E-mini Dow Futures - Taking a Breather

rhboskres

Publish date: Fri, 04 Jan 2019, 05:16 PM

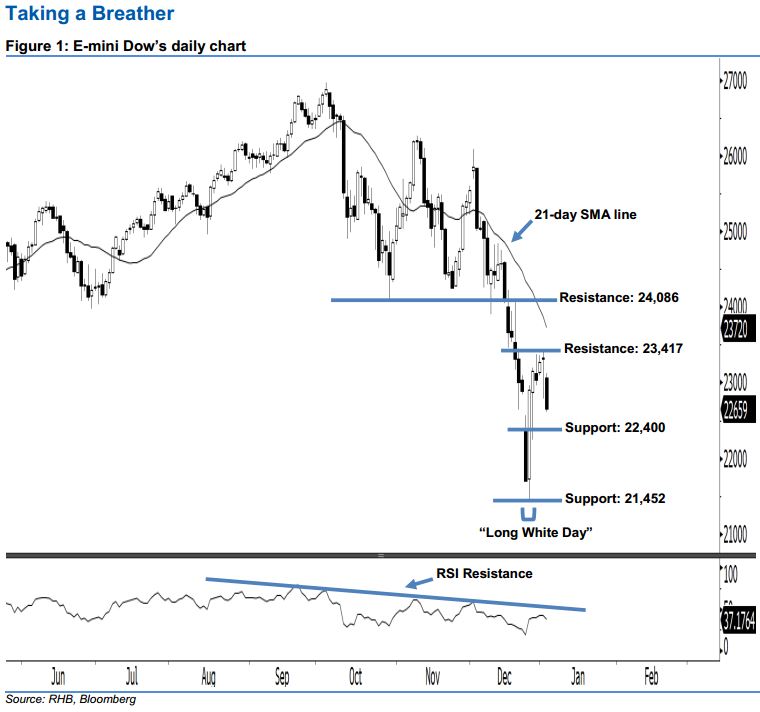

Stay long, with a stop-loss set below the 21,452-pt support. The E-mini Dow formed a black candle last night. It lost 666 pts to close at 22,659 pts, off the session’s high of 23,123 pts. However, the appearance of yesterday’s black candle can be viewed as a result of profit-taking activities after the recent gains. From a technical viewpoint, as long as the E-mini Dow does not negate the bullishness of 26 Dec 2018’s “Long White Day” candle, there is a possibility the rebound will continue. Overall, we stick to our positive view on the index’s outlook.

Currently, the immediate support is seen at 22,400 pts, which is situated near the midpoint of 26 Dec 2018’s “Long White Day” candle. The next support is anticipated at 21,452 pts – this was determined from the low of 26 Dec 2018. Towards the upside, we now eye the immediate resistance at 23,417 pts, ie the high of 2 Jan. The next resistance is set at 24,086 pts, which was obtained near the high of 19 Dec 2018.

Therefore, we advise traders to stay long, since we initially recommended initiating long above the 22,400-pt level on 27 Dec 2018. At the same time, a stop-loss set below the 21,452-pt threshold is preferable to limit the downside risk.

Source: RHB Securities Research - 4 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024