Daily Market Report - 14 May 2024

rakutentrade

Publish date: Tue, 14 May 2024, 10:39 AM

Previous Day Highlights

FBM KLCI closed marginally higher following a late buying momentum. The benchmark index was up 0.14% or 2.24 pts to close at 1,602.91. Majority of sectors were positive with transportation (+1.9%), technology (+1.6%), and property (+1.5%), leading the gains; while losers were seen in energy (-0.7%), and utilities (-0.7%). Market breadth was positive with 642 gainers against 505 losers. Total volume stood at 4.53bn shares valued at RM3.01bn.

Major regional indices trended mixed. HSI gained 0.80%, to end at 19,115.06. SHCOMP declined 0.21%, to close at 3,148.02. Nikkei 225 eased 0.13%, to finish at 38,179.46. STI rose 0.29%, to close at 3,300.20.

Wall Street closed mixed as investors await for key inflation data. The DJIA dropped 0.21%, to end at 39,431.51. Nasdaq rose 0.29%, to close at 16,388.24. S&P500 closed flattish at 5,221.42.

News For The Day

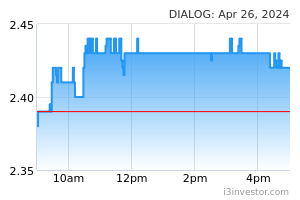

Dialog Group’s 3Q earnings rise 19% on higher output

Dialog Group reported its 3QFY6/24 net profit rose 19% YoY to RM156.16m compared to RM130.81m, thanks to higher upstream output. Revenue for the quarter fell 13% YoY to RM702.2m, from RM802.79m. The group declared an interim dividend of 1.50 sen. Dialog will continue to invest in phased capacity expansions for long-term customers across the ‘midstream terminals’ business portfolio. -The Edge Markets

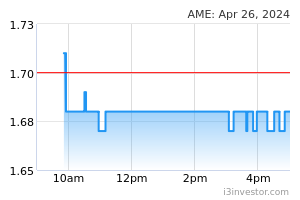

AME Elite to dispose of i-TechValley land for RM209.84m

AME Elite Consortium, via two wholly-owned subsidiaries, has agreed to dispose of 11 plots of industrial land in the i- TechValley in Phase 3 of the southern industrial and logistics clusters (SILC) in Iskander Puteri, Johor, to Digital Hyperspace Malaysia SB for a combined RM209.84m cash. The disposal consideration of the land, measuring a total of 34.91 acres. AME Elite said it is expected to realise an estimated net pro forma gain of about RM85.13m from the proposed sale, which is expected to be completed by 1Q25.-The Star

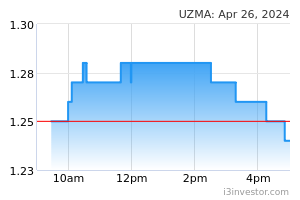

Uzma gets RM43.9m contract to undertake offshore services

Uzma has secured a contract valued at US$9.27m (RM43.9m) to undertake standard and special application of coiled tubing and pumping services. The contract under the Zawtika gas field project from PTTEP International Ltd commenced on May 1, 2024 until June 30, 2026. It is Uzma’s sixth win since the start of 2024, including from Shell to provide integrated production and integrity chemical and associated services. -The Edge Markets

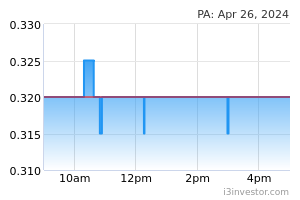

P.A. Resources achieves YoY net profit growth of 16%

PA Resources reported its 3QFY6/23 net profit leaped by more than 51 times YoY to RM12.43m, up from RM239,000, mostly contributed by its main extrusion and fabrication segment. While revenue was up 62.4% YoY to RM137.77m from RM84.81m. The group's extrusion and fabrication segment saw a surge of revenue by RM64.7m, predominantly due to higher orders for both exports and local sales, alongside a rise in inter-company sales.-The Edge Markets

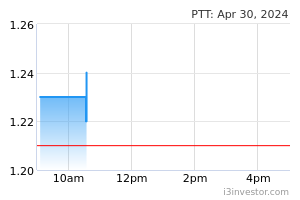

PTT Synergy secures 2 contracts worth RM169.85m

PTT Synergy Group has secured two contracts worth a total of RM169.85m from Sime Darby Property. The first is a RM96.61m contract for the proposed construction and completion of earthworks and ancillary works for Stage 1 at Lagong Mas, Gombak; Another contract for earthworks and ancillary works worth RM73.24m for the development of Bandar Bukit Raja Stage 3. “The date for completion shall be Nov 26, 2025,” the company said. -The Edge Markets

Our Thoughts

Wall Street ended on a mixed note as traders remain wary from a host of economic indicators which are due out namely the producer price index by today and the consumer price index tomorrow. As a result, the DJIA lost 81 points while the Nasdaq rebounded by 47 points with the US 10-year yield remaining stagnant at 4.49%. Over in Hong Kong, the HSI breached the 19,000 level to a 9- month high as optimism on loosening restrictions on the property sector and improving corporate earnings. Meanwhile, the latest weak credit data from China also prompted hopes of a possible cut in lending rates. Back home, the FBM KLCI closed slightly higher amid on a cautious note in line with regional performance while waiting for the US economic data. Nonetheless, we believe the market undertone to stay solid as accumulation of stocks continues thus expect the index to hover between the 1,600-1,610 range today. We also noticed that earnings reported so far have been encouraging and should act as a prelude for more strong earnings ahead.

Source: Rakuten Research - 14 May 2024

To sign up for an account: http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity: http://bit.ly/3I5Jzxo

Related Stocks

Market Buzz

2024-12-25

AME2024-12-24

AME2024-12-24

DIALOG2024-12-24

DIALOG2024-12-24

DIALOG2024-12-23

AME2024-12-23

DIALOG2024-12-23

DIALOG2024-12-23

PA2024-12-20

DIALOG2024-12-20

DIALOG2024-12-20

UZMA2024-12-20

UZMA2024-12-20

UZMA2024-12-20

UZMA2024-12-20

UZMA2024-12-19

AME2024-12-19

DIALOG2024-12-19

PTT2024-12-19

PTT2024-12-19

PTT2024-12-18

DIALOG2024-12-17

DIALOG2024-12-17

DIALOG2024-12-17

PA2024-12-16

DIALOG2024-12-16

DIALOG2024-12-16

PA