The Cheapest Glove Stock in Town - PE 4? Explaining the madness

projectwisdom

Publish date: Tue, 02 Jun 2020, 09:40 PM

The Cheapest Glove Stock in Town – PE 4??

A lot of people have been wondering why UG Healthcare is moving mountains for the past few days with assumptions that it is in line with all other small counter glove stocks in the KLSE. This could not be further from the truth. In fact, we could be looking at another SUPERMAX in the making. I understand that this has been thrown around a lot but I do not believe the other glove players such as Comfort or Rubberex is anywhere near the quality of UG.

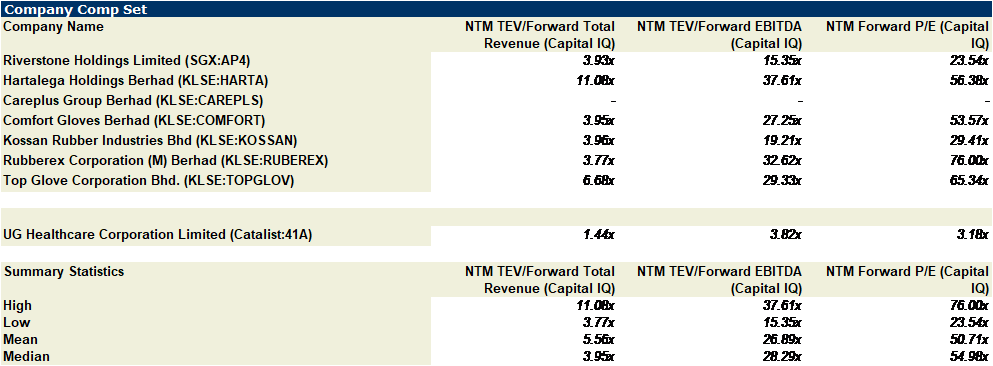

For this post we will ignore the general headwinds that have impacted other glove companies as well (surge in demand to the point of max capacity, exchange rate, COGS). I will have another post to compare UG vs it’s peers in terms of valuation.

Potential earnings excluding one-off expenses

- Reduction in administrative expenses, salaries and acquisitions

Management has spent SGD 16m on administrative expenses and acquisitions for the year 2019. Particularly for their expansion into Brazil. However, you should view this as a one-off expense and that the amount incurred for the year 2020 should not be as high. Additionally, part of the 16m expense was for promotions and marketing campaigns. To be honest, I personally feel that this expense should not be as high for the year 2020. It’s like buying advertising space to sell water in the dessert. Similar to Supermax, who gave guidance on lowered marketing and distribution expense, UG should have huge cost savings on this front.

To be prudent we can assume that a cost of about SGD10M will be incurred for this period which translates to an additional SGD 6m in profit due to reduced costs.

- One off maintenance and repairs (assume SGD 4M)

Management also spent an additional amount repairing their machinery to improve efficiency, but we can assume that this cost no longer applies seeing as how on the 19th of May, management has mentioned that they are operating at MAXIMUM EFFICIENCY. Again, great news for us! This translates into direct increase in profits assuming all things equal.

Altogether = increase in additional profits of SGD 10 (6+4)

OBM – Unigloves (like SUPERMAX?)

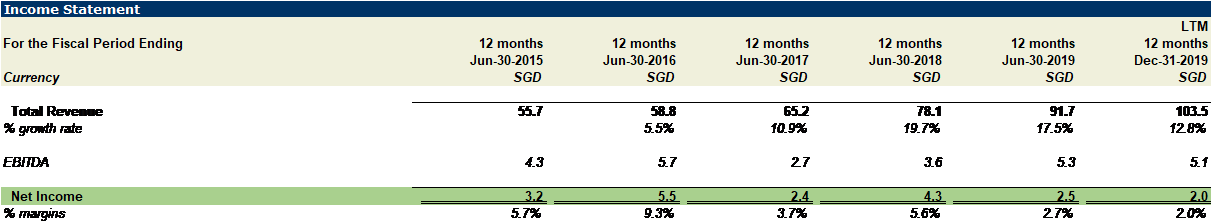

UG has been focusing on building their own brand of Unigloves for the past 5 years which has resulted in a very subdued earnings of SGD 2-3million per year despite recording an ever increasing revenue amount (an increase of 100% since 2015). Building out your own distribution network is not an easy task and it is a long-term play. SGD 16m recorded last year just in admin expenses, salary and acquisitions is the kind of commitment it takes and the market has obviously not rewarded management, given its poor net EPS. Very similar to Supermax it often traded at a discount compared to it’s peers who just did pure OEM.

I believe this fact is often overlooked when assuming that UG is just another glove company. If you take a look at their annual report, they mention UNIGLOVES 84 times vs OEM just once. It shows you the kind of commitment they have towards building out their own brand. While I have not been able to find the exact proportion that UG does OBM vs OEM, I feel that it is safe to assume that most of its sales can be translated to OBM at this point in time. Let’s assume 70% to be safe.

In this market UG is able to absorb THE ENTIRE markup of the increased ASP (average selling price) will result in SUPERNORMAL PROFITS. We should be able to see a quarterly report very similar to the one produced by Supermax! These guys will be holding contracts with themselves allowing them to increase prices significantly faster than companies like Kossan who only managed to increase it’s ASP by 1.4%. Holding the entire distribution chain will result in a faster increase in ASP having the margins all to themselves!

Increase in ASP – What does that mean for UG?

