Debt ridden Protasco Bhd catastrophe PPAM contract termination is a step to PN17? How Chongs made Protasco from Hero to Zero?

exposedcrime

Publish date: Wed, 13 Mar 2019, 02:04 PM

Original article from : https://lokapchong.law.blog/

KUALA LUMPUR (March 9): According to The Edge Malaysia, troubled construction company Protasco Bhd (5070)’s PPAM (PPA1M) project was suspended by Putrajaya Corp (PjC) as of 8 March 2019.

More Malaysia Civil Servants Housing Programme (PPAM) projects are “expected to be either put on hold or shelved”, reported The Edge Malaysia in its latest issue.

A source told the weekly that Protasco Bhd has been informed by Putrajaya Corp (PjC) (the project owner of PPAM in Putrajaya) to “temporarily postpone” development.

It was reported on Feb 27 that Damansara Realty Bhd announced that PjC had terminated a contract to develop 1,350 residential units and 45 commercial units with a gross development cost of RM467.3 million in Precinct 5 of Putrajaya.

Damansara Realty announced that the termination “was due to the government’s move to unify the development of affordable homes under the Ministry of Housing and Local Government”.

Developers contracted to construct PPAM homes include Ahmad Zaki Resources Bhd, Hap Seng Consolidated Bhd, Iris Corp Bhd, Zecon Bhd, LBS Bina Bhd and Spring Gallery Bhd.

Banks who funded PPAM projects are expected to call back facilities intensively in view of the catastrophe events and immediate defaults on these low margin portfolios.

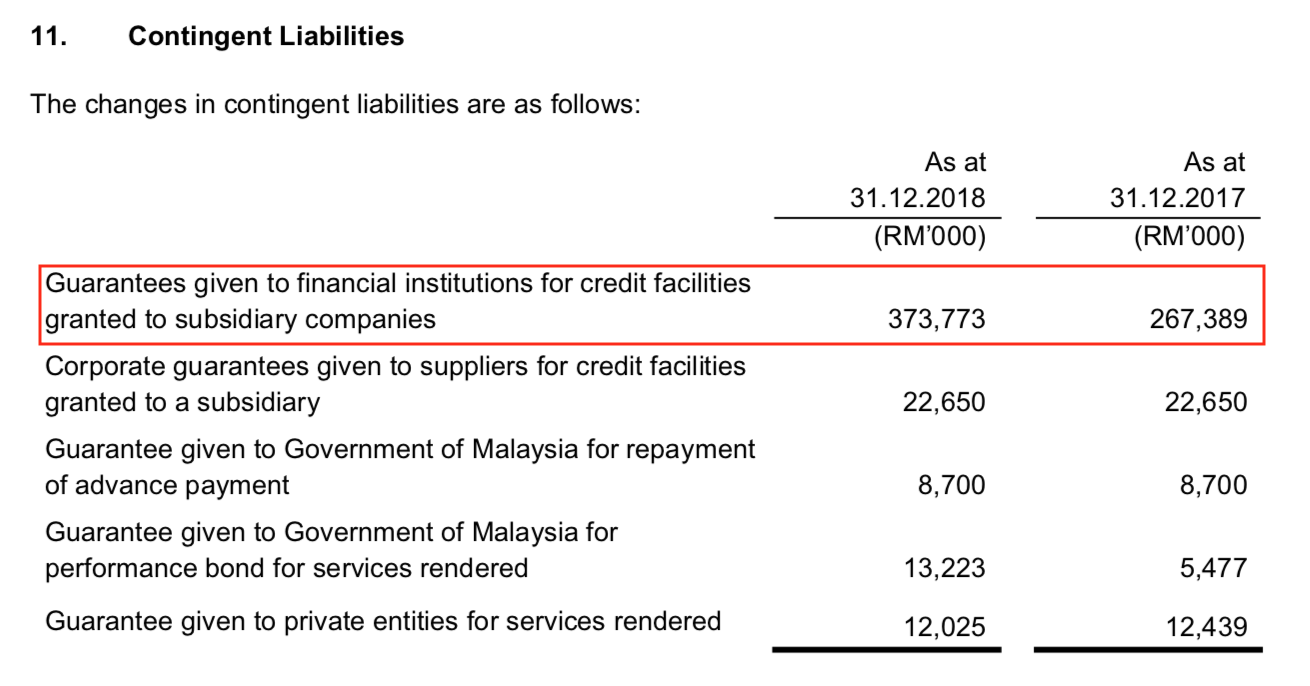

According to Bursa Malaysia information, the time bomb inside Protasco's RM622 million debt where RM374 million are guarantees given to financial institutions (banks), is exceptionally high.

