WTI Crude Futures - Rebound Still Developing

rhboskres

Publish date: Fri, 11 Jan 2019, 04:54 PM

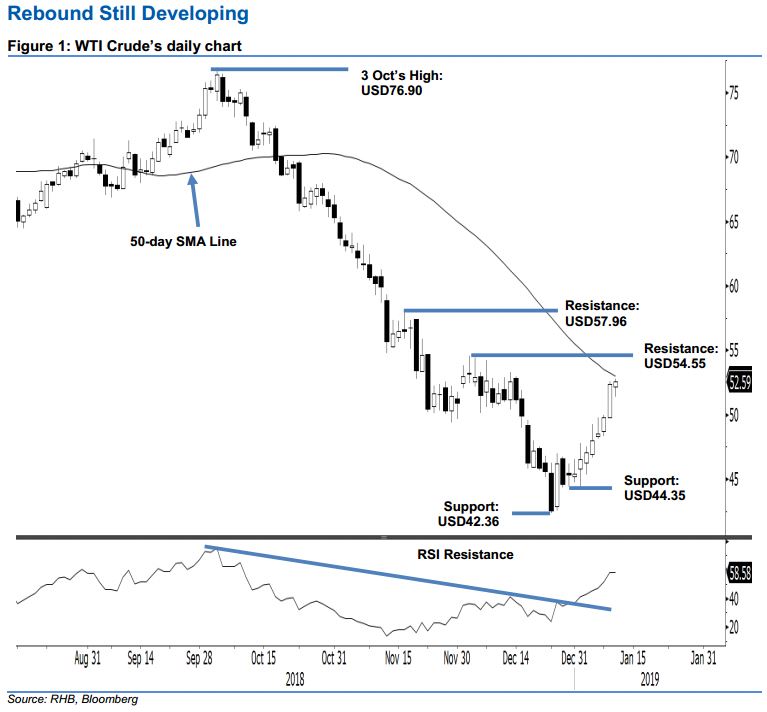

Maintain long positions as the bulls are approaching to test the 50-day SMA line. The WTI Crude ceased the latest trading session slightly higher by USD0.23 to settle at USD52.59. This was after it ranged between USD51.37 and USD52.78. Currently the commodity is located near the 50-day SMA line, we think the bullish bias could be enhanced should it manage to crack above this line. The momentum as measured by the Daily RSI is also encouraging, as it cracked above the resistance line recently (as labelled in the chart), while at the same time not flashing out an overbought reading yet. Hence, we maintain our positive trading bias.

In the absence of price exhaustion signals – as the commodity came near to the 50-day SMA line hurdle, we continue to recommend traders keep to long positions. These were initiated at USD49.78, or the closing level of 8 Jan. For risk-management purposes, a stop-loss can be placed at below the USD42.36 level.

Immediate support is still pegged at USD44.35, which was the low of 2 Jan. The second support is at the USD42.36 mark, or the low of 24 Dec 2018. Meanwhile, overhead immediate resistance is set at USD54.55, ie the high of 4 Dec 2018. This is followed by USD57.96, which was the high of 16 Nov 2018.

Source: RHB Securities Research - 11 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024