MQ Trader Analysis - GENM (4715) - Challenging year ahead

MQTrader Jesse

Publish date: Thu, 31 Jan 2019, 04:53 PM

GENM (4715)

Genting Malaysia is a resorts and casino company which is a subsidiary of the holding company Genting. The core business of GENM consists of 2 major business segments, namely Leisure & Hospitality and Properties.

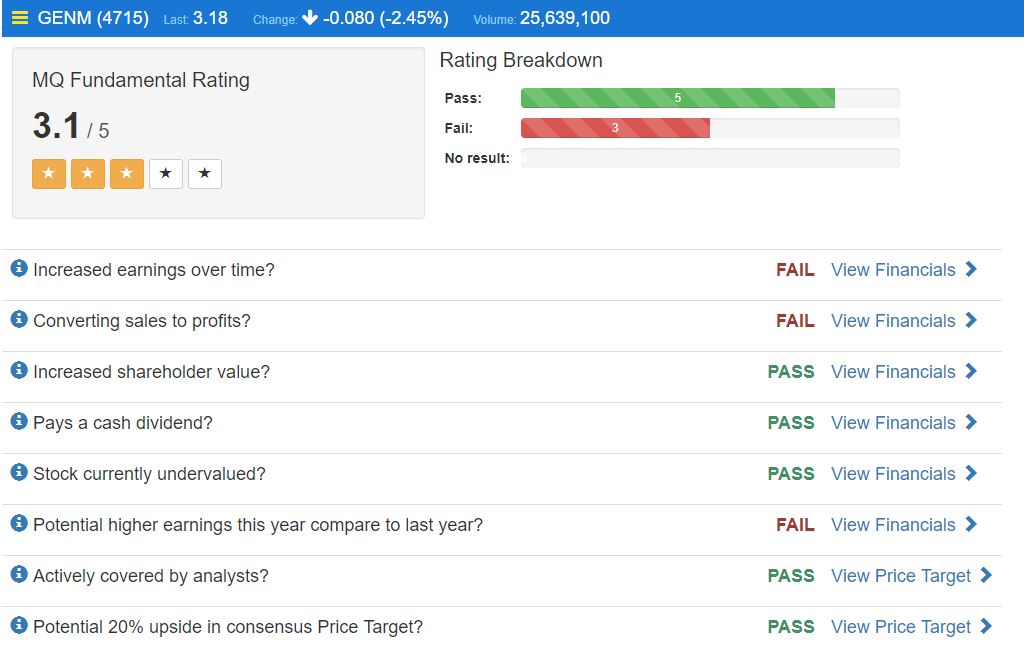

MQ Fundamental Rating

It is a fundamentally okay company, as it passes 5 out of 8 of MQ Fundamental tests. According to MQ Trader criteria, stocks with fundamental rating of more than 2.5/5.0 is considered as stocks with good fundamentals.

