Triplc Part 3: Is it still worth the wait?

Jay

Publish date: Tue, 23 Aug 2016, 06:46 PM

My simple answer is yes but mainly because 1) the price has dropped to a point where value emerges again; and 2) My average cost is low, which means I’m still sitting on a decent profit after the drop.

So my recommendation may or may not suit you. Please decide for yourself.

Disappointing developments

For those who do not track Triplc, recently they announced a not so good news and a bad news. First, they announced there’s an extension of 3 months for the HOA with Puncak, which is not good but not too bad. Second, they announced the termination of the land sales.

How does it affect the valuation?

If you had followed my previous articles, you would have known that I always see the disposal of its construction & concession biz and land sale as the 2 main catalysts for its deep value to be realized. So now 1 of it seemingly fail, this should prompt a revaluation of its value.

The value of the biz and the land

The value of its biz remains intact. By my estimate, it should still be worth RM145-RM180m in present value terms. But for the land, how much is it actually worth now that the sale was aborted?

Recall that the land was originally planned to be sold for RM140m. Its current book value of around RM37m. It’s a 338.67 acres leasehold land located in Seksyen 20 Bandar Serendah, Dsitrict of Ulu Selangor, originally earmarked for mixed development of residential and commercial. Forgive me but I’m not so good with the geography so I will not go into the analysis of its locations, amenities etc.

Back in 20 October 2014, WCT announced a purchase of 4 pieces of vacant freehold land with a land size of 220.74 acres located in Seksyen 20 Bandar Serendah, Dsitrict of Ulu Selangor for RM115.38m. On 20 March 2015, TA Global also announced the acquisition of 2 pieces of freehold vacant commercial land in the same area with a land size of 189.83 acres for RM106.86m.

Based on the average price per acre paid by these 2 companies and multiplied by the acreage, Triplc’s land would be worth around RM183m. However, we must notice that Triplc’s land is a leasehold land which means it would be less valuable. Besides, it is a larger piece of land so usually for transactions involving large acreage, the per acre value would be lower. If we go through the latest annual report, one of Triplc’s term loan is also secured by a legal charge over that particular parcel of land with a minimum market value of RM105m.

All in all, we could see that the previously announced RM140m seems reasonable compared to recent transactions. But to be conservative, I will assume the land value to be worth RM105m. If the bank is happy with that value, then it shouldn’t be too far off.

Now the possible outcomes

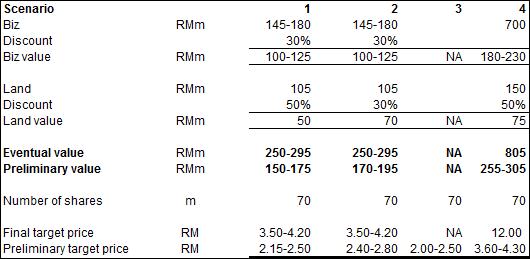

This will be the tricky part and the outcome would also determine the value. The possible outcomes are endless but I will summarise a few which I think is more likely.

1. Puncak acquires the biz but not the land

2. Puncak acquires both the biz and the land

3. Puncak launches a takeover of Triplc itself

4. Puncak does nothing and life goes on for Triplc

For scenario 1-3, Puncak could offer cash, shares or a combination of both. Personally I don’t like Puncak shares. Based on its balance sheet, even after netting off its liabilities it has close to RM1bil cash and short term investments which works out to be more than RM 2 per share. But I would rather receive cash and decide myself if I want to buy Puncak. For simplicity purposes, I will assume cash.

It is also worth noting that scenario 2 and 3 is not the same. The critical difference being in scenario 2, Puncak pays to Triplc. Triplc will remain as a listed shell company and decides what it wants to do with the cash. If there are more than 75% of shareholders agree to the transaction, it’s done. For scenario 3, Puncak offers and pays directly to Triplc shareholders. Decision will be up to the individual to accept the offer or not, unless Puncak hits 90% threshold for compulsory acquisition. If Puncak gets more than 50%, Triplc could remain listed and become Puncak's subsidiary. If more than 90%, Triplc will be delisted.