Here are the “contingent liabilities” inside Protasco as of December 2018 quarterly report.

Protasco’s RM622 Million Debt on top of PPAM Construction Scheme Burst (Finally)

Who is heading the PPAM project division inside Protasco Bhd? According to Protasco Bhd annual report and corporate web site, Kenny Chong Ther Nen is the Managing Director for Property, Trading & Manufacturing and Construction in Protasco Bhd.

Kenny Chong Ther Nen is also the head of Property Division, the De Centrum Development Sdn Bhd which develops the RM280 million GDV De Centrum Mall, and going to spend RM48.6 million cash to purchase the “Tampin, Negeri Sembilan land project” from his father Chong Ket Pen in 2 months as per announced to Bursa Malaysia on 1 March 2019.

De Centrum Development Sdn Bhd suffers continuous losses over the years under current management supervision, headed by Kenny Chong Ther Nen himself.

Kenny Chong Ther Nen, Chong Ket Pen’s son positioned by his father in Property and Construction Division. (Photo is 100% authentic public information from Protasco Bhd)

The exposure of PPAM (or PPA1M) project to Protasco started since the year 2014, and at the peak of the scheme, became the perfect public relation tool and “favours” to both ex-Prime Minister Najib Razak’s government, as well as the camouflage to contain the authorities in probes involving Protasco’s Executive Director Chong Ket Pen for suspected personal wrongdoings.

PPA1M project became the highlight of Malaysia General Election (GE-14), when Protasco Bhd got awarded a RM4.2 billion JKR road maintenance contract a month before GE-15 (on 4 April 2018), followed by a return of favour to the Barisan Nasional political election campaign (on May 2018) by using PPA1M project to pull civil servants’ votes.

The PPA1M project is also given a 49% profit sharing to “police retiree” koperasi KOP MANTAP as an excuse to get closer to PDRM to pacify suspected criminal investigation on Chong Ket Pen and associates. The “joint venture” was given to the koperasi without cost or capital outlay from KOP MANTAP, an obvious “favour” suspected currently under MACC investigation.

