E-mini Dow Futures: Positive Sentiment Stays Intact

rhboskres

Publish date: Wed, 30 Jan 2019, 04:36 PM

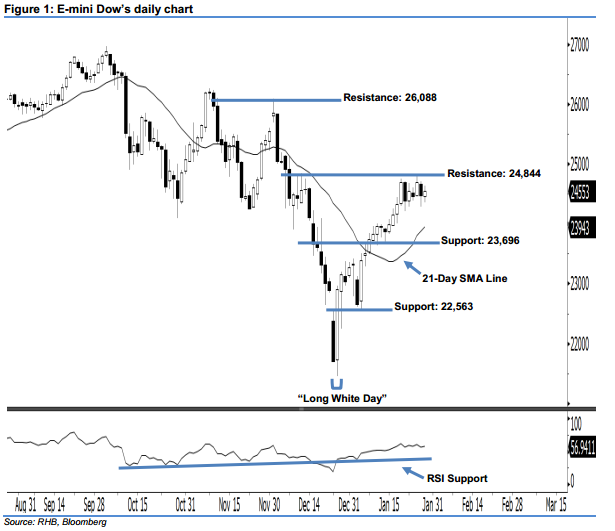

Outlook remains positive; maintain long positions. The E-mini Dow ended higher to form a positive candle last night. It rose 80 pts to close at 24,553 pts after oscillating between a high of 24,638 pts and low of 24,350 pts. From a technical perspective, we expect the upside swing – which began from 26 Dec 2018’s “Long White Day” candle – to likely continue. This is because the E-mini Dow has continued to stay above the rising 21-day SMA line and 23,696-pt support mentioned previously – implying that market sentiment is positive. Overall, we keep our bullish view on the index’s outlook.

As shown in the chart, we anticipate the immediate support at the 23,696-pt level, which was determined from the low of 14 Jan. Meanwhile, the next support is situated at 22,563 pts, ie the low of 4 Jan. Towards the upside, the immediate resistance is seen at 24,844 pts, which was the high of 12 Dec 2018. The next resistance will likely be at 26,088 pts – this was obtained from the previous high of 3 Dec 2018.

Consequently, we advise traders to stay long – in line with our initial recommendation to have long positions above the 22,400-pt level on 27 Dec 2018. It is advisable to set a trailing-stop below the 23,696-pt threshold to secure part of the gains.

Source: RHB Securities Research - 30 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024