COMEX Gold - Strong Bounce From Immediate Support

rhboskres

Publish date: Mon, 28 Jan 2019, 11:21 AM

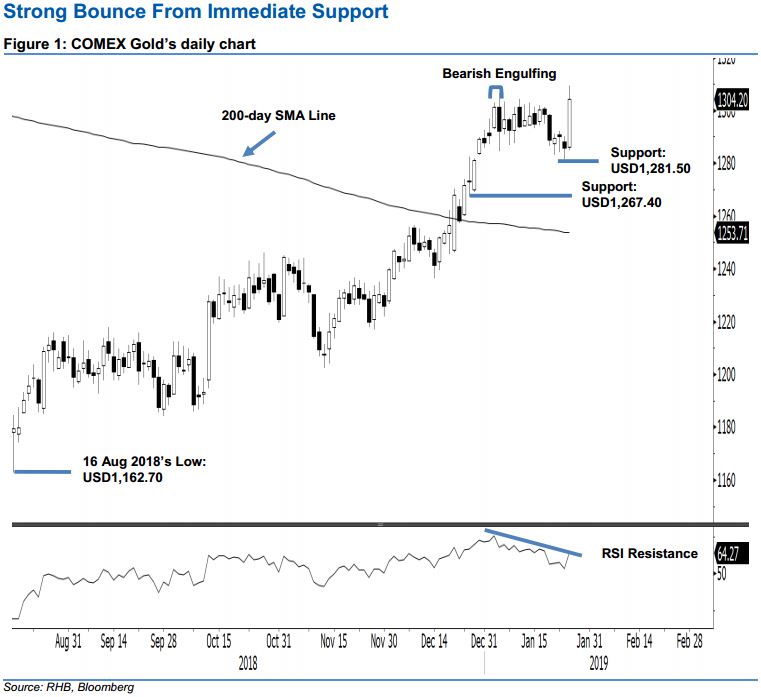

Bulls are emerging from the support, nullifying the “Bearish Engulfing”; maintain long positions. The COMEX formed a “Long White Candle” in the latest session that in our view has nullified 4 Jan’s “Bearish Engulfing” formation. The relatively strong session set in after the commodity tested the previous immediate support of USD1,284.60 in the previous three sessions. This may suggest that the 3-week sideways consolidation phase may have reached an end and that the upward move is likely resume. This encouraging tone is further supported by the fact that the yellow metal is trading on a strong footing above the 200-day SMA line. Considering these, we keep to our positive trading bias.

With the bias that the commodity is now ready to extend its upward move, we continue to advise traders stay in long positions. We initiated this at the USD1,216 mark, which was 14 Nov 2018’s closing level. For riskmanagement purposes, a stop-loss can now be placed below the USD1,281.50 threshold.

We revised the immediate support to USD1,281.50, which was the low of 24 Jan. This is followed by USD1,267.40, which was the low of 21 Dec 2018. Moving up, we are still looking at USD1,332.40 ie the high of 11 May 2018, as the immediate resistance. This is followed by USD1,370.50, or the high of 25 Jan 2018.

Source: RHB Securities Research - 28 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024