A comprehensive guide to trading warrants and call warrants Part 2

Jay

Publish date: Thu, 08 Jun 2017, 05:39 PM

This is part 2 of the series, Part 1 you can see here https://klse.i3investor.com/blogs/purelysharing/124972.jsp

In part 1, we have discussed on the basics of warrants and I also illustrated how its high return high risk nature could really profit you, or really hurt you. In part 2, I will go through how I usually select warrants. These steps are my personal method of selection and is by no means exhaustive or exclusive. Each investor may have different method of trading in warrants so below are just my suggestions.

How to select warrants

1. Select the mother share, not warrants

If you believe the company is good, then only you should consider the warrant/call warrant. If you don’t even like the company, forget about the warrants. It’s simple, warrants price trade in tandem with mother, so if you don’t like the mother, i.e. you don’t think the price will appreciate, why would you buy its warrants? If you think the company is bad but want to bet the price will go up, then it’s just gambling. Betting with warrants is essentially double the gambling, you may get it lucky once or twice, but I have never met a person who made a consistent profit from such approach.

For call warrants, the challenge of getting the mother right is even more important as it expires fast. Which means you need to find the mother share that you like and you think there is a reasonable chance that it will appreciate before the call warrant expire. An undervalued mother may not cut it, if you are unsure when the mother will be picked up by the investing community and price starts to rise.

2. Longer time to expiry

Warrants have a shelf life and they expire. Recall in part 1, I mentioned one of the premium that investors pay is theta or time to expiry premium. The longer the expiry, the higher premium investors are willing to pay because that means they can keep the warrants longer for exposure if they want to.

For warrants buyer, time is against you. What happens when warrant is about to expire is the premium will start to shrink as people are only willing to pay less premium for it. So even if the mother price held steady, you will see the warrant price dropping. So choose a warrant with a comfortable time to expiry. Generally I won’t touch warrants that expires in less than 3 months time. Why 3 months? If you google an option time decay chart, the premium shrinking over time does not happen in straight line but like a waterfall. The closer it gets, the faster it falls. Most of the time, the premium will really collapse in the last 1 month to expiry. So if you enter a warrant that expire in 3 months, you are giving the company less than 2 months to appreciate in price, which is too short a time if you ask me.

3. Don’t pay over the odds premiums

If you have identified a good company and there’s a warrant that has a long time before expiry, don’t pay over the odds premium. If you pay a high premium, you are exposed to higher risks. Premiums are a flimsy thing. Professionals will tell you it’s a function of leverage (delta), volatility (vega), time to expiry (theta), interest rate (rho) etc. The truth is you can’t measure these accurately, regardless of how sophisticated your warrant valuation model is.

If you pay a high premium, there is a higher chance that it may shrink and this would affect your warrant value. On the other hand, if a warrant is trading at a low premium, even if it stays low, you are ok. But there is a chance that the premium might expand (especially when volatility increases) and you could benefit from both mother price appreciation and premium expansion.

As a rule of thumb, I typically don’t pay more than 10% premium for a warrant expiring in less than a year. 10-20% premium is acceptable for longer expiry but not more than that. Usually those trading at 50% premium or above are out of money warrants. I also don’t recommend going for these as well.

4. Higher effective leverage

If the company you selected has more than 1 warrant or call warrants, then you get to choose. So after considering the first 3 points, if all things equal, you should choose the one with higher % return when the mother price move by 1%. That gives you the highest leverage with similar time of expiry and premium paid.

5. Risk management

The last but most important step, deciding the risk exposure. By now I hope you can appreciate that warrants are inherently riskier than shares (because of higher returns), call warrants more so. Despite all the research done, there is still a chance that the mother price will not react as you expected. When mother price drop by 5% and your warrant drop by 50%, do you have the stomach to take it? Decide how much you can risk and stick to it. Never at any time risk more than what you can afford to. And never ever borrow money to trade on warrants.

Now we have gone through the steps, I will take you through a real life example.

