IPO - Topvision Eye Specialist Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 29 Nov 2024, 05:36 PM

Financial Highlights

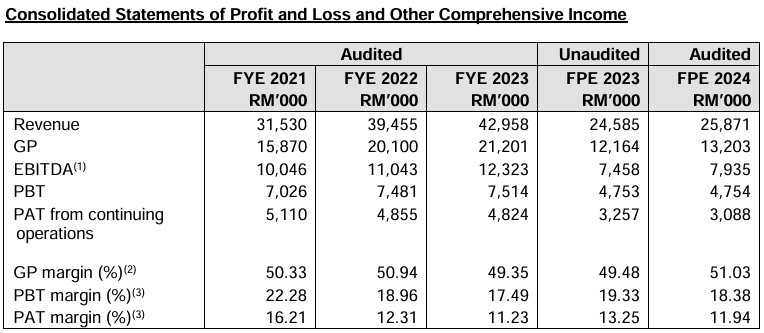

The table below sets out financial highlights based on the company's audited financial statements for the Period Under Review.

- The revenue grew from RM 31 million in FYE 2021 to RM 42 million in FYE 2023, indicating that the company is expanding its market share.

- The gross profit margin rose from 50.33% in FYE 2021 to 50.94% in FYE 2022, and decreased to 49.35% in FYE 2023. This was mainly due to higher service costs and an increase in high-revenue cases, such as cataract treatments and management.

- The PAT margin fell from 16.21% in FYE 2021 to 11.23% in FYE 2023.

- The gearing ratio reduces to 0.76 after listing and utilizing proceeds, indicating manageable reliance on debt relative to equity. (A healthy gearing ratio range is between 0.25 – 0.5)

Major customers and suppliers

Major Customers

Due to the nature of the business, the company’s customers comprise individual patients and patients with corporate or insurance guarantee letters, thus, the company is not dependent on any single individual patient or patients with corporate or insurance guarantee letters.

Major Suppliers

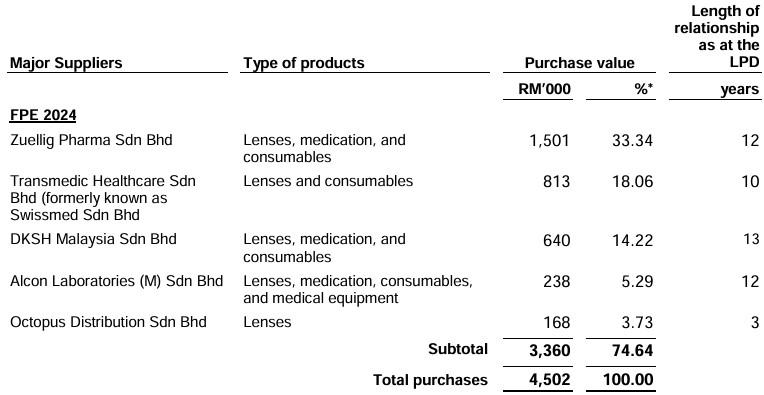

The company purchases lenses, medication, consumables and medical equipment mainly from various local suppliers. The company's top 5 suppliers for FPE 2024 is as follows:

The company is not dependent on any of its major suppliers as they have identified substitute brands of the products which are readily available and can be readily procured from various other suppliers.

Industry Overview

The medical eye care industry is a sub-segment of the eye care industry. Medical eye care or ophthalmology refers to the branch of medicine that specialises in the anatomy, function and diseases of the eye such as blepharitis, conjunctivitis, dry eye syndrome, cataracts, diabetic retinopathy, macular degeneration and retinal detachment. By extension, an ophthalmologist is a medical or osteopathic physician that specialises in the medical and surgical care of the eyes and the prevention of eye diseases. These specialists are usually trained to provide the full spectrum of eye care, from prescribing glasses and contact lenses to complex and delicate eye surgery.