Will Puncak buy the land

After the termination of land sale, the possibility has indeed increased. On paper, property development has nothing to do with Puncak. The 338 acre land is massive in size. Just to give you a bit of context, Mah Sing’s Southville City, an integrated township project with multiple commercial buildings and residential towers planned is about 428 acres. If you have seen Mah Sing’s brochure, you would be able to imagine how huge it is. Property development on such a large scale definitely is not within Puncak’s expertise.

There is another possibility that the termination of the land sale is to ensure that Triplc have a business after it disposes off the construction arm. This would avoid the company falling into PN17.

But to be honest, I don’t care if Puncak has the expertise to develop the land, all I care is if it acquires the land how much is it willing to offer.

Bursa shareholder protection

Fortunately, there is a provision in Bursa Listing Requirement. If you refer to 10.04 of the listing requirement, a valuation will need to be conducted on any acquisition or disposal of real estate when the percentage ratio is 5% or more for a related party transaction.

What it means is if Puncak is adamant of getting the land, the land has to be revalued and Puncak has to pay close to the fair value (of course can manipulate a bit here and there, but not too much). So if Puncak acquires the land, it’s actually good news for Triplc shareholders as there is not much room for it to significantly underpay.

Takeover scenario

Another alternative is Puncak make a direct offer. The key is how much would they pay. Again they have to address the elephant in the room which is the land revaluation. In takeovers, there will be an independent adviser, similar to related party transactions. It is not possible for the adviser to ignore the land revaluation as well as the cashflows from the construction biz. So if Puncak were to offer a low price, it is unlikely to be fair. And since Triplc just recently traded as high as RM2.40 and liquidity has also improved in recent months, the adviser could also find it difficult to argue that a low offer to be reasonable. These advisers will also be scrutinized by securities commission. And from what I heard from my friends in the investment banks, securities commission is way tougher to handle than Bursa so they won’t be able to get away easily without justifying their recommendation.

What is possible is that Puncak can still offer a price which is not too high (possibly between RM2.00-RM2.50). Even if the adviser said it is not fair and not reasonable, my bet is there will still be a lot of shareholders who will accept the offer.

Value based on outcome

Just to explain my method, a discount is applied for timing delays, not for value. If you could recall, my initial valuation of the biz is about RM180-230m, but I already applied a discount for the acquirer. So I believe both biz and land value are considered conservative.

Discount for the disposals should be removed gradually as it gets closer to completion. Discount applied to the land was larger in Scenario 1 as it would take longer to be developed or sold separately by Triplc. For takeover scenario, I am just going by my gut feeling as I think they will track more on the share price rather than underlying value. For scenario 4, on paper the value looks the best but the time horizon is more than 20 years compared to others which can be completed within 6-12 months. I also assumed that the land value will increase by another 50% by 20 years which is not unreasonable.

ESOS coming on stream

If you have noticed, recently there are quite a number of ESOS listed. Based on my compilation, there were about 1.37m new shares listed in the past 4 months since the HOA with an average issue price of RM1.31. This is approximately 2% of the previous shares outstanding. Average daily trading volume for the past 4 months was only around 80,000 shares per day. Previously, it took Triplc 1.5 year to issue the same number of ESOS. Basically what I am trying to illustrate is the company is definitely speeding up the issuance of ESOS to allow its employees to benefit from the deal. So if the company and the employees are on board, that would give me a bit of a comfort (not much, but better than none).

Conclusion

Triplc remains a company with deep value but after the recent disappointments, my priliminary target price is now reduced from RM2.85-RM3.20 to RM2.00-RM2.80. Yes the range is much wider but this is also to reflect the increased number of scenarios being considered. So for those on board Triplc, now is the time to test your stamina.

Cheers

J

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Jay's market diary

Created by Jay | Nov 17, 2018

Created by Jay | Nov 05, 2018

Created by Jay | Oct 14, 2018

Discussions

EPS 2.34 sen. Annualised EPS 9.36 sen. PE 10 TP 94 sen?

http://www.malaysiastock.biz/Corporate-Infomation.aspx?type=A&value=T&securityCode=5622

2016-10-27 22:37

phase 2 is now cashflow based, major profit recognition phase over. phase 3 haven't started. please read through part 1-3 to get a better idea

2016-10-28 02:26

prescott2006

Excellent insight

2016-08-23 21:22