Practical example of picking call warrants – Top Glove

1. Top Glove is a good company

Top Glove is literally the top glove company in the world (25% market share), not just Malaysia. The way it has grown over the years and managed is nothing but exceptional. However, the past year has been tough on glove companies though due to over-capacity and competition, which brought down the profit margins. So why do I like Top Glove now?

i) Strong revenue growth

Demand for gloves never stop and is expected to go higher as more hospitals are built around the world and awareness rises. That’s why over the years Top Glove revenue just kept growing and this is not expected to stop in the near to medium term.

ii) Competition has eased

Revenue growth is always there, but margins may not be. From what I read from some analyst reports, industry competition has eased now as players slow down on capacity growth. That is what I expect when a few big players dominated the industry. With that, profit margins should rebound again.

iii) Cost has came down

One of the biggest cost is latex and the price has shot up since late last year. For glove players, they do cost past though to the end-customers but there will be a time lag. So while technically cost increase shouldn’t hurt their margins, the time difference would. Despite the high latex price, Top Glove still came up with a commendable RM83m profit last quarter (Dec-Feb).

If you notice, latex price has since came down significantly since April. From the peak around RM8 per kg in Feb, it has since came down to around RM6.30 level at May. (today it went below RM6). Again, any cost savings they will pass it back to customer but this time round, the timing difference is in the glove players’ favour. So Top Glove’s upcoming results on 16 June which is for Mar-May quarter is likely to be better.

Meanwhile for labor costs, foreign labour shortage has affected a lot of industries. Top Glove has already over time try to increase automation and expand in Thailand where they find it more conducive to do business. Therefore, automation cost savings will also slowly kick in over time.

2/3/4 Choosing the one with best balance of time, premiums and leverage

I combine steps 2 to 4 because more often than not, you won’t find a warrant that has the best of everything. So you have to balance between the factors and choose one with the best overall combination.

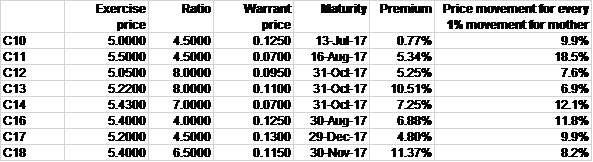

Top Glove doesn’t have warrants, only call warrants. Using the 6 June data, we get the following table.

Excluding C10, C11 and C16 that expires in 3 months time, let’s rank them now.

By time to maturity: C17, C18, C12-C14

By premium: C17, C12, C14

By price movement: C14, C17, C18

For me, based on all the factors above, I would go for C17.

The day I last commented in Top Glove page was 6 June (you can trace it if you want). Unfortunately, Top Glove price has shot up today right around when I published part 1 and before I could share part 2, so has the call warrants. So you may say this article has came out a day too late. However, the main purpose of this 2 parts article is to educate, Top Glove part is more for illustration. Once you have learnt, you can do it yourself next time.

But for the interest of the readers, I have rushed to finish part 2 (skipping some not so important parts I originally plan to write) and upload it.

So can Top Glove still go higher?

Based on the above positive factors I highlighted, I do think it can. Some forumers are already expecting back to RM100m net profit for the coming quarterly results. I don’t have a crystal ball, so I don’t know whether it will hit RM100m. But what I believe is it should be on a positive trajectory now and if not this quarter, then next or coming quarters it will hit RM100m. A glove company that makes RM400m net profit a year, if trading at 20x PE would be worth RM8b or around RM6.35. 20x PE is not unreasonable for a growing company (in fact largest company in the world) in a resilient demand industry. In fact, Top Glove historically is trading around that level and is relatively cheaper compared to Hartalega and Kossan (both higher margins because of higher efficiency).

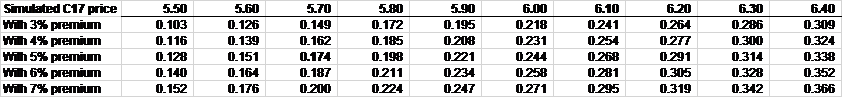

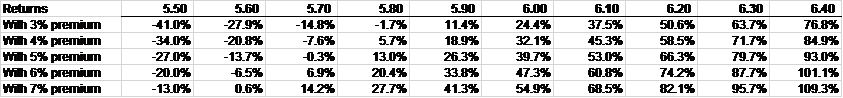

If I plot the risk return tables based on different Top Glove prices and based on different premiums, I would get these figures.

