Hang Seng Index Futures - Maintain Long Positions

rhboskres

Publish date: Wed, 27 Mar 2019, 05:08 PM

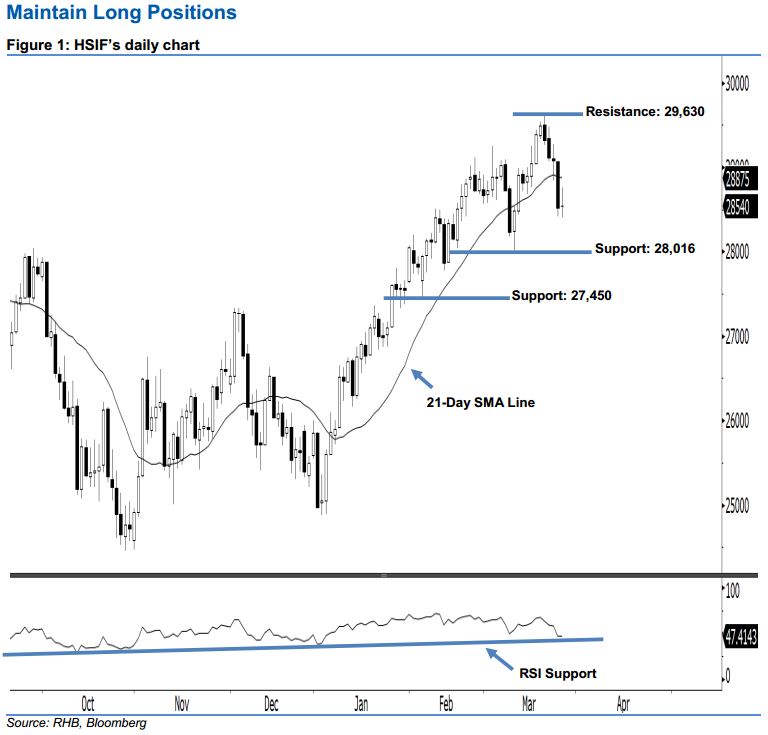

Stay long. The HSIF formed a “Doji” candle yesterday. It settled at 28,540 pts, after hovering between a high of 28,755 pts and low of 28,410 pts throughout the day. Yet, we maintain our bullish sentiment, as the index failed to close below the 28,016-pt support mentioned previously. From a technical perspective, the buyers may continue to control the market as long as the HSIF does not erase the gains from 11-12 Mar’s white candles. Overall, we remain positive on the HSIF’s outlook.

As seen in the chart, we are eyeing the immediate support level at 28,016 pts, which was the previous low of 11 Mar. The next support would likely be at 27,450 pts, determined from the low of 8 Feb. Towards the upside, the immediate resistance level is anticipated at 29,630 pts, ie the previous high of 20 Mar. Meanwhile, the next resistance is maintained at the 30,000-pt psychological mark.

Hence, we advise traders to maintain long positions, since we initially recommended initiating long above the 29,039-pt level on 20 Mar. In the meantime, a stop-loss can be set below the 28,016-pt mark in order to minimise the downside risk.

Source: RHB Securities Research - 27 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024