E-mini Dow Futures - Third Consecutive White Candle

rhboskres

Publish date: Fri, 18 Jan 2019, 04:50 PM

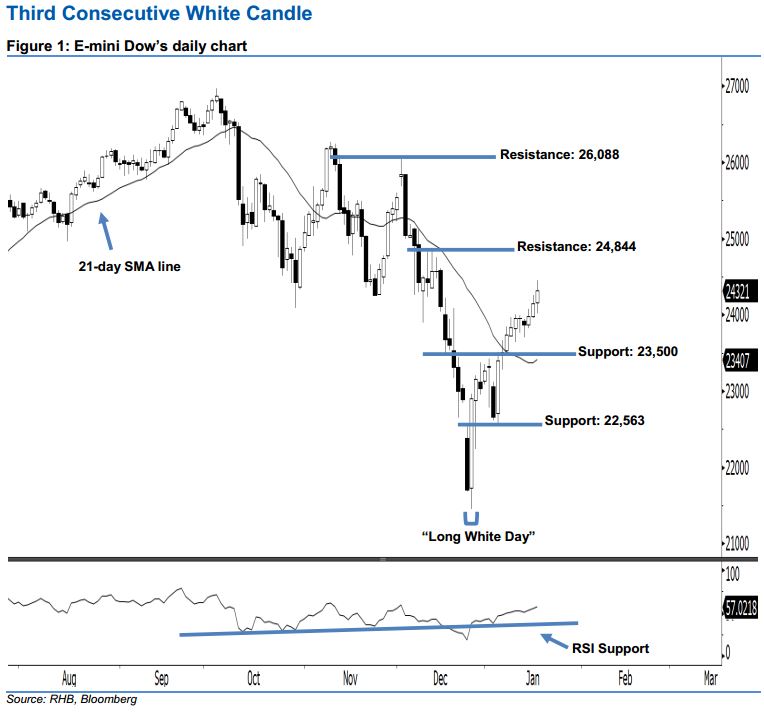

Maintain long positions. The upward movement in the E-mini Dow has continued as expected: a white candle was formed last night. It rose 170 pts to close at 24,321 pts, off the session’s high of 24,449 pts and low of 24,010 pts. Judging from the current technical landscape, we expect the upside swing from 26 Dec 2018’s “Long White Day” candle to continue. This is because the E-mini Dow has marked a higher close vis-à-vis the previous sessions since 15 Jan – implying that the market sentiment is considered bullish. Overall, we maintain our bullish view on the E-mini Dow’s outlook.

As shown in the chart, we anticipate the immediate support level at 23,500 pts, ie near 4 Jan’s high and 8 Jan’s low. Meanwhile, the next support is seen at 22,563 pts, determined from the previous low of 4 Jan. On the other hand, the immediate resistance level is maintained at 24,844 pts, obtained from the high of 12 Dec 2018. The next resistance is situated at 26,088 pts, ie the previous high of 3 Dec 2018.

Therefore, we advise traders to maintain long positions, since we had originally recommended initiating long above the 22,400-pt level on 27 Dec 2018. In the meantime, a trailing-stop can be set below the 23,500-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 18 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024