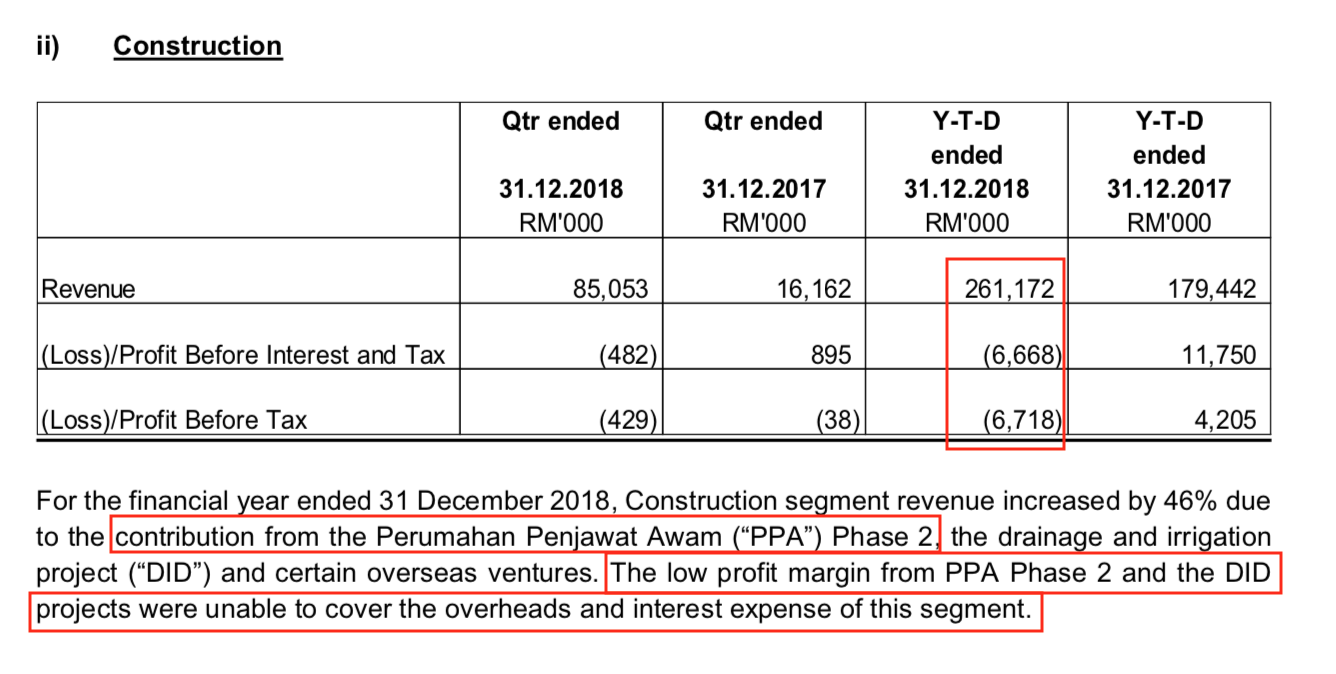

Under Kenny Chong Ther Nen’s management, how did PPAM project contribute to Protasco’s bottomline? Here is a snap shot of Protasco’s Dec 2018 quarterly report:

As proven above, the Construction Division (PPAM) delivers -RM6.7 million losses on a RM261 million revenue, a pathetic business model to justify the financial cost and risk, especially massive bank loans, unless there is suspected transfer pricing to justify the bank roll and resumption of such projects which benefits the external (related) parties.

