E-mini Dow Futures - Still Positive

rhboskres

Publish date: Thu, 03 Jan 2019, 05:02 PM

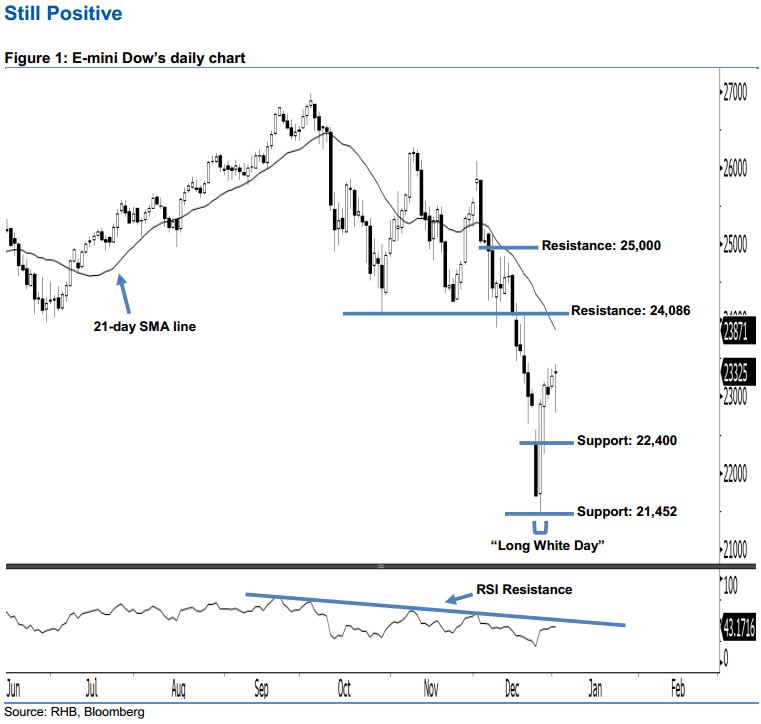

Maintain long positions. The E-mini Dow ended higher last night to form a “Doji” candle with a long lower shadow. It declined to a low of 22,786 pts during the intraday session before ending at 23,325 pts for the day. We note that the index has marked a higher close – vis-à-vis the previous sessions since 31 Dec 2018 – which suggests the positive sentiment stays unchanged. Technically, the long lower shadow implied there was an initial selling momentum during the day before the market moved up by the end of the trading session. This indicates that the buyers ought to still have control over the market.

As seen in the chart, we anticipate the immediate support at 22,400 pts, which is set near the midpoint of 26 Dec 2018’s “Long White Day” candle. The next support is seen at 21,452 pts, or the low of 26 Dec 2018. On the other hand, the immediate resistance is maintained at 24,086 pts, ie near the high of 19 Dec 2018. Meanwhile, the next resistance is situated at the 25,000-pt psychological mark.

As a result, we advise traders to maintain long positions, given that we initially recommended initiating long above the 22,400-pt level on 27 Dec 2018. In the meantime, a stop-loss can be set below the 21,452-pt threshold to minimise the downside risk.

Source: RHB Securities Research - 3 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024