So you can see if Top Glove price continue to go up, your reward will be extremely high, but so if it goes the other way round. My entry price is much lower so my risk reward ratio is much more favourable than if anyone enters today. And I can also be wrong. So please make your own decision as an adult.

And again, never forget step 5.

Happy investing.

Jay

More articles on Jay's market diary

Created by Jay | Nov 17, 2018

Created by Jay | Nov 05, 2018

Created by Jay | Oct 14, 2018

Discussions

Hi, Jay, Thanks again for the write up and it was educations.

I have a question for you and if you dont mind answering, what are the costs involved if I were to hold a call warrant until expiry. If the Call Warrant is in the money, the IB would need to pay the difference between the exercize price and the weighted average 5/6 day closing price of the stock before expiry. The cost would be the cost I paid to buy the warrant and the conversion ratio.My question is, is there any other hidden cost like admin fees, brokerage fees etc?

Thanks and would appreciate if you are able to help. :)

2017-06-09 07:20

Very good educational article.

Buying company warrant can be considered as investing as one can convert it to mother share whenever he wishes. Hence for me, whether a company is a good company matters.

Call warrant is pure punting in my opinion. I like to do punting to have a little excitement too, but I will never advise anyone to punt, unless you have a little advantage as Jay does, knowing what make up he value of a call warrant.

For punting of call warrant, the quality of a company doesn't matter as much for me, but its price movement in the near future matters more; is its share price going to rise in the near future, after considering everything such as premium, gearing/delta, time to expiry etc.

Note price doesn't equate to value, especially short-term price movement. Call warrant is basically short-term instrument. In US and other matured option markets, call warrant is what they term as option, and options are basically very short-term, and three months expiry or less are very common.

In this respect, good TA may be more important than FA, much more.

2017-06-09 08:02

Very good article. This is the type that we need to see in i3. Not those rubbish posted by "someone"

2017-06-09 08:40

@Dragon88 I don't think there is any costs involved if you hold it till expiry. You will only incur the brokerage costs when you bought it earlier. However, it's best to confirm with your brokers as things may have changed over all these years. I have never held a call warrant till expiry because like I mentioned, premium would collapse in the last month. most call warrants expire out of money. It's usually better if you sell it earlier, unless you are very sure something big will happen in the last month before expiry.

2017-06-09 08:42

@kcchongnz thanks for the comments. yes call warrants are more speculative, that's why I mentioned the company you like must have price appreciation potential in the short term. even though FA sometimes teach you to go contrarian, never do that when you buy call warrant. do not go against the trend.

however if you buy a call warrant that expire in 6-9 months, you should go through at least 1 or 2 quarterly earnings and if they are good, then the price will move. for beginners especially should go for longer expiry as possible to buy time

my TA is not that strong, so I perfer to rely more on FA. with good FA support, even if the price doesn't go up, it shouldn't fall too much, so my risk reward ratio is effectively higher.

2017-06-09 08:52

@Dragon88 just to elaborate on my point, imagine if a stock trading at RM1.50, exercise price RM1, exercise ratio 1 to 1. the warrant trading at RM0.60 or 6.7% with 1 month to expiry. if the stock held steady at RM1.50, the warrant value will slowly trend down toward RM0.50. If you hold until expiry, you are expecting stock to trend above RM1.60. say if it close at RM1.58 on last day, your warrant eventually only get RM0.58 even if it ends up in the money. anything below the breakeven price of RM1.60 at expiry it is better for you to sell the warrants earlier.

if you are interested on the topic on options time decay, you can google it. my general advice is don't hold until expiry unless you are reasonably quite sure.

2017-06-09 09:04

Good article to follow.

Why not consider Kimlun-WA?