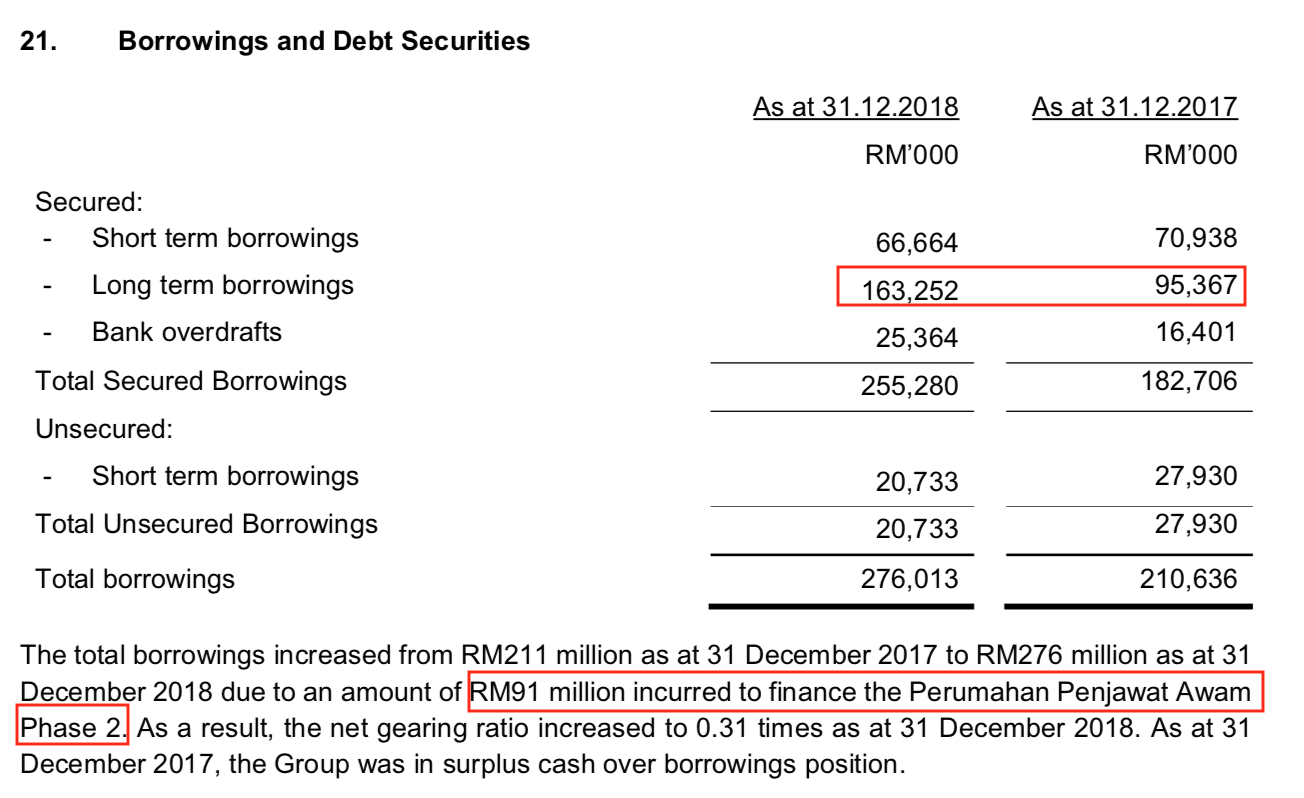

Long term borrowings piled up from RM95 million to RM163 million, while total borrowings ballooned RM65 mil to RM276 million, Y-to-Y. Protasco Bhd December 2018 quarterly report clearly stated that “additional RM91 million” was incurred to finance the Perumahan Penjawat Awam Phase 2. Could this be direct impact to the suspension and potential contract termination? Who are the bankers which financed the RM276 million outstanding borrowings?

Guess who are the banks that exposed to Protasco’s Construction or PPAM projects and further exposed to the up coming RM48.6 million “Tampin Land Project” cash stripping scheme?

According to Bursa Malaysia, UOB Bank seems to have highly exposed in the support of Protasco’s Executive Director Chong Ket Pen, both personally and in the company Protasco Bhd during the year 2014-2019.

Protasco Bhd’s annual report listed these banks as the company principle bank(ers):

UOB (Malaysia) Berhad

RHB Bank Berhad

OCBC Bank (Malaysia) Berhad

AmBank (M) Berhad

CIMB Bank Berhad

RM280 million GDV white elephant “De Centrum Mall”, plus RM48.6 million in-coming “Tampin Project”?

The De Centrum Development Sdn Bhd saw the loss making business unit sunk RM280 million Protasco’s money into owning De Centrum Mall, a small 160,000 sqft community retail outfit facing intense competition from gigantic players such as IOI City Mall.

The failed project is an expensive toy Chong Ket Pen placed under his son Benny Chong Ther Vern supervision. Benny Chong Ther Vern was named the “head of De Centrum Mall” in Protasco newsletter July-December 2016.

According to Protasco corporate web site, Benny Chong Ther Vern is also the Executive Director for Clean Energy, Engineering and Education Division.

Benny Chong Ther Vern, Chong Ket Pen’s son given portfolio of RM280 million as “Head of De Centrum Mall”. (Photo is 100% authentic public information from Protasco Bhd)

How did Protasco property division burn so much money and where does Protasco money goes despite carrying RM622 million debt, perhaps The Malaysian Institute of Accountants (MIA) shall question the company auditor how these cash went missing in a massive way landed in suspected “related parties” linked to the principle:

Crowe Horwath (AF 1018)

