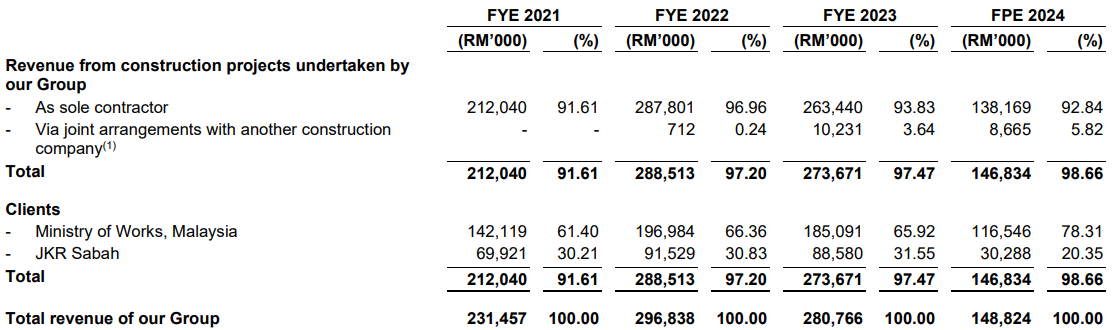

Major customers and suppliers

Major Customers

The company major clients for the Period under Review were the Ministry of Works, Malaysia and JKR Sabah which contributed almost all of the company Group’s construction revenue. The revenue contributions of both clients are as follows:

The company is dependent on the Ministry of Works, Malaysia and JKR Sabah in view that the revenue contribution from them is over 90% of the company Group’s total revenue for any of the years during the Period under Review. Due to the project-oriented nature of the construction industry, the company revenue will continue to be generated from the Ministry of Works, Malaysia and JKR Sabah until all awarded contracts by them are completed. For the avoidance of doubt, the company will continue to be dependent on the Ministry of Works, Malaysia and JKR Sabah as they specialise in road infrastructure construction and intend to continue tendering for road infrastructure construction projects from the Ministry of Works, Malaysia and JKR Sabah.

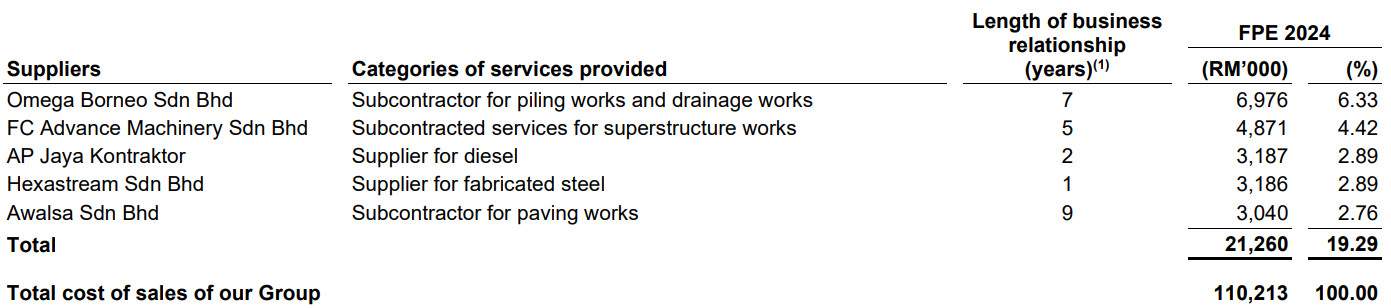

Major Suppliers

The company Group’s top 5 suppliers by total cost of sales for FPE2024 are as follows:

The company is not dependent on any individual subcontractor or supplier for its business operations as their individual share of the cost of sales was not significant. In addition, the Company has alternative subcontractors and suppliers who are able to provide the same products or services as mentioned above.

Industry Overview

The construction industry generally relates to the construction of physical infrastructure,

buildings and special trade activities. It involves the full cycle of infrastructure and buildings, ranging from initial construction such as land reclamation, drainage and piling, to postconstruction building services and maintenance such as refurbishments, renovations, retrofitting, repairs and maintenance, as well as their eventual demolition, dismantling or decommissioning. The construction industry follows two broad business models, depending on the nature and complexity of the project:

Build-only projects - the design phase would be separated from the construction phase. The main contractor may divide the project into several work packages with other construction companies acting as subcontractors. However, the main contractor will be responsible for the overall performance and progress of the project.

Design and build projects - the project owner may prefer a single point of responsibility by appointing a main contractor who would be responsible for both the design and construction of the project (design and build model).

The construction industry constitutes an important component of Malaysia’s economy as it acts as a catalyst to spur the economy, as construction activities will also spur the manufacturing of various building materials and the provision of services locally. It has also played a key role in accumulating the nation’s capital stock such as buildings, roads, railways, ports and airports, which are necessary for the economy to expand. Between 2019 and 2023, the construction industry accounted for an average 3.9% share of the GDP (Figure 3). The construction industry rebounded by 5.0% in 2022 and 6.1% in 2023, after declining by 19.3% and 5.2% in 2020 and 2021, respectively, due to the various lockdowns associated with the COVID-19 pandemic. This was lifted by the continued progress of both infrastructure and building construction projects.

Source: Infobusiness Research

Future plans and strategies for AZAM JAYA BERHAD

The company's business strategies and future plans are as follows:

To maintain / enhance their position as one of the major road infrastructure players in Sabah

To maximise equipment utilisation by continuously tendering for more construction projects

MQ Trader View

Opportunities

The company specializes in road infrastructure construction and is one of the major players in road infrastructure construction in Sabah

The company has strong relationships with subcontractors and materials suppliers

Risk

The company is highly dependent on the Ministry of Works, Malaysia and JKR Sabah as their major clients

The company business is dependent on its ability to secure new projects and replenish order book

The company's joint arrangements with other construction companies to undertake construction projects are subject to the risk of non-performance / termination

Click here to continue the IPO - IPO - Azam Jaya Berhad (Part 1)

Looking for 3x cash & 2x shares trading limit? Get started now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)