E-mini Dow Futures - Taking a Pause

rhboskres

Publish date: Tue, 16 Apr 2019, 09:07 AM

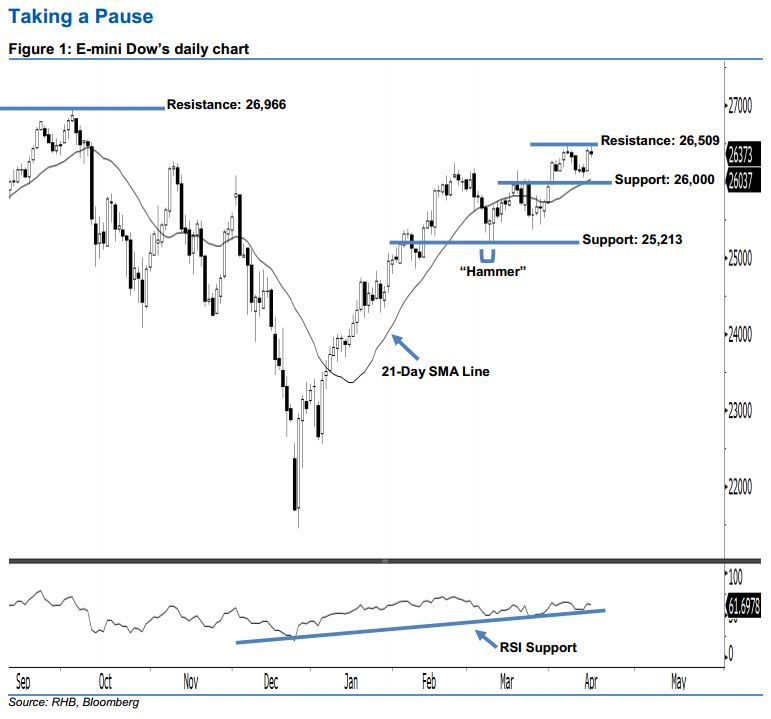

Stay long while setting a stop-loss below the 25,213-pt support. The E-mini Dow ended lower to form a “Doji” candle last night. It slipped 35 pts to settle at 26,373 pts, after hovering between a high of 26,476 pts and low of 26,317 pts throughout the day. However, it is not surprising that buyers may take a breather after the recent gains. Since the 21-day SMA line is likely to turn higher, this indicates that the market sentiment remains positive. Overall, we expect the market to rise further if the immediate 26,509-pt resistance mentioned previously is taken out decisively in the coming sessions.

According to the daily chart, we anticipate the immediate support level at the 26,000-pt psychological spot. The next support is maintained at 25,213 pts, ie the low of 8 Mar’s “Hammer” pattern. Towards the upside, the immediate resistance level is seen at 26,509 pts, determined from the high of 5 Apr. If a breakout arises, the next resistance is maintained at the 26,966-pt historical high.

Therefore, we advise traders to maintain long positions, following our recommendation of initiating long above the 26,000-pt level on 2 Apr. A stop-loss is preferably to set below the 25,213-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 16 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024