Gadang - Chart the next phase of growth.

excelyou

Publish date: Fri, 21 Oct 2016, 02:23 PM

Gadang - Chart the next phase of growth.

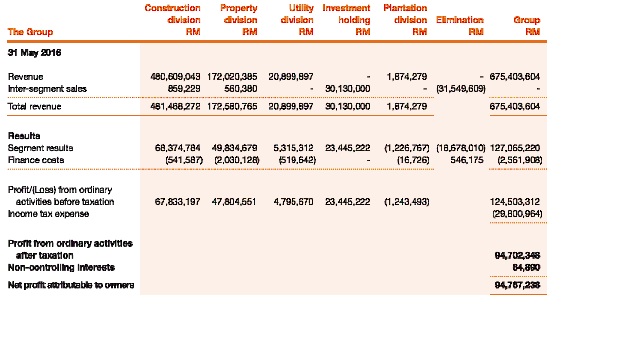

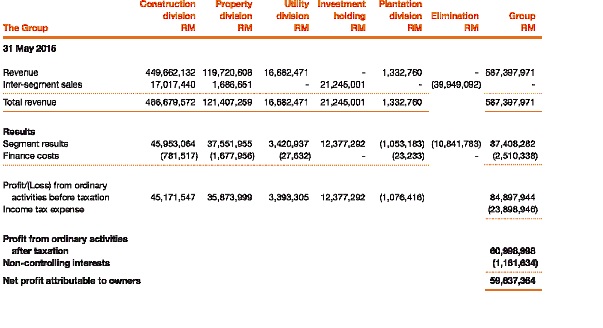

TABLE A:

| Financial Year - Net Profit Margin % | Construction | Property | Utility | Plantation |

| 2016 | 14% | 28% | 23% | -66% |

| 2015 | 10% | 29% | 20% | -81% |

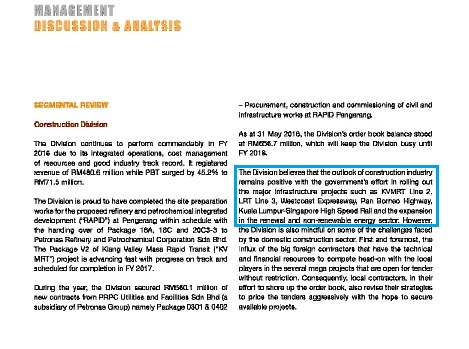

Construction Division:

Gadang continue to bid infrastructure jobs with preserve profit margin and maintain a healthy book orders.

Gadang seem maximise it workforce for better margin projects, rather than recording HIGH revenue but LOW profit.

We can see at Table A.

As at September, its tenderbook was at RM5.2 billion, mainly on highways and viaduct jobs for the MRT2.

RHB stated RM300-500 mllion annual orderbook replenishment rate assumption to be achievable and reasonably.

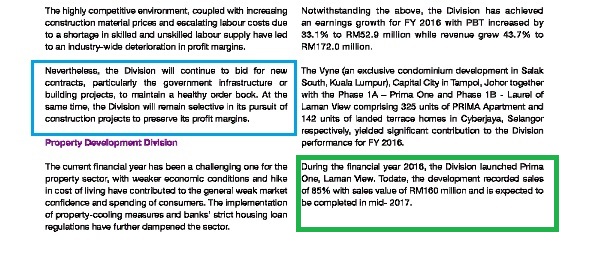

Property Division:

Gadang manage to shown continue improvement in sales value and new launching at PRIMA 2 at Cyberjaya and affortable housing at

Semenyih to sustain it revenue and profit margin.

As at 30 May 2016, unbilled sales of RM233 million, represented 1.35 times of FYE2016 revenue of property division.

Gadang was recently awarded the development rights for a 24.08-acre plot called R3-1 within the Kwasa Damansara township by the

master developer Kwasa Land, with GDV unknow yet, but in the region of RM700-900 million.

Utility Division:

Gadang have 4 water concessions with steady income from Indonesia.

Due to increase demand from rise population in Indonesia, Gadang expected major water and electricity plants are requited in near term.

Gadang have established reputation in Indonesia and these will benefit them as eveidenced that Gadang able to develop and operate

mini-hyro power plant in Sumatera Barat, target to be commence in year 2018/2019.

Conclusion

Year by year, Gadang was continue improving their both revenue and profit margin.

With PE less than 10x, is Gadang worth to consider?

(PE range of 10x-14x for small and mid-cap construction companies).

The One •

Thank you for sharing ya..

2016-10-21 14:39