E-mini Dow Futures - Bullish Trend Likely to Persist

rhboskres

Publish date: Mon, 15 Apr 2019, 08:50 AM

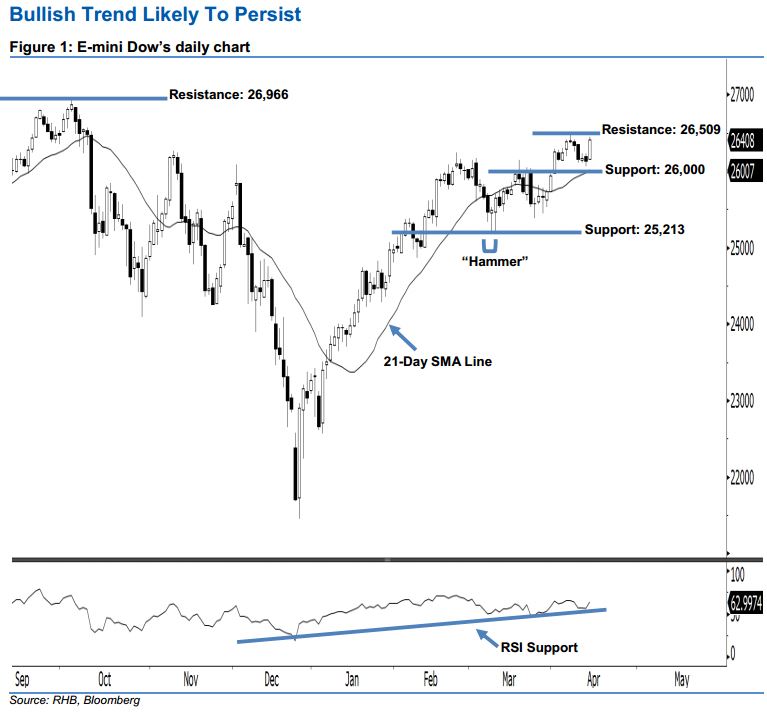

Market sentiment remains bullish; stay long. The E-mini Dow formed a white candle last Friday. It rose 275 pts to close at 26,408 pts after oscillating between a high of 26,441 pts and low of 26,141 pts. From a technical viewpoint, the bullish trend is likely to continue. This was after the index recouped the previous week’s losses and marked a higher close above the rising 21-day SMA line. Furthermore, as the 14-day RSI indicator turned higher for a better reading at 62.99 pts last Friday, the bullish sentiment has been enhanced. Overall, we stay bullish on the E-mini Dow’s outlook.

As seen in the chart, we are eyeing the immediate support at the 26,000-pt psychological mark. If this level is taken out, look to 25,213 pts – the low of 8 Mar’s “Hammer” pattern – as the next support. On the other hand, the immediate resistance is anticipated at 26,509 pts, ie the high of 5 Apr. Meanwhile, the next resistance is situated at the 26,966-pt record high.

As a result, we advise traders to stay long, in line with our initial recommendation to have long positions above the 26,000-pt level on 2 Apr. At the same time, a stop-loss set below the 25,213-pt threshold is advisable to limit the downside risk.

Source: RHB Securities Research - 15 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024