Chartered Accountants

Level 16, Tower C, Megan Avenue II

12, Jalan Yap Kwan Seng

50450 Kuala Lumpur, Malaysia

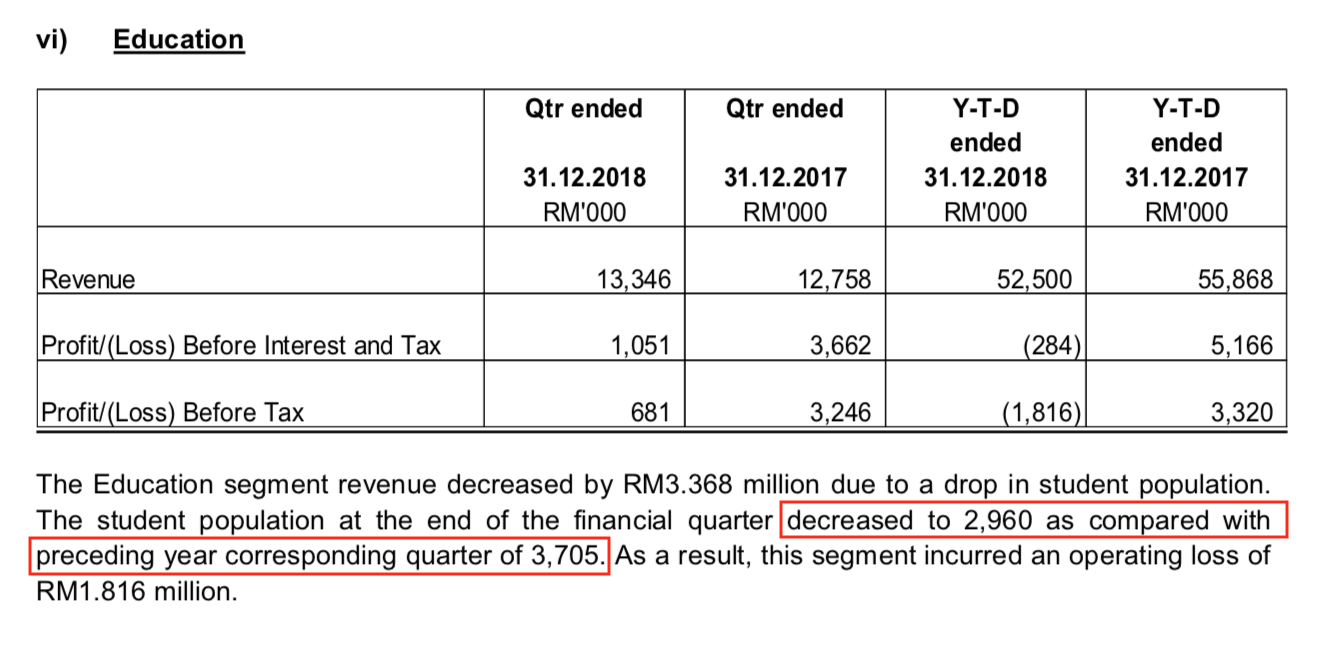

Under little Benny Chong Ther Vern’s management, the Education Division suffer lost of students and financially in the red. The ill intention of the Chong’s is a toxic to Protasco Bhd, and such curse even students flee the Infrastructure University Kuala Lumpur (IUKL), as evidence from 4th quarter’2018 report.

RM14.25 million investment in “44% shareholding associate company” in Green Energy?

The RM622 million debt ridden Protasco Bhd compared to its RM353 million equity is extremely fragile and worrying. Yet, Protasco Bhd under Chong Ket Pen’s management had invested over RM14.25 million to a pet project oversight by another one of Chong Ket Pen’s son, Denny Chong Ther Shern.

Denny Chong Ther Shern, Chong Ket Pen’s son given RM14.25 million (so far) for the up coming Green Energy Whiz Kid. (Photo is 100% authentic public information from Protasco Bhd)

On Oct 9 2017, Protasco’s wholly-owned subsidiary Ikram Greentech Sdn Bhd said it had bought two shares or 100% of dormant company Ikram Infra Bina Sdn Bhd, which will be known as I2 Energy Sdn Bhd, for RM2.

Under the group’s proposed internal restructuring, I2 Energy is intended to undertake a new energy business, and will eventually increase its paid-up capital from RM2 to RM100,000. Ikram Greentech will own 50,998 shares or 51% stake in I2 Energy while Icon Energy Solutions Sdn Bhd and KI Engineering Sdn Bhd will hold 45% and 4% stakes respectively.

According to Focus Malaysia, Protasco Bhd, which has faced declining earnings lately, is looking at expanding into solar power and renewable energy (RE) to broaden its income base. However, the move is unlikely to have any impact in the short term. (source: http://www.focusmalaysia.my/Mainstream/jury-still-out-on-protasco-s-re-venture )

How the son of Chong Ket Pen going to save Protasco Bhd’s RM622 million debt by burning more money into a pet project? Authorities such as Bursa Malaysia and Securities Commission are all eyes on the 44% Protasco owned associate company spendings.

How much would this quicksand investment sinks Protasco cash flows is yet to be disclosed nor discovered.

Chong Ket Pen’s Report Card 2018:Total Failure. Would banks such as UOB Group in massive cash craw backs?

How Protasco Bhd’s Executive Director cum questionable “self-made” largest shareholder Chong Ket Pen going to answer to the public shareholders and the authorities how he took Protasco cash to buy Protasco shares and increase his 15.5% shareholding in November 2012 to 29.5% shareholding today, which cost a whopping RM70 million cash. The jaw dropping fact is, all these cash came from Protasco.