Overall technical chart of GENM

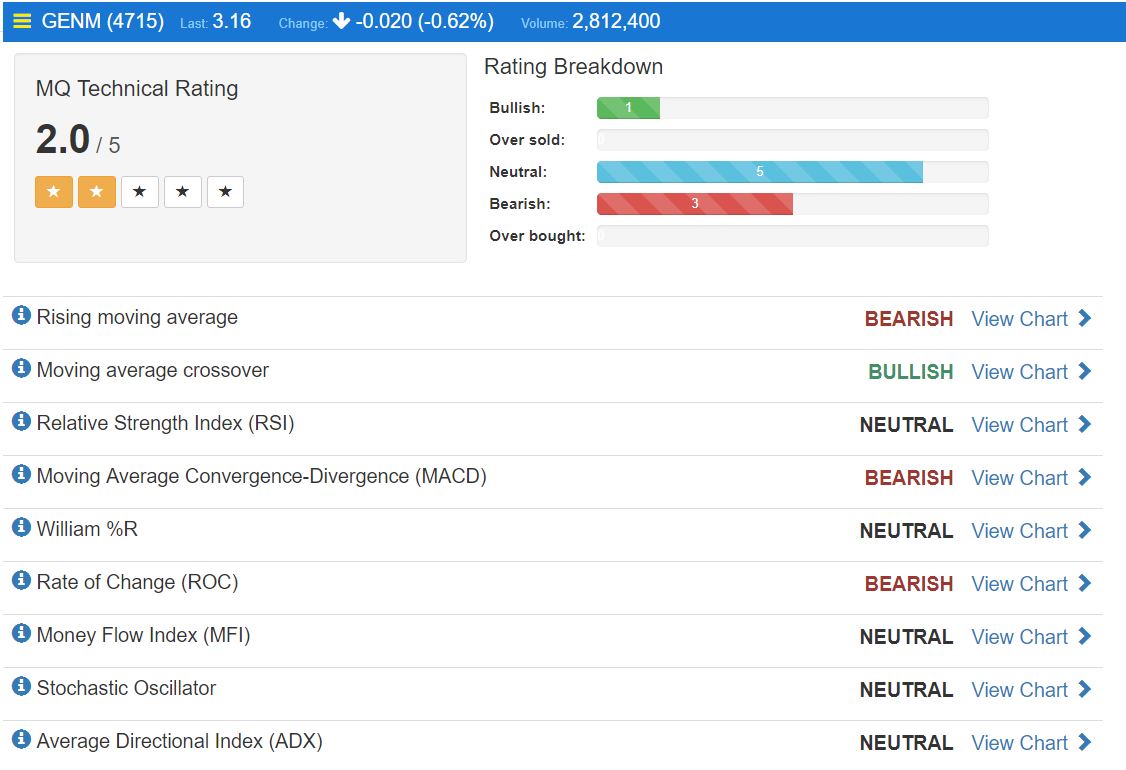

MQ Technical Rating

EMA 5 Crossover Daily Chart

EMA 5 Crossover Hourly Chart

GENM is still experiencing down-trending price movement, as most of the technical indicators detects bearish signal at the moment. Some MQ Trader trading strategies detected buy signal but the signal quality is tested to be poor. For instance, technical indicators such as ADX and OBV which can detect buying volume effectively, as showing negative result. On top of that, MQ Backtesting is showing low rating that confirms the winning chance of the buy signal to be low.

Why did sharp drop in price happen?

GENM had been growing steadily until the end of year 2018 when some events took place simultaneously and brought a huge impact to GENM’s share price. First of all, the implementation of higher gaming tax was expected to decrease the profit earned by GENM and it became the key factor that dragged GENM’s share price. Next, the market sentiment was further affected by the news breaking that GENTING was suing Disney Co and Twenty First Century Fox Inc for more than USD 1 Billion.

Not long after that, announcement on the impairment loss in 3Q18 was made influencing the confidence of traders on GENM. Recently, there is another event challenging GENM, as Twentieth Century Fox has filed a countersuit against GENM over the scrapped theme park deal.

Will these events affect GENM’s fundamentals in long term?

1.Hike in gaming tax

The gaming tax is increased by 10% after the implementation of Budget 2019 to increase and diversify Malaysia government’s revenue streams via indirect taxes. This hike can essentially cause Malaysia’s GGRR tax rate to be higher and less competitive than its neighboring peers-ex Macau. Gaming sector is anticipated to experience margin compression and potential earning contraction in the long run. Thus, this factor will indirectly influence the share price of GENM due to lower profit margin in long term.

2.Termination of Fox Theme Park

We believe that this incident will not bring serious impact to GENM’s revenue. This is because revenue generated by the theme park will just contribute a fraction of the total non-gaming revenue which accounts for only 10-15% of GenM’s 4-8%. Besides, no severe impacts on GENM’s operation and earning are resulted after the theme park was closed several years ago. Thus, the theme park is expected to operate as usual (possibly under a different brand) because 21st Century Fox is just only the licensor.

