E-mini Dow Futures - Bullish Sentiment Remains Unchanged

rhboskres

Publish date: Tue, 22 Jan 2019, 09:01 AM

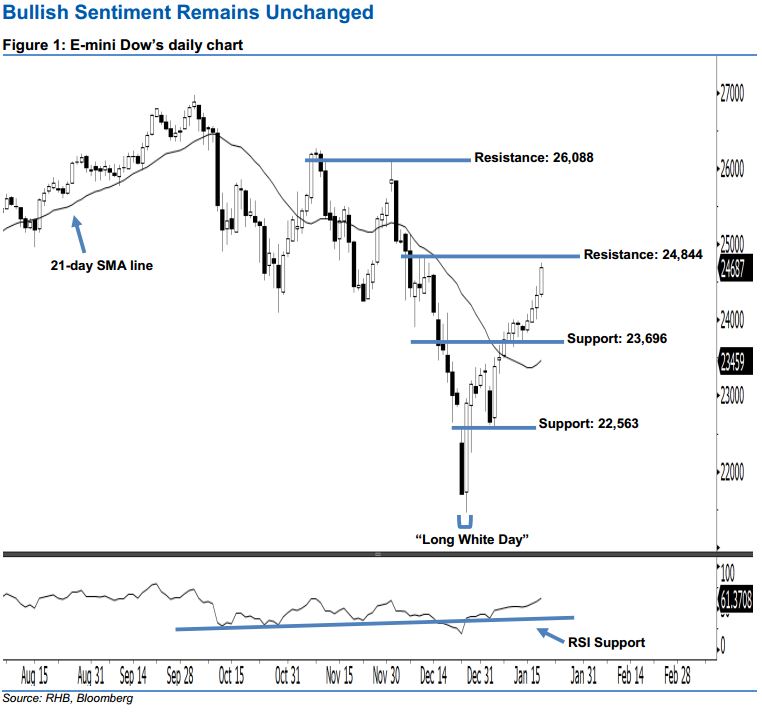

Stay long while setting a new trailing-stop below the 23,696-pt level. Buying momentum continued as expected, as a long white candle was formed last Friday. It gained 366 pts to close at 24,687 pts, after oscillating between a high of 24,745 pts and low of 24,298 pts. Market sentiment remains bullish, as the index posted a white candle for a fourth consecutive session. This may further extend the rebound that started with 26 Dec 2018’s “Long White Day” candle. Given that the 21-day SMA line is likely to turn upwards, the bullish sentiment has been enhanced.

Presently, we are eyeing the immediate support at 23,696 pts, which was the low of 14 Jan. The next support is seen at 22,563 pts, situated at the low of 4 Jan. To the upside, the immediate resistance is seen at 24,844 pts, determined from the high of 12 Dec 2018. Meanwhile, the next resistance is anticipated at 26,088 pts, obtained from the previous high of 3 Dec 2018.

To recap, on 27 Dec 2018, we initially recommended traders to initiate long positions above the 22,400-pt level. We continue to advise staying long for now, while setting a new trailing-stop below the 23,696-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 22 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024