FCPO - Bulls Are Charging Ahead

rhboskres

Publish date: Tue, 29 Jan 2019, 11:18 AM

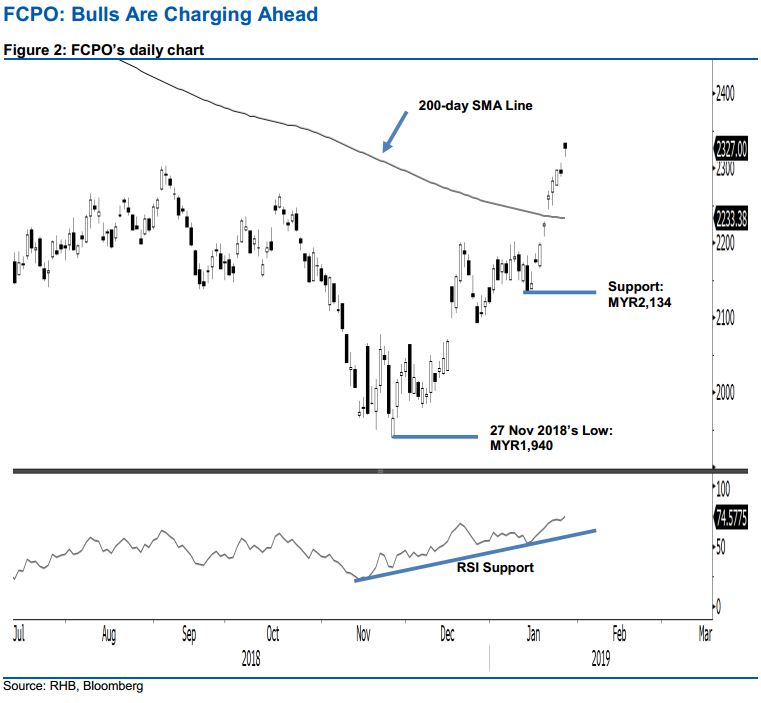

Maintain long positions as the bulls crush through the previous immediate resistance. The FCPO performed positively, at the closing, decisively breached above the previous immediate resistance of MYR2,303. The low and high were at MYR2,315 and MYR2,333, before it closed at MYR2,327, indicating a gain of MYR33. The breakout from the said previous immediate resistance indicates the commodity’s rebound is still being extended. While the Daily RSI is now flashing out the overbought reading of 74.6, in the absence of a price reversal, the overall upward move should remain intact. Hence, we keep to our positive trading bias.

As the bulls are showing clear dominance despite the overbought daily RSI reading, traders are advised to stay in long positions. We initiated these at MYR2,226, the closing level of 18 Jan. To manage risks, a trailing-stop can be placed below MYR2,288, the low of 25 Jan.

The immediate support is revised to MYR2,300, a round figure. The second support is now expected at MYR2,134, the low of 14 Jan. Moving up, the immediate is revised to MYR2,348, the high of 29 Jun 2018. This is followed by MYR2,400, a round figure.

Source: RHB Securities Research - 29 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024