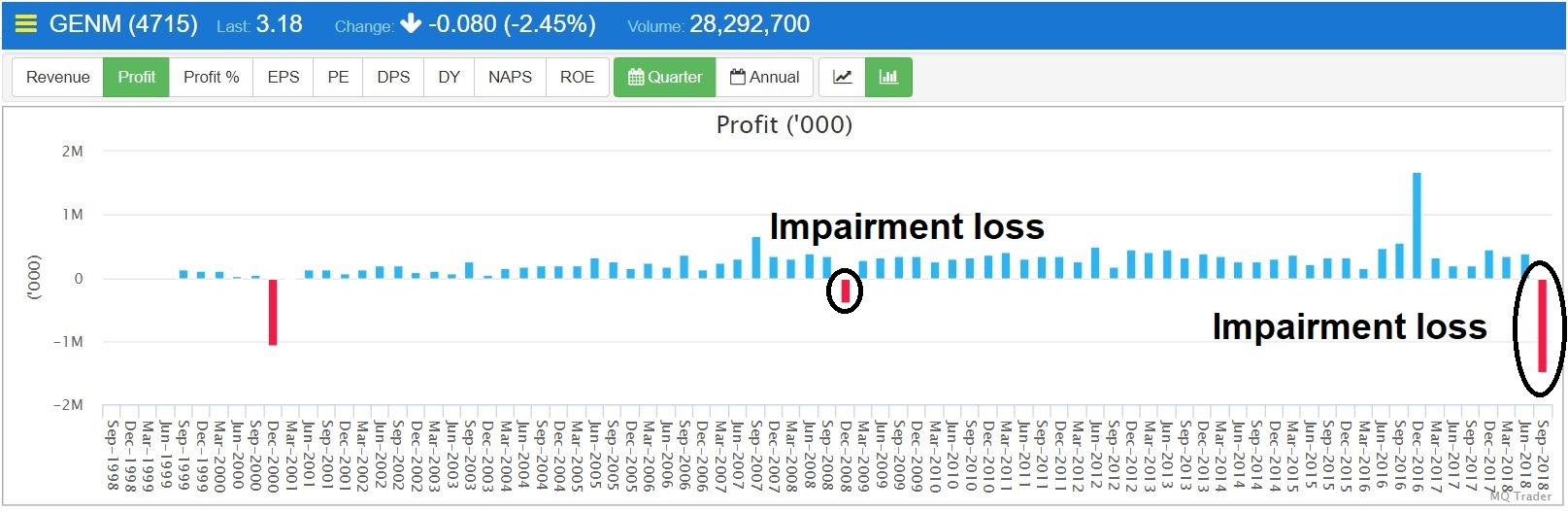

3.Impairment loss

Impairment is an accounting principle that describes a permanent reduction in the value of a company’s asset typically a fixed asset. Impairment normally occurs to write off the difference in the fair value and the book value of an asset when depreciation on the asset happens. There will be no negative impact on a company’s performance, so it will not affect the company’s fundamentals ultimately.

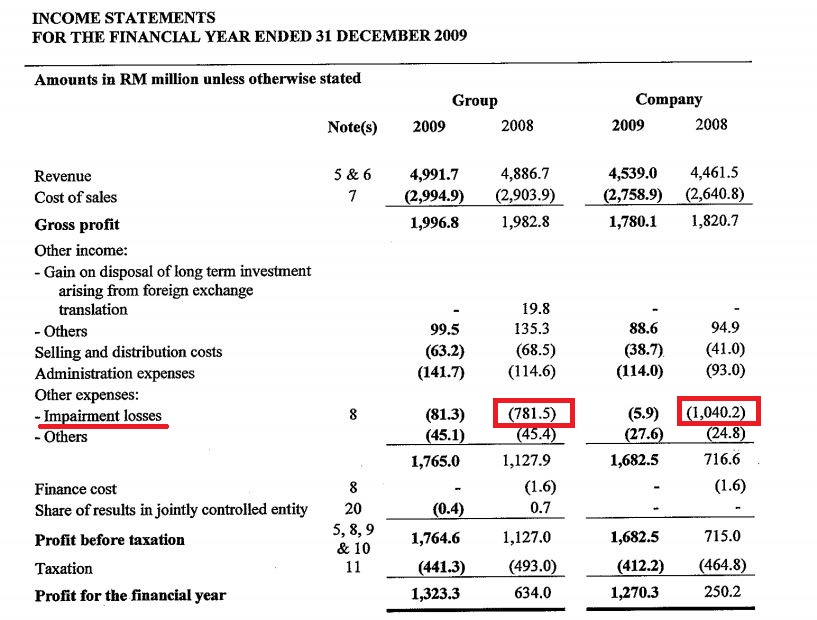

Figure 1 and 2 shows that impairment was made on GENM’s balance sheet once after approximately 9 years.

Figure 1: Annual profit of GENM

Figure 2: Income statement of GENM

1.Countersuit by Twentieth Century Fox

The US$ 46.4mil (RM 191.84mil) countersuit by Fox claiming that GENM had breached its contract, as it fails to fulfill its commitments towards completing the Fox-branded theme park within the agreed time frame. This event will influence the cash flow of GENM in short term if GENM is countersuit successfully by Fox. Operation of GENM’s theme park will be continued regardless of the outcome of countersuit by Fox, so it will not affect the earning of GENM in the long period of time.

MQ Trader View

Road to Recovery is challenging for GENM but the events that happened to the Theme Park listed above has minimal impact to its current operations – where GENM has past experience running its own brand of theme park and it was fairly popular. We have faith that GENM will not have issue to run another new theme park brand and make it popular.

The key thing that we would like to stress is on the gaming tax – how the management will manage the tax increment. Thus, next quarter results shall reveal the capability of the management to cope with the gaming tax.

Conclusion

In our opinion, we will put this stock into our watch list until the outcome of countersuit by Fox is announced. If Fox fails to countersue GENM, the market sentiment will be expected to improve. By that time, we can utilize “fast in fast out” strategy to grab opportunities within a short period by using MQ Trader trading strategies (i.e. ADX Crossover). At the same time, we will wait for next quarter financial result which plays an important role in ascertaining the fundamental rating of GENM, to identify the potential of GENM for long term investment.

MQ Trader Analysis Tool

To view GENM’s fundamental analysis on MQ Trader: https://klse.i3investor.com/mqtrader/sf/analysis/fa/4715

To view GENM’s technical analysis on MQ Trader: https://klse.i3investor.com/mqtrader/sf/analysis/stkta/4715

To know more about MQ Trader system, please visit MQ Trader Education Series.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on MQTrader Stock Discussion

Created by MQTrader Jesse | May 20, 2021

Created by MQTrader Jesse | Jul 05, 2019

Created by MQTrader Jesse | Jun 03, 2019