FCPO - Rebound Is Developing

rhboskres

Publish date: Fri, 21 Dec 2018, 04:25 PM

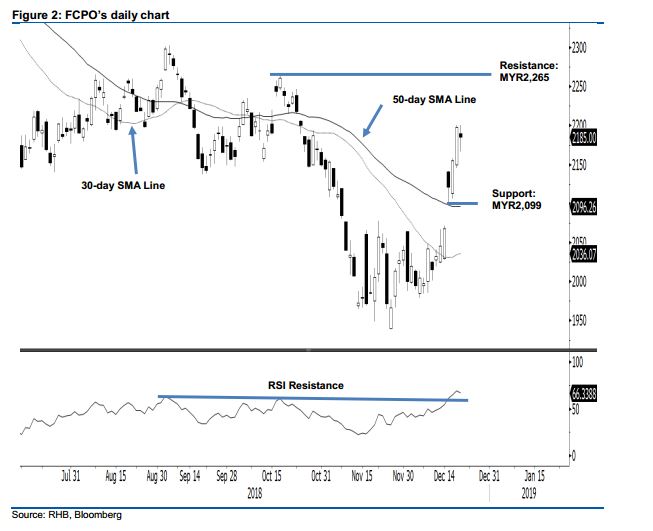

Maintain long positions. The FCPO formed a black candle in the latest session as it settled MYR13 lower at MYR2,185, after oscillating between a low and high of MYR2,167 and MYR2,200. The weak session may suggest the commodity is consolidating around the immediate resistance of MYR2,200 – after the recent relatively sharp upward move. Once this consolidation is finished, chances are high that the uptrend could be extended. Additionally, the risk of a deeper retracement from the said immediate resistance happening – which has been tested twice over the latest two sessions – may only arise if there is a clear price rejection. Until this happens, we keep to our positive trading bias.

As the recent two sessions’ price actions indicate that the rebound is still in healthy shape, traders are advised to remain in long positions. We initiated these at MYR2,057, or the closing level of 22 Nov. A stop-loss can now be placed at below MYR2,099.

Towards the downside, the immediate support is set at MYR2,099, the low of 17 Dec – which is also located near the 100-day SMA line. The following support is at the MYR2,000 mark, a round figure. Conversely, the immediate resistance is still pegged at MYR2,200, the next round figure. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 21 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024