The money stripping mania started in November 2014 when Chong Ket Pen uses a fraud scheme to defraud Protasco former controlling shareholders to stolen their rights in Protasco control, and further abuses his ill-gotten power to control of Protasco and draws unrealistic salaries (RM600,000/year ballooned to RM4,200,000/year), made up (misleading account) and paid the dividends using bank-borrowed money, and other questionable perks and fees including Protasco’s 3 sports cars bought for his sons Kenny Chong Ther Nen, Denny Chong Ther Shern, and Benny Chong Ther Vern.

These “personal benefits” and “secret profits” is already added up in exceed of RM100 million swindler from Protasco Bhd, all taken by the Chongs.

The up coming RM48.6 million Related Party Transaction which is expected to take Protasco cash to pay Chong Ket Pen himself for a piece of land in Tampin might just be the last push to throw Protasco off the cliff. According to numbers derived from December 2018 quarterly report, if banks such as UOB Group rush for the exit, Protasco Bhd is suspected PN17 by default.

The desperate move by Chong Ket Pen to load (RM48.6 million) more burden on top of the RM622 million debt inside Protasco is reckless.

Forget about the authorities, would the banks allow more cash to be stripped from Protasco Bhd?

Guess who are the directors that colluded with Chong Ket Pen in approving the up coming RM48.6 million cash-stripping exercise?

Once a “hero”, today Protasco is as good as “zero” if not sub-zero in no time, thanks to the Chongs leeching Protasco until today. The music chair has to stop some where, and PPAM project suspension might just be the black swan.

Chong Ket Pen, the father who planted 3 sons into public listed company Protasco Bhd to leech and strip public money for personal gain and secret profits from year 2014 – 2019. (Photo is 100% authentic public information from Protasco Bhd)

= The Edge with real edge report =

Source of news: https://www.edgeprop.my/content/1490466/ppam-contract-terminations-impact-more-developers-report

DISCLAIMER

ALTHOUGH WE USE REASONABLE EFFORTS TO INCLUDE 100% AUTHENTIC, ACCURATE AND UP-TO-DATE INFORMATION IN OUR SITE AND TO ENABLE SMOOTH AND SAFE OPERATION OF THIS SITE, WE DO NOT GUARANTEE, NOR DO WE MAKE ANY PRESENTATIONS OR REPRESENTATIONS WHATSOEVER AS TO THIS SITE WITH RESPECT TO ITS ACCURACY AND/OR QUALITY AND/OR SUITABILITY AND/OR TIMELINESS AND/OR ACCESSIBILITY AND/OR AVAILABILITY AND/OR COMPLETENESS AND/OR RELIABILITY AND/OR CORRECTNESS OF THE INFORMATION OR OF ANY PART THEREOF, OR OF THE PRODUCTS, OR OF ANY OTHER MATERIALS AND/OR SERVICES THROUGH THIS SITE (HEREINAFTER: “THE CONTENTS”).

WE DO NOT GUARANTEE OR REPRESENT THAT THIS SITE AND/OR THE CONTENTS INCLUDED IN IT IS/ARE OR WILL BE AVAILABLE AT ANY PARTICULAR TIME OR LOCATION; NOR DO WE ASSURE THAT ANY DEFECTS OR ERRORS WILL BE CORRECTED OR THAT THE CONTENTS ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. AS THE CONTENTS ARE PROVIDED WITHOUT WARRANTIES OF ANY KIND, EITHER EXPRESS OR IMPLIED, YOU SHOULD NOT RELY UPON ANY OF THE CONTENTS AS DEFINED ABOVE. WE OFFER THIS SITE AND ITS CONTENTS AS DEFINED ABOVE ON AN “AS IS, AS AVAILABLE” BASIS, AND YOU MAY USE IT SUBJECT TO ALL TERMS OF USE AND AT YOUR OWN RISK.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Exposed Protasco House of Crime

Discussions

Chong Ket Pen and sons. Catch, vomit back all Protasco money, and put behind bar.

2019-03-13 16:14

Massive CBT and breach of directors duties. SSM charges on Chong father and sons. All 4 behind bar 20 years each.

2019-03-15 13:59

PUNISHMENTS FOR THIS CULPRITS SHOULD BE RETURN BACK INVESTED MONEY BY RETAIL INVESTORS OR THE PUBLIC, THEN THIS WILL BE A GOOD LESSON TO ALL DIRECTORS

2019-03-20 16:44

speakup

duorang ni mesti tangkap, penjara & sebat ni!

2019-03-13 14:33