WTI Crude Futures - Bulls Close to Testing Immediate Resistance

rhboskres

Publish date: Mon, 07 Jan 2019, 10:34 AM

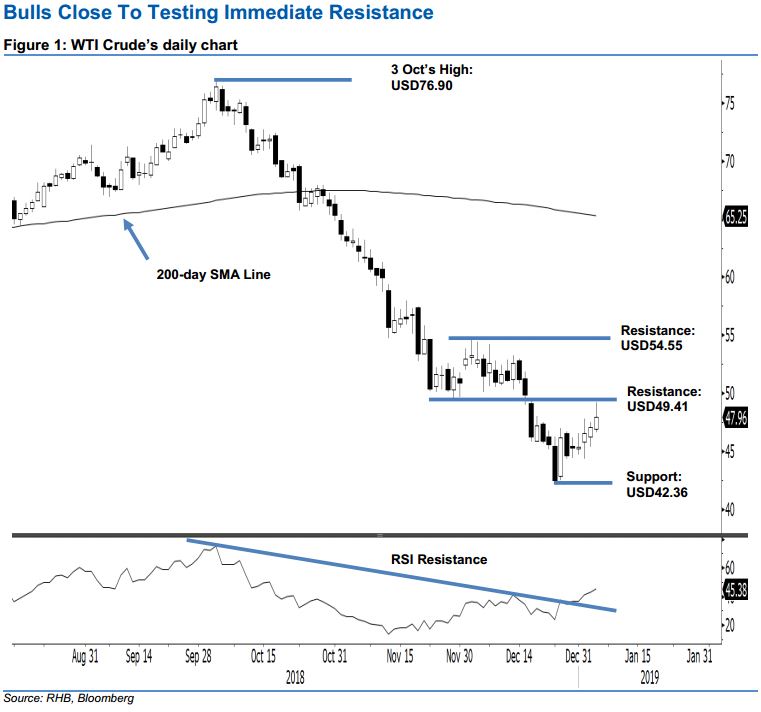

Maintain short positions until bulls manage to recapture the immediate resistance. The WTI saw a positive performance in last Friday’s session and at one point came in relatively near to the immediate resistance of USD49.41. The commodity advanced USD0.87 to end at USD47.96, this was after it registered a low and high of USD46.65 and USD49.22. Until the commodity manages to crack above the said immediate resistance decisively, the overall negative price trend that started from the high of USD76.90 on 3 Oct is still valid. Hence, we are keeping our negative trading bias.

As there is still no confirmation that a deeper rebound could be developing, we continue to recommend traders keep to short positions that were initiated at USD46.14, the closing level of 19 Dec. A stop-loss can be placed above USD49.41.

Immediate support is still expected at the USD42.36 mark, which was the low of 24 Dec 2018. The following support is at USD40, the next round figure. On the other hand, the immediate resistance is expected at USD49.41, ie the low of 29 Nov. This is followed by USD54.55, the high of 4 Dec.

Source: RHB Securities Research - 7 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024