Stock: [PUNCAK]: PUNCAK NIAGA HOLDINGS BHD

Jun 5, 2017 03:28 PM | Report Abuse

Sell PN.

Take the proceed to look for better prospect.

KimLun will be earning more next year.

Go for KimLun-WA for it still has 8 years lifespan, with 4% premium over the mother share.

Plenitude is good.

Tsunami sheltered counter with good potential on Taman Desa Tebrau.

KSL and Crescendo also good. Good cash flow and having very cheap development land.

Jtiasa having more and more acreage of oil palm plantation reaching maturity.

Reits are good. They give you consistent and reliable dividends payout.

Don't buy Xinquan. It is going to suspend next Thursday (8th June 2017) for failing to release QR.

So there are thousands and one good alternatives.

Why still want to pray for something which you will not be answered?

2017-06-09 09:21

always wonder the criteria of selecting a warrant and JAY has provided crystal clear guideline !! once again, a mil thanks for the great effort :)

2017-06-09 09:49

Thanks Jay for your respond and for your insightful explanation.

The reason I am actually thinking of holding the call warrant i bought till expiry is because it is actually trading at discount (negative premium) compared to the mother share, i.e. if the cw expires today, I would make more money compared to its current warrant price.

Thanks again Jay for the info and explanation. :)

2017-06-09 10:04

Hi jay, may i know the formula to calculate "price movement for every 1% movement for mother" in table?

2017-06-09 10:07

Posted by Dragon88 > Jun 9, 2017 10:04 AM | Report Abuse

Thanks Jay for your respond and for your insightful explanation.

The reason I am actually thinking of holding the call warrant i bought till expiry is because it is actually trading at discount (negative premium) compared to the mother share, i.e. if the cw expires today, I would make more money compared to its current warrant price.

Thanks again Jay for the info and explanation. :)

I held call warrants to expiry a number of times, precisely because of the discounts and leverage they offered. There is a small settlement cost.

Ensure the mother share is very liquid such that it cannot be manipulated in price the last few days, for example it is hard to control the price of AirAsia, Genting or TopGlove.

2017-06-09 10:13

Thanks kcchongnz for the explanation. I am an avid reader of your articles posted in i3 as well. Thanks again :)

2017-06-09 10:17

yes, like what kcchongnz has mentioned. don't forget your last trading day is 3 market days before expiry. so last 3 days your hands are tied and can only watch on the sidelines

2017-06-09 10:26

@yoloisreal say a warrant is 2 for 1, if the premium is maintained, every 2 sen movement in mother the warrant should move 1 sen. so if 1% of mother now is 5 sen, warrant technically should move 2.5sen, so you divide 2.5sen over current warrant price to get the % movement.

in real life, all price movement is subject to supply and demand so premiums will fluctuate constantly

2017-06-09 10:33

the most important rule in investing/trading, know what you are doing. if you are unclear, please seek help or just avoid it, no matter how attractive the potential returns are

2017-06-09 11:00

even if it turns out bad after doing this way...at least u will know the reason...enabling u to improve-refine your competence on what 'you thought' u know well.

Posted by Jay > Jun 9, 2017 11:00 AM | Report Abuse

the most important rule in investing/trading, know what you are doing. if you are unclear, please seek help or just avoid it, no matter how attractive the potential returns are

2017-06-09 11:19

Hi Jay, your these 2 sharings really help alot understanding on warrant especially CW selection...by the way, do u knw how the IB make profit by issuance a CW. Just wish to understand more on how their position as Issuer since most of the time, they are the one control over the supply & demand over the CW on market...

2017-10-09 08:33

another good refreshing course article by jay, thx.

just like to point out that liquidity is sometimes very thin and thus a big issue for call warrants.

2017-10-09 08:46

call warrants is gambling,better bet in casino than trade on these kinda things.

2017-10-09 08:50

probability

people write so lengthy with so much information...you just come and comment like this... a little politeness does not make you so down rMoi

furthermore the writer already mentioned he does not welcome abusive comments...

2017-06-08 18:59