FCPO - Revising Stop-Loss

rhboskres

Publish date: Thu, 03 Jan 2019, 05:10 PM

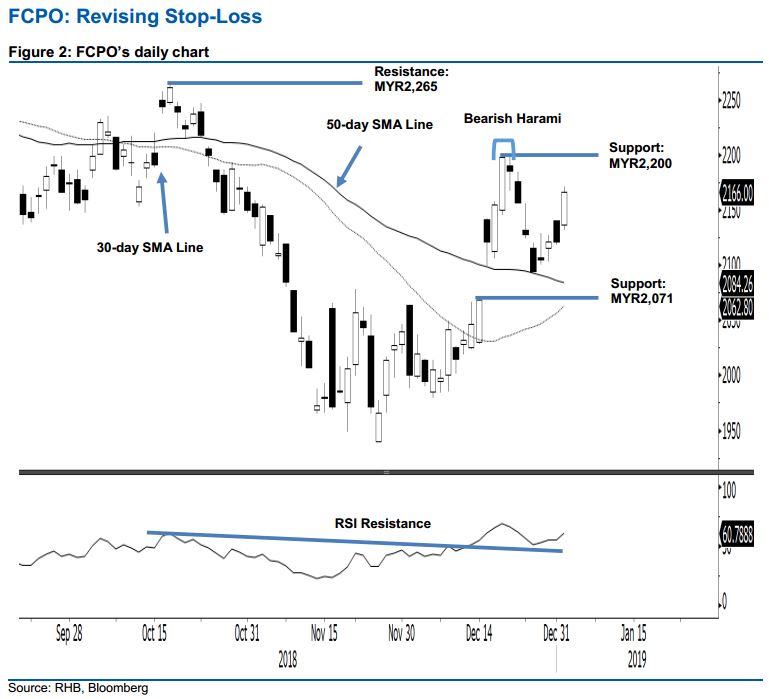

Tighten up trailing-stop for short positions. The FCPO formed a white candle in the latest session and successfully crossed above the previous immediate resistance of MYR2,156 – indicating it was under the bulls’ control. The intraday trend was positive as the commodity generally moved higher for the entire session. The low and high were posted at MYR2,132 and MYR2,171, before the commodity closed at MYR2,166, with a gain of MYR45. For now we still deem the retracement that started from the 20 Dec’s “Bearish Harami” formation as still valid, until a strong price reversal signal appears – signalled by a firm upside breach of the latest session’s high. Until this happens, we keep to our negative trading bias.

Pending a firmer price confirmation that the retracement that started from the said “Bearish Harami” has ended, we still recommend that traders maintain short positions. These positions were initiated after the commodity crossed below MYR2,124 on 27 Dec. The stop-loss is now revised to MYR2,171.

Towards the downside, immediate support is expected at MYR2,071, the high of 17 Dec. This is followed by MYR2,000, a round figure. On the other hand, the immediate resistance is revised to MYR2,200, the high of the 20 Dec’s “Bearish Harami” formation. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 3 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024