FCPO - Negative Bias Stays

rhboskres

Publish date: Thu, 17 Jan 2019, 05:14 PM

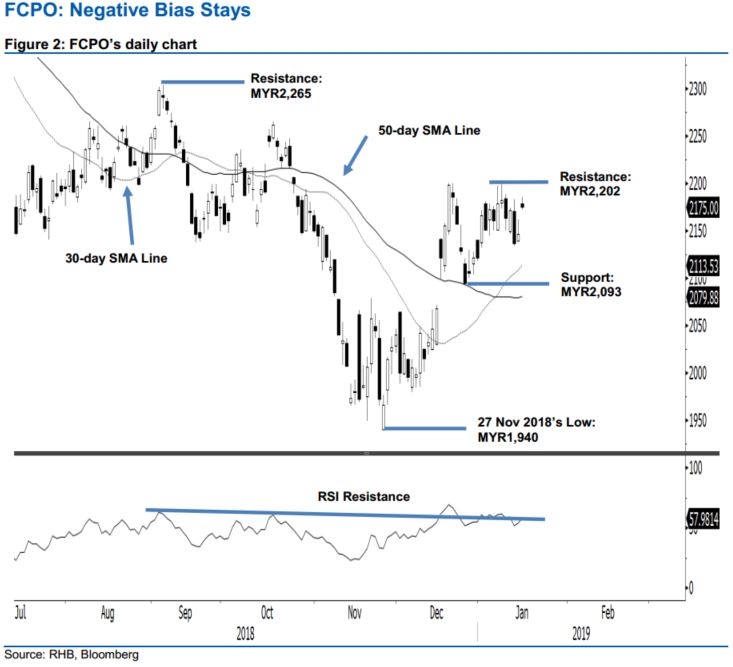

Maintain short positions. The FCPO formed a black candle, shedding MYR9 to settle at MYR2,175 yesterday. The low and high were at MYR2,173 and MYR2,185. Broadly, the negative bias that set in after the failed attempt to break above the immediate resistance of MYR2,200 on 9 Jan is still valid. By extension, we continue to see a greater risk for the commodity to retest the immediate support of MYR2,093 – which is located near both the 30- day and 50-day SMA lines. This negative bias will remain valid as long as the commodity is capped by the said immediate resistance. Hence, we maintain our negative trading bias.

As chances are still high for the commodity to retrace towards the said immediate support, we continue to recommend that traders keep to short positions. We initiated these at MYR2,136, the closing level of 14 Jan. For risk management purposes, a stop-loss can be placed above MYR2,202.

Immediate support is maintained at MYR2,093, the low of 26 Dec 2018. The second support is at MYR2,000. Moving up, the immediate resistance is now expected at MYR2,202, the high of the 9 Jan. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 17 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024