COMEX Gold - a Sharp Pullback

rhboskres

Publish date: Fri, 12 Apr 2019, 05:52 PM

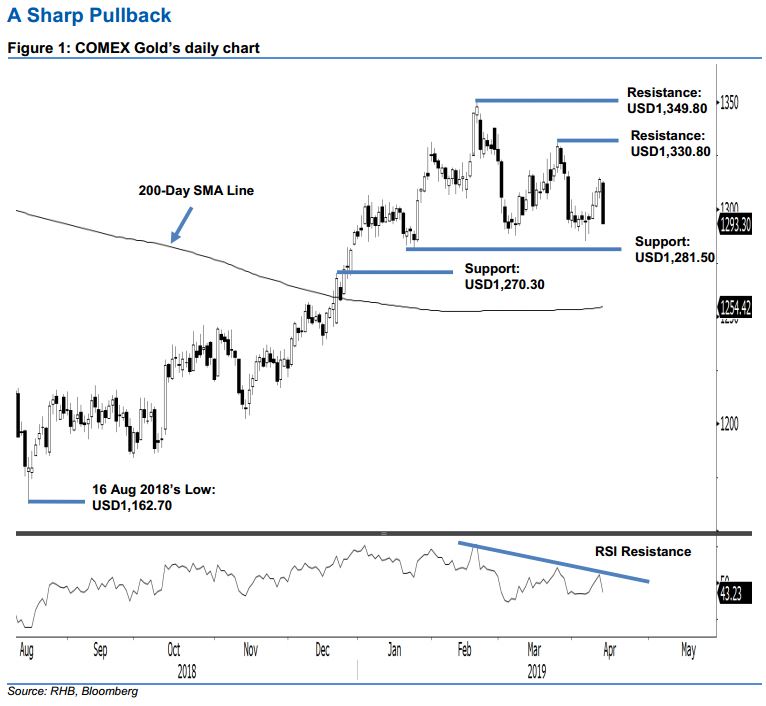

Maintain long positions while waiting for further price signals. The COMEX Gold formed a long black candle in the latest session which erased the prior sessions’ cumulative gains. The high and low were posted at USD1,313.10 and USD1,292.90, before closing at USD1,293.30, indicating a decline of USD20.60. Our ongoing positive bias is premised on the commodity’s multi-week consolidation phase which took place between 20 Feb and 4 Apr, with the possibility of a “Bull Flag” reaching an end. This bias remains until the immediate support of USD1,281.50 is broken. Maintain positive trading bias.

Until there are price signals to nullify our positive trading bias, we continue to recommend that traders stay in long positions. We initiated these positions at USD1,308.30. For risk management purposes, a stop-loss can be placed below USD1,281.50.

Immediate support is retained at USD1,281.50, or the low of 24 Jan 2018. The second support may emerge at USD1,270.30 – the high of 20 Dec 2018. Meanwhile, the immediate resistance is set at USD1,330.80, which was the high of 25 Mar. This is followed by USD1,349.80, ie the high of 20 Feb.

Source: RHB Securities Research - 12 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024