What does an increase in ASP translate to for UG? Right now from our understanding, ASP has increased by 45%. An OEM distributor will have to share that increase in ASP with its distributor to be fair. However, OBM distributors do not need to share this and again get to have the whole margin to themselves.

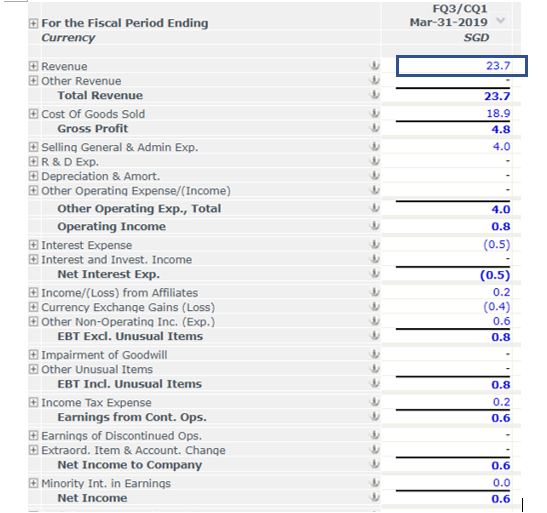

Lets translate this to simple math. We can use the quarter ending March 2019 as an example where the price of gloves are still normalized and we even discount the increase in improved efficiency from their recent upgrades.

Lets take SGD 23.7m in revenue x with an increase in ASP

What happens to margins when there is an increase in ASP? Revenue goes up. But everything else REMAINS THE SAME. I need to repeat this everything else REMAINS THE SAME. It’s like when you sell a bowl of noodles for RM 10, and decide the next day because my noodles are so popular im going to increase it to RM 14.50. I then collect an additional RM4.50 to my profit line. It doesn’t translate to an increase in COGS but rather an increase straight down to the bottom line of an increase in RM4.50!

I feel like the market is horribly discounting this fact at the moment. Let’s assume some leakages along the way and that UG does not enjoy the full 45% increase in ASP. We can take an increase of 30% in ASP and we still get an increase of (SGD 23.7m*0.3)* 4 quarters = SGD 28.4M (we can be generous and neglect any increase in capacity due to higher utilitzation)

That’s an additional SGD 28.4M in PURE PROFIT for the year.

PURE PROFIT!!! =)

What does this all mean for valuation?

Now I understand that the price has moved a lot since a week ago but lets look at today’s statistics:

- Closing price: SGD 0.69

- Market cap: SGD 128.4m

- Enterprise value: SGD166.3m

- Yearly net profit estimation: Additional profits of 28.44M + 10M (saved expenses) + 2m (previous years profits) = SGD 40.4m

This equates to a P/E 2020E ratio of SGD128.4m/ SGD40.4m = 3.2x.

This clearly highlights how terribly undervalued UG Healthcare is! Keep in mind, there isn’t much uncertainty in terms of how much this profit is as we can already attest that orders are all FULLY BOOKED A YEAR IN ADVANCE!!!

We aren’t even comparing this to the current market P/E other glove counters are trading at! I don’t mean to bash other stocks but if you compare this to Rubberex and Comfort its absolutely insane in terms of the valuation those two are running at! Without their own OBM and distribution network there’s no way their valuations are justified. Not unless they seriously screw over their distributors and forcing them to accept significantly increased manufacturers price and not splitting the difference with their distributors. Remember, you can’t do business with a short-term view. All partnerships need to be created equal.

Sure you could argue that well, this is only relevant because of COVID and this does not last in perpetuity. COVID like it or not will be here for the next year or so and by the time we do a full rollout and get the human race COVID free it will be June 2021 at the earliest. Even then, the market has changed and we will expect increased usage of gloves. Sure we won’t have supernormal profits but we will continue to see an increase in glove usage by a significant amount.

Even assuming a more normalized net profit of around SGD 10m, we are still looking at a very cheap P/E multiple of 12.8x. At these prices, UG Healthcare is a no-brainer – it has just managed to slip by unnoticed in the Catalyst market, and its only a matter of time before it will be noticed.

I hope this makes sense to you guys and the methodology as to how I came up with my valuation for UG. This, to be honest applies across the board for all glove companies, particularly for Supermax, Riverstone and UG, who have OBM manufacturing capabilities. It would also explain why the glove market is so hot!

Disclaimer – I am personally invested in UG healthcare and these are my personal thoughts and views for recreational use. I have no insider knowledge

More articles on Project Wisdom

Created by projectwisdom | Jun 03, 2020

Discussions

I found that they don't own all their distribution companies. some 50%, some only 17%. And your calculation have not deducted tax. Directors salary and fees also very high. If they can make SGD8 million consider very good already.

2020-06-04 00:44

hi guys,

just checked online the selling price of Uniglove's antimicrobial glove, the selling price is crazy. It is close to USD 250 per 1000 pcs. Please refer to the link below.

https://www.safetygloves.co.uk/unigloves-fortified-gf001-antimicrobial-blue-nitrile-gloves.html

Even though this selling price is from the dealer or distributor. But let's assume Uniglove is selling at USD 150 to the distributor. What kind of profit they are making??

2020-07-06 00:20

calvintaneng

Good one

Any Singaporeans reading this post?

Can consider UG Healthcare

For all Malaysians who cannot benefit from this Spore listed stock?

Never mind

2 sanitizer stocks still got value are Nylex and RGTech

Both can do well like UG health as all are in the same battle against Covid 19

2020-06-02 21:50