FKLI - Risk of Retracement Still High

rhboskres

Publish date: Thu, 14 Feb 2019, 05:45 PM

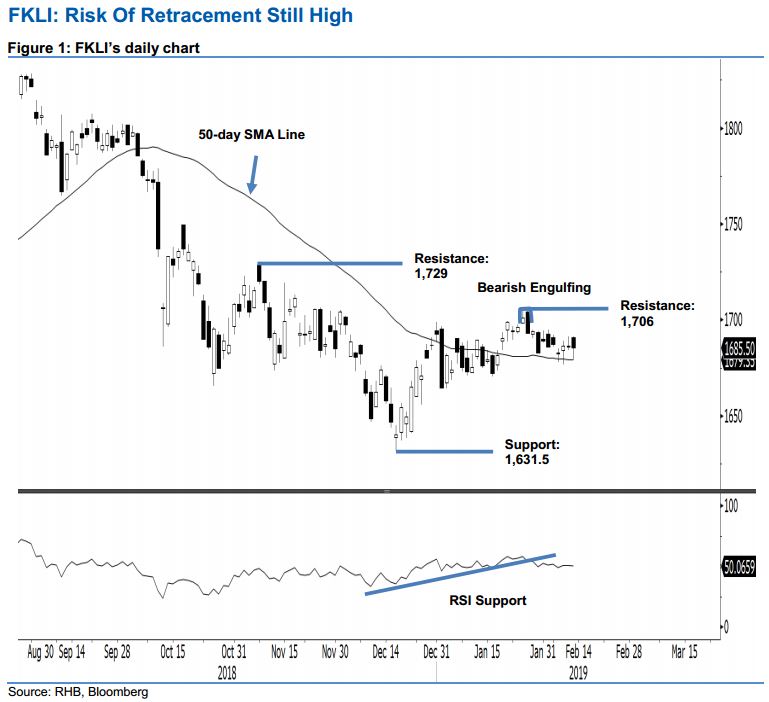

Maintain short potions as the bulls are not in control. The FKLI closed the latest trading marginally lower by 1 pt at 1,685.5 pts – this was after it failed to sustain its earlier session’s positive tone. The high and low were at 1,691.5 pts and 1,679.5 pts. The failure of the bulls to maintain the intraday positive tone indicates a lack of strength on their side. The negative bias that started from the 29 Jan’s “Bearish Engulfing” formation is still in place. Additionally, we continue to observe the index as just hovering around the 50-day SMA line over the recent sessions, without showing any sign of reversing towards the upside. As such, we maintain our negative trading bias.

As the index is still under the bear’s control and the 50-day SMA line at risk of being broken, we continue to recommend that traders maintain short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, a stop-loss can be paced above 1,706 pts.

The immediate support is eyed at 1,631.5 pts, the low of 18 Dec 2018. This is followed by the 1,600-pt mark. On the other hand, the immediate resistance is set at 1,706 pts, the high of the 28 Jan’s “Bearish Engulfing” formation. This is followed by 1,729 pts, the high of 8 Nov.

Source: RHB Securities Research - 14 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024