The medical eye care industry revolves around the provision of medical eye care services. Medical eye care encompasses a range of clinical, technical and rehabilitative services that includes diagnosis and treatment of visual impairment in adults and children as well as the provision of medical and surgical treatment to correct vision-threatening conditions and other eye disorders. Medical eye care services in Malaysia are provided by a dual healthcare system which is the public system, commonly through the hospitals operated by the Ministry of Health and a fee-for-service private system through the hospitals and standalone ambulatory care centres. Medical eye care services are offered at multiple types of facilities. The service offerings vary across different types of facilities.

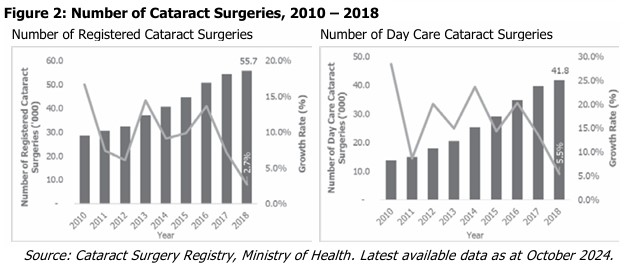

In Malaysia, there has been an increase in the number of registered cataract surgeries performed in the country over the years. The increase in the number of surgeries indicates a growing demand for medical eye care services. Based on the Cataract Surgery Registry published by the National Eye Database, an eye health information system supported by the Ministry of Health Malaysia, there were a total of 55,687 registered cataract surgeries performed in 2018 (latest available statistics). During the period from 2010 to 2018, the number of registered cataract surgeries increased by a compound annual growth rate (“CAGR”) of 9.6%. At the same time, the number of daycare cataract surgeries has also been increasing over the years, with 41,755 daycare surgeries registered in 2018. From 2010 to 2018, the number of daycare cataract surgeries increased by a CAGR of 16.4%.

The medical eye care industry (based on revenue) in Malaysia expanded by 29.4% to RM702.4 million in 2022 from RM542.8 million in 2021 mainly driven by the surge in patients’ demand for medical eye care services after prior years of delays attributed to the various novel coronavirus disease 2019 (“COVID-19”) induced movement control orders in Malaysia. In addition, with the opening of international borders, the medical eye care industry in Malaysia also benefitted from increased number of healthcare travellers. According to the Malaysia Healthcare Travel Council, the number of healthcare traveller increased by approximately 51.5% to 850,000 in 2022 (2021: 561,000), while revenue from healthcare travellers more than doubled to RM1.30 billion (2021: RM600.0 million) in the same year.

Following the strong growth seen in 2022, expansion in the Malaysian medical eye care industry is expected to moderate to 10.4% to RM775.8 million in 2023 as the demand for medical eye care services normalises. Going forward, the expansion of the medical eye care industry in Malaysia will be driven by demand factors such as steady population growth and aging population, growth in medical tourism, growing affluence of consumers and the prevalence of lifestyle disease among Malaysians. Meanwhile, supply factors such as the strong support from the Malaysian government and the advancement in medical eye care technology are also expected to bolster the growth of the medical eye care industry in Malaysia. Accordingly, the size of the medical eye care industry (in terms of revenue) in Malaysia is forecast to expand at a CAGR of 10.0% from RM849.5 million in 2024 to RM1,249.4 million by 2028.

The key drivers in this industry:

- Strong support from the Malaysian Government

- Supported by the advancement in medical eye care technology

The key risks and challenges in this industry:

- Growth dependent on the availability of ophthalmologists

- Highly-regulated industry

Source: Protégé Associates

Future plans and strategies for TOPVISION EYE SPECIALIST BERHAD

A summary of the company future plans and business strategies is set out as follows:

- Establishment of TOPVISION International Eye Specialist Centre

- Expansion of ACC network

- Centralised procurement and distribution of eye care supplements under “Topwellness” brand

MQ Trader View

Opportunities

- The company has an experienced team of ophthalmologists

- The company has a wide range of medical eye care services

Risk

- The company is subject to the risk of relocation due to the expiry or termination of the rental agreement or an increase in rental cost

- The company is subject to the risks of medical and legal claims, regulatory actions and professional liability, which may not be fully covered by the insurance

- The company's business may be affected by obsolescence related to its medical equipment

Click here to continue the IPO - Topvision Eye Specialist Berhad (Part 1)

Eager to explore more trading opportunities? Apply margin account now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)