WTI Crude Futures - Shooting Star Near the Immediate Resistance

rhboskres

Publish date: Tue, 08 Jan 2019, 09:06 AM

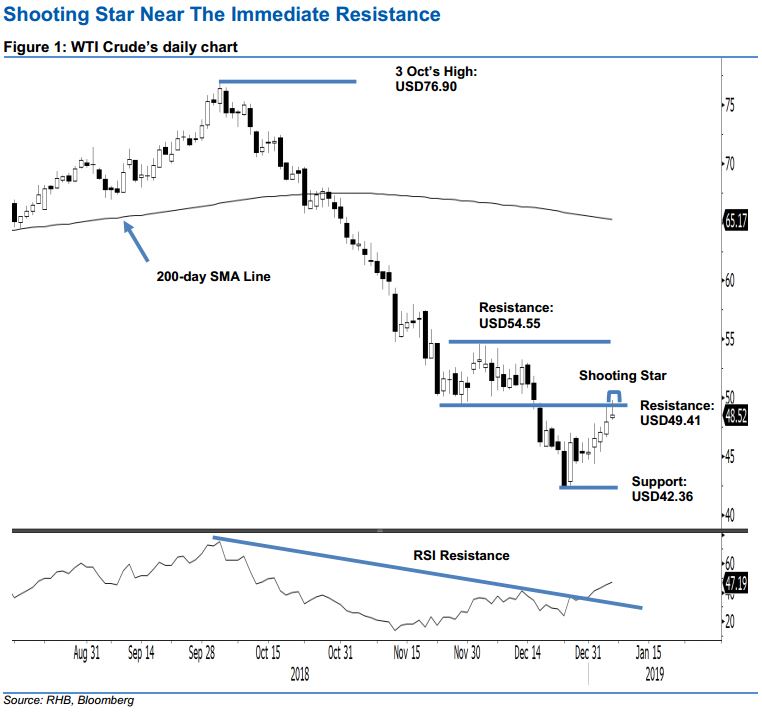

Maintain short positions. The WTI Crude formed a “Shooting Star” formation in the latest session – indicating a possible price rejection at the USD49.41 immediate resistance. The commodity failed to sustain its breakout from said immediate resistance during the intraday session, sliding from a high of USD49.79 to end at USD48.52. This implied a gain of USD0.56. Until the WTI Crude is able to decisively recapture the aforementioned immediate resistance, its negative price trend – which started from early Oct 2018 – is still considered valid, and the possibility for a deeper rebound to develop should still be low. As a result, we keep our negative trading bias.

As the price reversal formation appeared near the immediate resistance, we continue to recommend traders keep to short positions – these were initiated at USD46.14, or the closing level of 19 Dec 2018. A stop-loss can be placed above the USD49.41 mark.

The immediate support is eyed at the USD42.36 mark, which was the low of 24 Dec 2018. Breaking this may see the market test the USD40 threshold, or the next round figure. Conversely, the immediate resistance is expected at USD49.41, ie the low of 29 Nov 2018. The following resistance is at USD54.55, which was the high of 4 Dec 2018.

Source: RHB Securities Research - 8 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024