Most counters had been rising quick and sharp since the dip from last week but VS and SKPRES had yet to move following the broad market this time around.

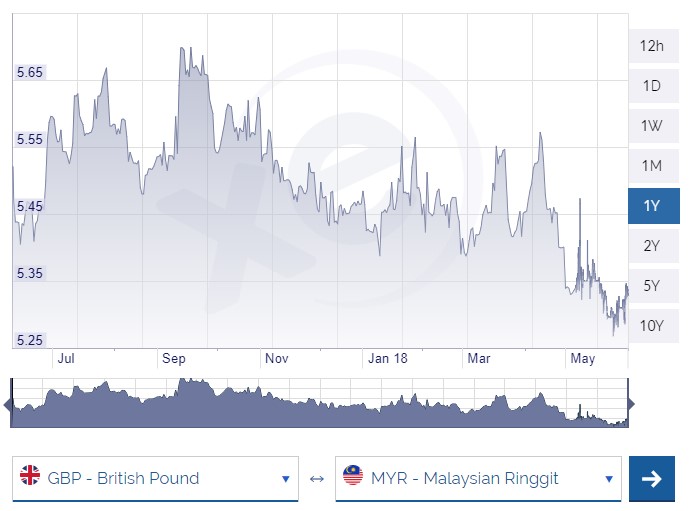

For obvious reasons, VS and SKPRES are makers of plastic products for the famous brand Dyson and GBP is the biggest threat to them so far. Much like stock prices spiking for exporting counters when you see the USD strengthened three years ago, the weakening GBP had caused these two counters to follow suit.

GBP dropped significantly due to Brexit and we felt that it would remain weak for the time being. Nevertheless, these two counters has value with the availability of capacity to deal with continuous order increases.

The only doubtful factor would be a range of new products by Dyson that might not include SK Pres and VS in their OEM supplier list. All things remain constant, we believe that these two counters are cheaply priced for the time being neglecting the fact that external risk could still point downwards.

We think that it is worth to collect some if you had made profits from this rise as it is hard to find counters which are high in value after this rally.

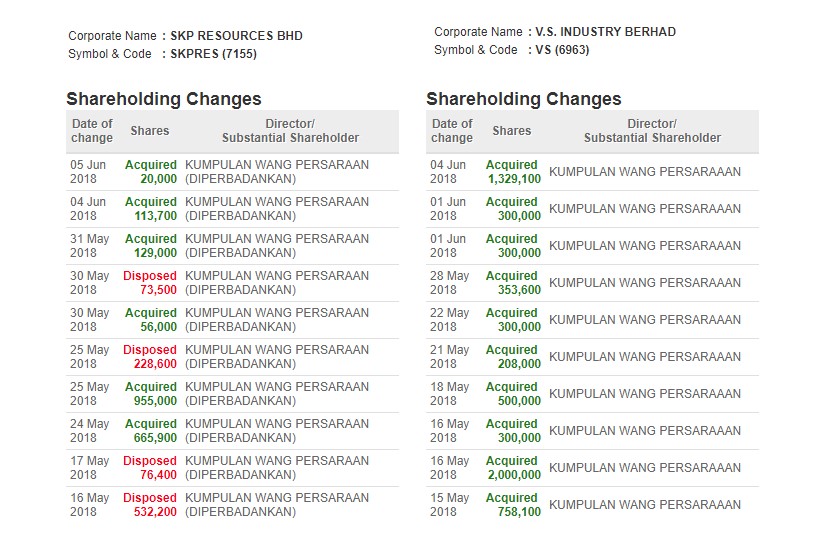

Looking at institutional transactions, they had began collecting these two counters in anticipation for a better GBP strengthening in the coming months or so.

Net-off, both counters see addition by KWAP but VS seems to be more aggressively bought by them so far. You be the judge on which to buy. We like both!

Chart wise, both trades similar as well and we are on the lower side of things than what it was starting this year alone.

SKPRES down 50% YTD

VS down 29.5% YTD

Yu_and_Mee

not follow because both are overpriced?

2018-06-08 22:32