FKLI - Eying for Further Retracement

rhboskres

Publish date: Fri, 11 Jan 2019, 04:55 PM

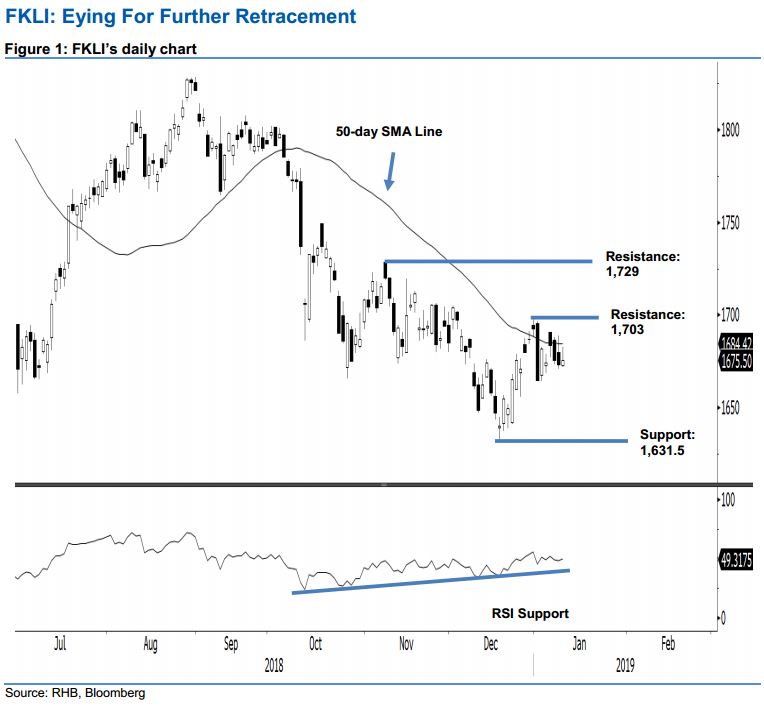

Maintain short positions on bias of deeper retracement. The FKLI was trading in a directionless manner in the latest session – it was confined in the sideway range of between 1,672 pts and 1,682.5 pts before closing marginally higher by 2.5 pts at 1,675.5 pts. This implies the index is still capped by the 50-day SMA line – this suggests the bearish bias that set in on 2 Jan remains in place, and the risk of further retracement is still high. At the minimum, we are expecting the index to test the immediate support of 1,631.5 pts. On these observations, we are keep to our negative trading bias.

As the bias is tilted towards an extension of the negative bias, we continue to recommend that traders maintain short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, a stop-loss can be placed above 1,703 pts.

The immediate support is set at 1,631.5 pts, the low of 18 Dec, while the second support is still pegged at the 1,600-pt mark. Moving up, the immediate resistance is expected at 1,703 pts, the high of 31 Dec 2018. This is followed by 1,729 pts, the high of 8 Nov.

Source: RHB Securities Research - 11 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024