COMEX Gold - Bulls Are Turning Cautious

rhboskres

Publish date: Fri, 22 Feb 2019, 05:46 PM

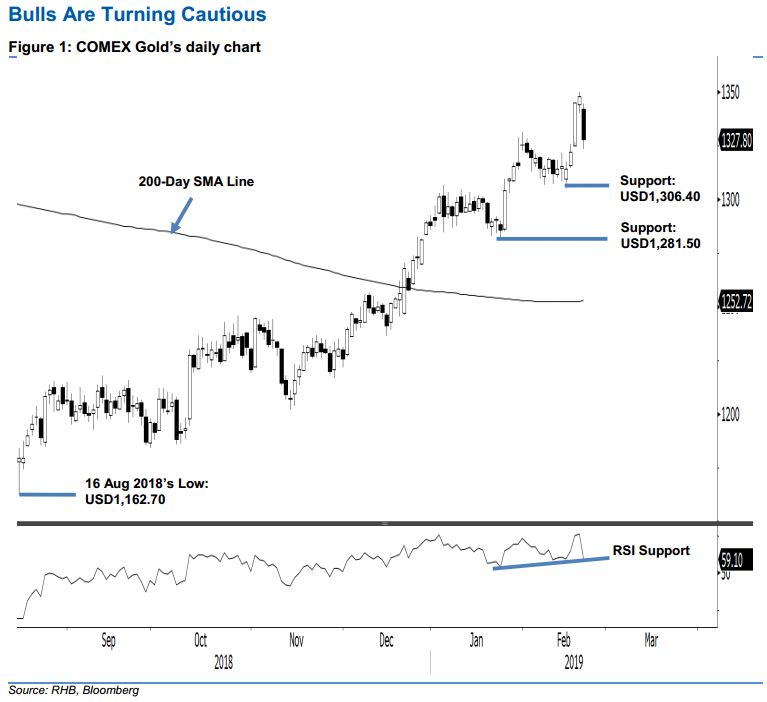

Maintain long positions until deeper retracement is confirmed. The precious metal formed a black candle in the latest session. At the closing it erased USD20.10 to settle at USD1,327.80, this was after it generally trended lower intraday, the high and low were at USD1,344.30 and USD1,323.30. While the latest strong negative price action may be an early indication that the bulls have hit a wall, further negative price actions are needed to confirm such possibility. For now, we are looking at the downside breach of the immediate support of USD1,306.40 as the required signal. Until this happens, we keep to our positive trading tone.

As the daily chart is still constructive at this juncture, we continue to advise traders stay in long positions. We initiated this at the USD1,216 level, which was 14 Nov 2018’s close. For risk management purposes, a stop-loss can be placed below the USD1,306.40 mark.

Immediate support is expected at USD1,306.40, which was the low of 7 Feb. The second support is at USD1,281.50, the low of 24 Jan. Moving up, the immediate resistance is expected at USD1,370.50, which was the high of 25 Jan 2018. This is followed by USD1,400, a round figure.

Source: RHB Securities Research - 22 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024