FCPO - Sentiment Remains Positive

rhboskres

Publish date: Thu, 07 Feb 2019, 05:22 PM

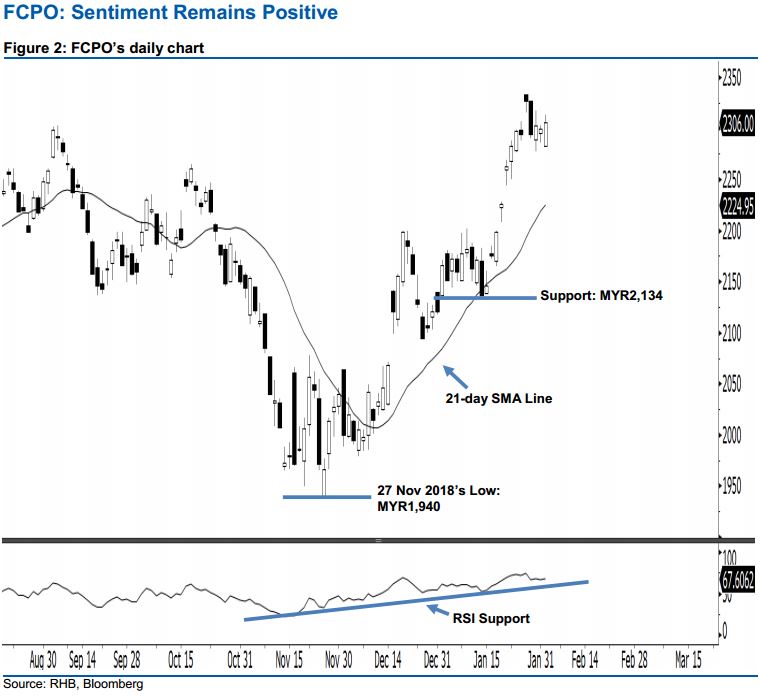

Upside move is likely to continue; maintain long positions. The FCPO ended on a white candle on Monday. It rose to a high of MYR2,313 during the intraday session, before ending at MYR2,306 for the day. Given that the commodity has posted a third consecutive white candle, it suggests that the upside move is not diminished yet. Moreover, as the 21-day SMA line is likely to turn higher, it would appear that the bullish sentiment has been enhanced. Overall, we maintain a positive view on FCPO’s outlook.

As shown in the chart, the immediate support level is seen at the MYR2,200 psychological spot. The next support would likely be at MYR2,134, determined from the low of 14 Jan. On the other hand, we anticipate the immediate resistance level at MYR2,348, obtained from the high of 29 Jun 2018. If a breakout arises, the next resistance is seen at the MYR2,400 round figure.

Thus, we advise traders to maintain long positions, since we had originally recommended initiating long above the MYR2,226 level on 22 Jan. In the meantime, a trailing-stop can be set below the MYR2,288 threshold in order to limit the downside risk.

Source: RHB Securities Research - 7 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024