FKLI - 50-Day SMA Line Remains a Barrier

rhboskres

Publish date: Wed, 09 Jan 2019, 05:37 PM

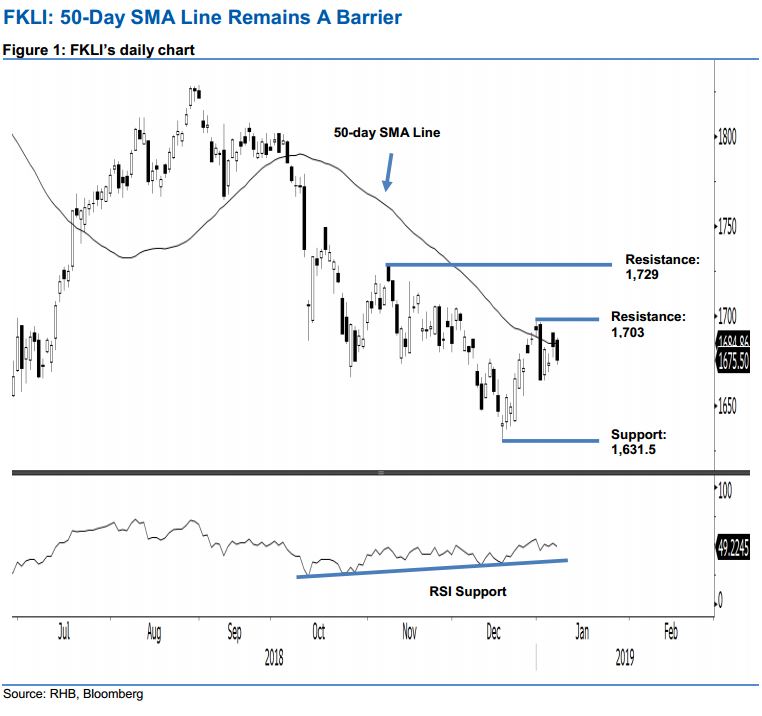

Maintain short positions as the bulls are constrained by the 50-day SMA line. The FKLI weakened 8 pts to settle at 1,675.5 pts in yesterday’ session. Intraday, the tone was negative, generally moving lower throughout the session with the high and low posted at 1,688 pts and 1,673 pts. The index has been consolidating around the 50-day SMA line in the last four sessions, implying the weak bias that started from the negative session on 2 Jan is still firmly in place. As long as the index is still capped by both the said SMA line and immediate resistance of 1,703 pts, chances are high that it could retest the immediate support of 1,631.5 pts. Based on these technicalities, we keep to our negative trading bias.

As the index is still driven by the bears and could retrace further, we continue to recommend that traders maintain short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, a stop-loss can be placed above 1,703 pts.

Towards the downside, the immediate support may appear at 1,631.5 pts, the low of 18 Dec. The second support is expected at the 1,600-pt mark as the next support. Meanwhile, the overhead immediate resistance is at 1,703 pts, the high of 31 Dec 2018. This is followed by 1,729 pts, the high of 8 Nov.

Source: RHB Securities Research - 9 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024