Fiscal QE for Malaysia? (Part 2)

omightycap

Publish date: Tue, 21 Jun 2016, 10:35 AM

In part 1, we discussed about how developed economies would react to avoid a recession at the current moment. Most of them have their tools but how would Malaysia fare? We would look into the likely action that the Malaysian government can take for the time being in this part.

Back to Malaysia

Going back to Malaysia, we aren’t going to experience growth if major developed economies are foreseeing the economy going on a recessionary cycle soon. Unlike developed economies who covered more than 50% of the world’s GDP, our GDP growth relies on how well these majors are doing.

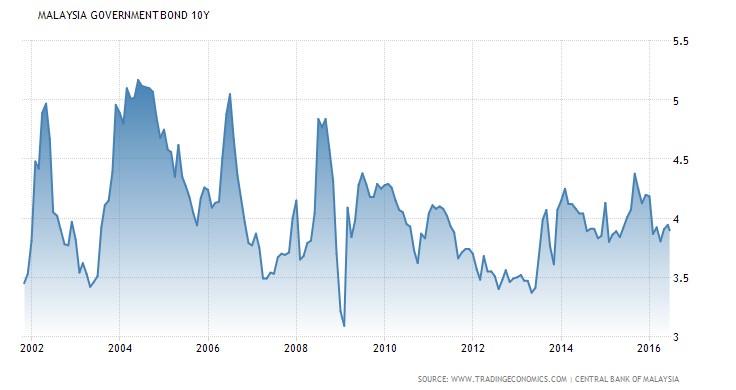

The last I looked at the Malaysian Government Securities (MGS) yield was coming in at 3.25% (3yrs), 3.52% (5yrs) and 3.88% (10yrs).

It’s pretty obvious that the debt financing vehicle gets expensive as time goes by. One reason to this is credit rating agencies aren’t giving our government investment grade ratings for its MGS. In other words, government debt financing isn’t suitable for Malaysia like what developed economies with zero yield could do explained in part 1 of this article.

Furthermore, the government debt to GDP levels are at its all-time high since the 1997 crisis. Continuously increasing the leverage on the government’s balance sheet might pose the risk of another downgrade to our MGS. This definitely isn’t the risk worth taking as we should move towards the range of lower yields as our economy matures.

Furthermore, the government debt to GDP levels are at its all-time high since the 1997 crisis. Continuously increasing the leverage on the government’s balance sheet might pose the risk of another downgrade to our MGS. This definitely isn’t the risk worth taking as we should move towards the range of lower yields as our economy matures.

Most Likely Outcome

Most Likely Outcome

Since a fiscal QE isn’t going to work out similar to developed economies, the use of monetary policy has to be utilize to its maximum potential for our country.

We see that interest rate would come down eventually even though it happened that Bank Negara Malaysia (BNM) hiked its Overnight Policy Rate (OPR) not long ago. The lowered interest rate wouldn’t be coupled with massive open market operations like what US did after the crisis since that would devalue the currency even more.

But the lowering of OPR would still be better compared to directly pumping liquidity into the banking sector. The rebuilding process would need to happen then with the government taking the primary role in pushing the economy out from the slump.

It seems that we are running out of tools to smoothen growth therefore when a recession hits, we should see rates go down pretty quickly. As said in part 1, the probability of a recession in next 5 years is getting higher and we shouldn’t be spared from it.

But prior to an expected global recession, the Malaysian government could still spur investment towards infrastructure. This time round, the GST collection might turn in a savior to provide the funds for infrastructure investment like what we are currently experiencing. Unlike developed economies, emerging markets takes a different route to achieve the same outcome.

The inability to do a proper debt financing leads to higher taxation and increasing consumer prices within the economy. Similar to the middle income problem in most countries, a country in the middle income range is having similar problems of migrating from mid to high income nation as the economy changes rapidly over the course of only a decade. Every action might backfire due to the delay between implementation and effect versus the change in economic environment from factors such as technology to business cycle. I guess it seems that in this era, it is hard for a country to breach through the income barrier.

A likely mechanism that the government could use is to increase on corporate tax rate. The likelihood of a higher collection of corporate tax is low but it makes way for investments. Corporate tax increase promotes investment to reduce on the amount of tax that one pays. In contrast, it might be bad for developed economies since investment might be random and doesn’t provide the best payoff but emerging markets have no choice but to accept it rather than having no activity within the economy.

Taxation is vital in this period of time where everything seems to be stable but when the economy really takes a hit, the government isn’t likely to maintain income tax at current levels and would likely lower it to promote consumption. Hopefully the collection at the moment from GST is a saving for a rainy day in the future.

Market Outlook

We believe that the market still has room to rally for the time being before an actual slump dragging everything down. When countries round the world are beginning to step up on their infrastructure spending, the most likely thing to happen prior to that would be the wake of commodity prices. That would induce a CPI and PPI growth and before you know it, market sentiment picks up and spending momentum comes in foreseeing an increase in price in future.

When sentiment picks up, that leads to a healthy demand for all sectors while market turns optimistic on the outlook ahead. If fiscal spending are the sparks that light the fire, then sentiment is the fuel that burns steadily in the economy.

The recession would come after the sentiment dropped ‘the next time round’. It is pretty certain that ‘the next time round’, governments round the world would run out of ammo having zero percent benchmark interest rate with no more room to go lower and exhausting the government budget for any investment ahead. I forecast that this event would occur in 4 years from now (2020) and that is when a global recession would likely happen.

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com