RHB Investment Research Reports

Health Care Facilities & Svcs - Prospects Remain Exciting

rhbinvest

Publish date: Fri, 07 Jun 2024, 11:11 AM

- Maintain OVERWEIGHT; IHH Healthcare (IHH) is now our sector Top Pick. We expect the private healthcare sector to record stronger numbers in 2H24, predicated on its organic expansion strategies, the visa-free entry into Malaysia for tourists from China and India, a growing number of non-communicable diseases (NCD), rising health awareness among consumers, and a rapidly ageing society. We switch to a risk-on mode, leaning towards companies with the ability to pass on higher costs, inelastic demand as well as having a more aggressive expansion plan.

- Healthcare service providers (HSP). For HSP, the key focus for IHH will primarily hinge on its aggressive expansion strategy down the road. According to PWC, global M&A trends in healthcare industries are expected to accelerate in 2024 as hospitals around the world are faced with financial and operational challenges stemming from heightened operating costs and clinical workforce shortages. Being the largest HSP in Asia, IHH’s clinical excellence and advanced medical equipment could enable it to spread its geographical presence in the high-growth region. Encouragingly, the group is actively looking out for acquisition targets alongside its organic expansion strategy to boost bed capacity by 4,000 units by 2028. Meanwhile, KPJ Healthcare’s (KPJ) outlook is expected to be underpinned by: i) Growing contributions from health tourism, as well as ii) enhancing operating efficiency from hospitals under gestation. We gathered that KPJ received overwhelming response from visitors during its marketing roadshows in Jakarta, in May. This, along with the influx of healthcare tourists (related to visa-free travel for China and India nationals) should propel KPJ’s growth trajectory in 2H24.

- Pharmaceutical segment. We maintain that the pharmaceutical segment should undergo a robust recovery in 2H24, underpinned by a pick-up in consumer healthcare and over-the-counter product segments, as well as it benefiting from the spillover effect of rising hospital activities and a surge in foreign tourist arrivals. The acceleration in trade and manufacturing activities as suggested by RHB Economics should underpin the growth of pharmaceutical companies with export exposure (Kotra Industries: 32%; Duopharma Biotech (DBB) : 8%). On the other hand, the higher government budget allocation for medicine procurement (2024F: MYR5.5bn vs 2023: MYR4.9bn), as well as the recent concluded price negotiations under the Approved Products Purchase List or APPL should support earnings growth for DBB.

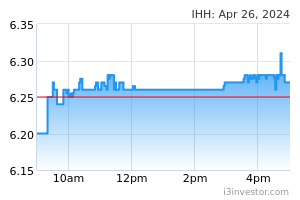

- Outlook and sector Top Pick. We maintain our OVERWEIGHT stance on the healthcare sector. Our choice of Top Pick, IHH, is premised on its robust balance sheet (IHH’s net gearing is at 0.32 vs KPJ’s 0.49), established medical technology infrastructure and appetite for inorganic growth. IHH’s valuation remains attractive – it is trading at 2024F 12.2x EV/EBITDA, 0.6SD below the historical mean of 15x. KPJ is currently trading at a 8% premium over IHH vs both their relative valuations’ historical mean of -14.5% (Figure 7), which we deemed unjustified, given IHH’s more aggressive expansion plan. Key downside risks: Higher-than-expected operating costs, lower-than-expected patient visits and revenue intensity growth, and unfavourable changes to the drug pricing mechanism by the Ministry of Health.

Source: RHB Research - 7 Jun 2024

Related Stocks

Market Buzz

2025-01-06

IHH2025-01-03

IHH2025-01-03

IHH2025-01-03

IHH2025-01-03

IHH2025-01-03

IHH2025-01-03

IHH2025-01-02

IHH2025-01-02

IHH2025-01-02

IHH2024-12-31

IHH2024-12-31

IHH2024-12-31

IHH2024-12-31

IHH2024-12-31

IHH2024-12-30

IHH2024-12-30

IHH2024-12-27

IHH2024-12-27

IHH2024-12-27

IHH2024-12-27

IHHMore articles on RHB Investment Research Reports

Discussions

Be the first to like this. Showing 0 of 0 comments