HSBC Preview on Malaysia’s 2017 Budget

omightycap

Publish date: Thu, 20 Oct 2016, 09:01 AM

See the original here. You can download the report from our site!

The HSBC report gave us the general view which is in-line with almost everyone’s expectation and there’s nothing to be surprised of.

As expected, the government revenue this year had stabilized with oil coming back from the $25 lows and the increase of economic activity creating more GST revenue for the government.

Also as expected, since 2017 can be an election year. The BR1M would likely increase to strengthen the coalition influence within the country.

One thing that is different in our view is how PM Najib would squeeze on spending in their view. We believe that a range of expenses would be launched since its election year to promote strength and growth within the current government. Instead of narrowing budget deficit, we guess the budget deficit would remain above 3% of GDP and tightening measure would come in place in 2018.

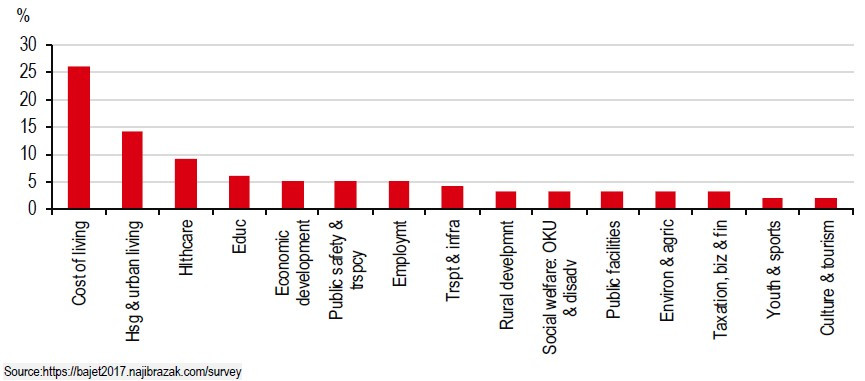

The top three concern of citizen is still the hardest to address.

In our view, disappointingly there’s isn’t a way government could address them lowering the concern percentages since.

- Oil rebound higher fuel prices. Since we are on floating mechanism now.

- Lowering benchmark interest rate likely lead to higher inflation.

- Lowering benchmark interest rate likely see housing prices inflate again.

- Inflation rate > savings rate typically lowers the wealth of citizens.

- Lowering tax further isn’t going to guarantee improvement in consumption. The government isn’t likely to initiate it since it takes money out from their pocket without much benefit.

Sentiment hasn’t improve much at the current moment and that could be well represented with the performance of KLCI. Markets round the world started moving while Malaysia lags. The bottom might be visible but there isn’t any catalyst to move things up!

In short, infrastructure spending would continue and that is why the likelihood of a budget contraction wont happen. Continuous spending spree pays the best outcome at the current moment compared to the government tightening its belt.

That’s our view on the latest Budget 2017…

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com

Jonathan Keung

with GE 14. BN may surprised us with election goodies (cookies ). tax cuts could be on the table ( both corporate and individual )

2016-10-20 09:42