COMEX Gold - Trend Seems Encouraging

rhboskres

Publish date: Thu, 17 Jan 2019, 05:05 PM

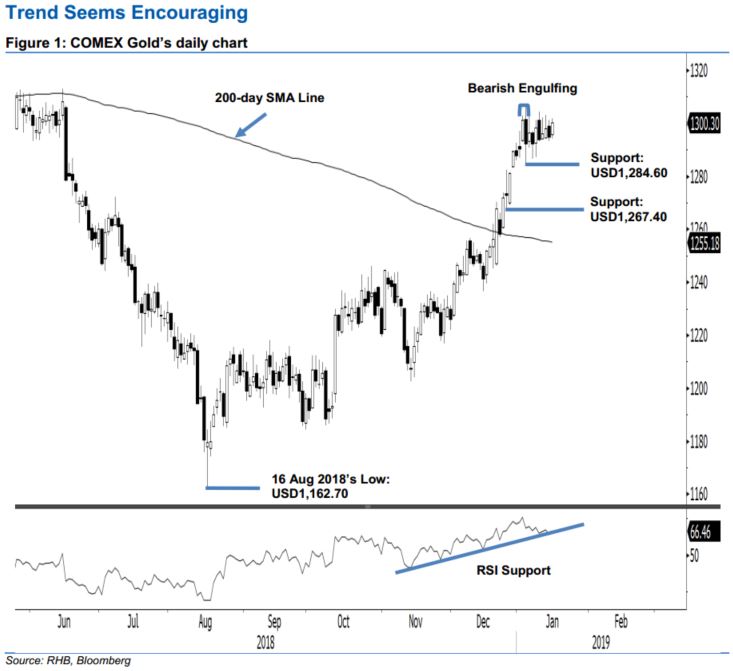

Still looks like a narrow sideways consolidation; maintain long positions. The COMEX Gold posted a gain of USD5.40 to settle at USD1,300.30 – after it swung between a low and high of USD1,294.10 and USD1,301.90. Nevertheless, the commodity is still confined within the narrow sideways trading range that has been in development since the appearance of the “Bearish Engulfing” formation on 4 Jan. The commodity’s upward move may resume if it manages to break away from this consolidation mode in the coming sessions. Towards the downside, risk for a greater retracement to develop may only rise if the immediate support is broken. Hence, we keep to our positive trading bias.

As the recent sessions’ price actions are indicating the bulls are merely taking a pause and that the overall positive price trajectory is still firmly in place, we continue to recommend traders to keep to long positions – we initiated this at the USD1,216 mark, which was 14 Nov 2018’s closing level. For risk-management purposes, a stop-loss can be placed below the USD1,284.60 threshold.

Towards the downside, immediate support is set at USD1,284.60, ie the latest session’s low. Breaking this may see market test USD1,267.40, or the low of 21 Dec 2018. Meanwhile, overhead resistance is set at USD1,332.40, which was the high of 11 May 2018. This is followed by USD1,370.50, or the high of 25 Jan 2018.

Source: RHB Securities Research - 17 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024