E-mini Dow Futures - Outlook Remains Positive

rhboskres

Publish date: Thu, 24 Jan 2019, 04:30 PM

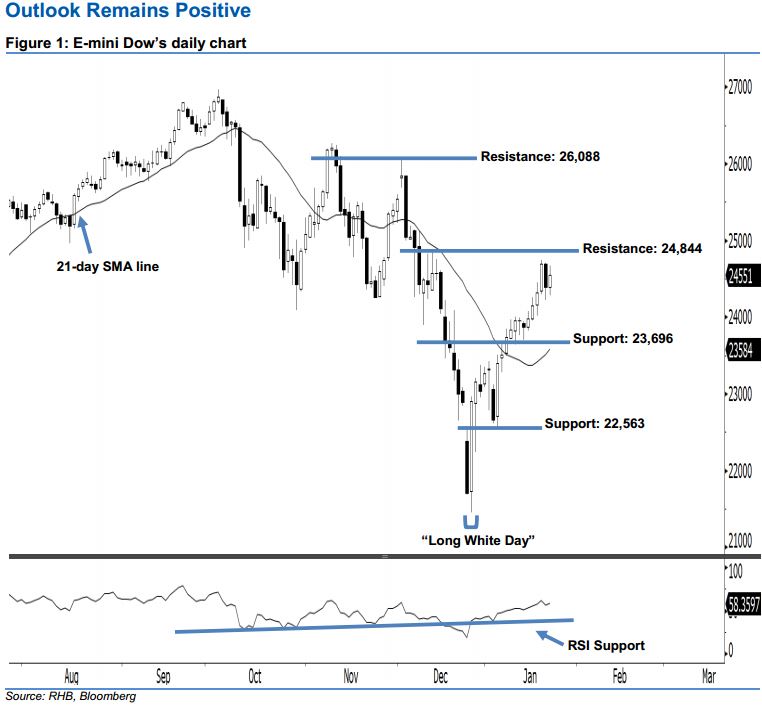

Stay long, with a trailing-stop set below the 23,696-pt support. The E-mini Dow formed a white candle last night. It rose 161 pts to close at 24,551 pts, off the session’s high of 24,673 pts and low of 24,276 pts. From a technical perspective, the positive sentiment stays unchanged, as the index continues to hold above the rising 21- day SMA line. Furthermore, yesterday’s candle may further extend the upside swing that started with 26 Dec 2018’s “Long White Day” candle. Overall, we expect the market to rise further if the immediate 24,844-pt resistance mentioned previously is taken out decisively in the coming sessions.

Based on the daily chart, we are eyeing the immediate support level at 23,696 pts, which was the low of 14 Jan. If this level is taken out, look to 22,563 pts – ie the low of 4 Jan – as the next support. On the other hand, the immediate resistance level is seen at 24,844 pts, defined from the high of 12 Dec 2018. Meanwhile, the next resistance is situated at 26,088 pts, obtained from the previous high of 3 Dec 2018.

Thus, we advise traders to stay long, following our recommendation of initiating long above the 22,400-pt level on 27 Dec 2018. In the meantime, a trailing-stop can be set below the 23,696-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 24 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024